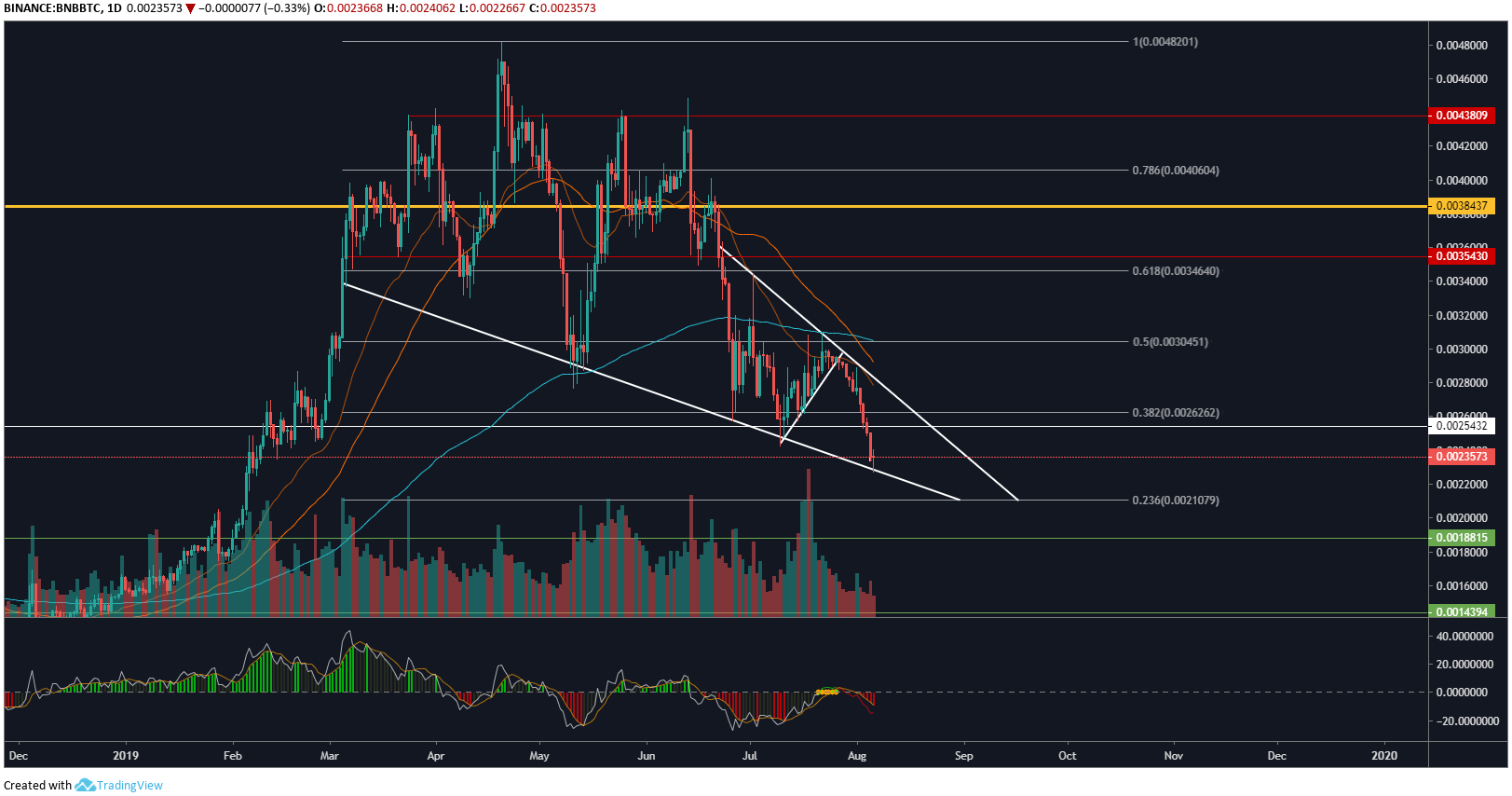

Binance Coin has dropped to the underside of a transparent falling wedge sample after crashing 20% towards BTC pairing over the past 2 weeks. A brief-term reversal may very well be on the playing cards if this specific formation performs out.

Binance Coin Each day Evaluation

On the each day chart for BNB/BTC, we are able to see the wedge sample forming in a descending trend. Each the 50 MA and 15 SMMA have crossed down signalling bearish momentum. Maxx Momentum has additionally flagged what seems to be a promote sign.

Quantity is terribly low and has been for the final 2 weeks as value ranges dropped from 29,500 to 22,500 Sats. It’s seemingly that we’ll see Binance Coin’s value motion bounce across the present market value of 23,500 Sats and $26 on the USD pair for BNB. Nonetheless, quantity must return to comparable heights that we’ve seen all through the previous couple of months to ensure that a bounce to be sustainable.

Two key assist ranges to look out for in case value ranges break down out of the wedge displayed on the technical evaluation are 21,700, 18,800, and 14,300 Sats. Nonetheless, given the asset’s reputation and normal efficiency it’s unlikely value ranges will drop this low.

4-Hour Evaluation

On the Four hour chart for BNB/BTC, we are able to see the break-down extra clearly because of a pointy uptrend shaped all through July talked about in a earlier evaluation right here. The 200 EMA has but to drop into the descending wedge and POC (Level of Management) at 27,700 Sats nonetheless stays over 10% + from the present market value at 23,500 Sats. That is often a sign {that a} bounce might occur to lead to value ranges re-testing the overhead wedge resistance line yet another time.

Proper now, the RSI clearly oversold with momentum simply peaking above 30.00. This at the side of value ranges touching the wedge assist factors in the direction of a possible bounce taking place over the approaching days which might flip right into a breakout reversal. The 50 MA at 26,500 Sats and the 15 SMMA at 25,00zero Sats could be short-term targets inside the wedge.

We all know if value ranges surpass the 50 MA a reversal is probably going, after which confirmed as soon as value ranges surpass the 200 EMA. Merely utilizing shifting averages to gauge the momentum of the present short-term pattern because it’s unfolding is a helpful trick. Nonetheless, this might all exit of the window if value ranges break beneath the wedge assist. Please refer again to the important thing assist ranges talked about within the each day evaluation above.

Do you assume Binance coin is able to bounce after the 20% drop within the final 2-Three weeks? Please go away your ideas within the feedback beneath!

This text is strictly for schooling functions and shouldn’t be construed as monetary recommendation.

Photos through Shutterstock, BNB/BTC charts by Tradingview

The submit Binance Coin Value Evaluation: Bullish Reversal On The Playing cards appeared first on Bitcoinist.com.