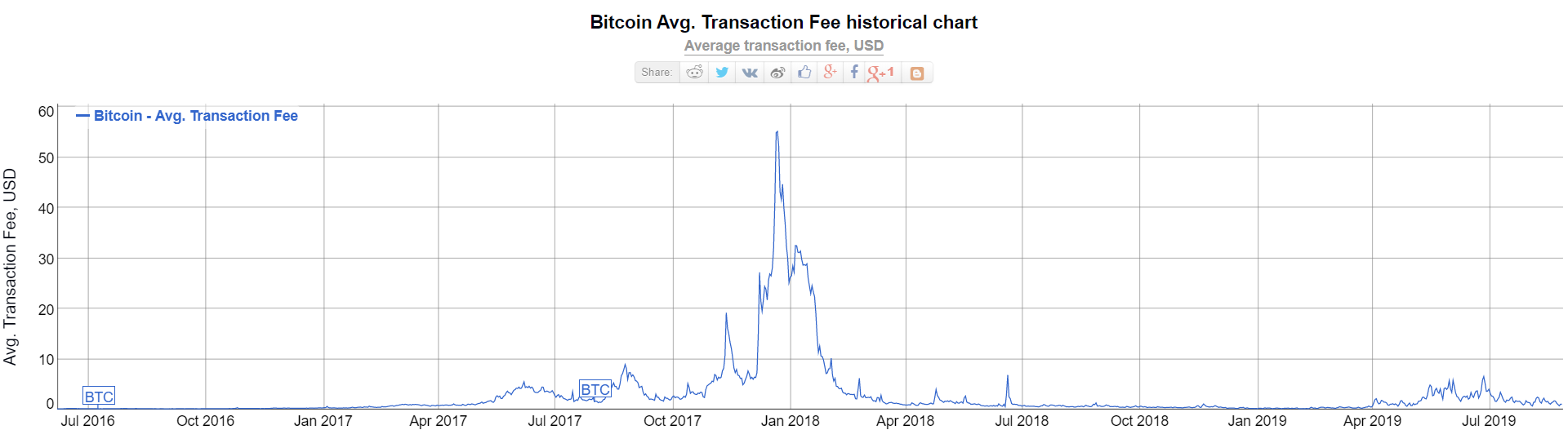

Bitcoin Charges in December 2017 had been virtually at all times above $10, generally reaching practically $30. At the moment we’re practically on the similar worth and costs have dropped significantly; lower than a greenback typically. However has Bitcoin truly scaled, or is it only a case of fewer transactions taking place on the community?

Charges are solely a part of the story

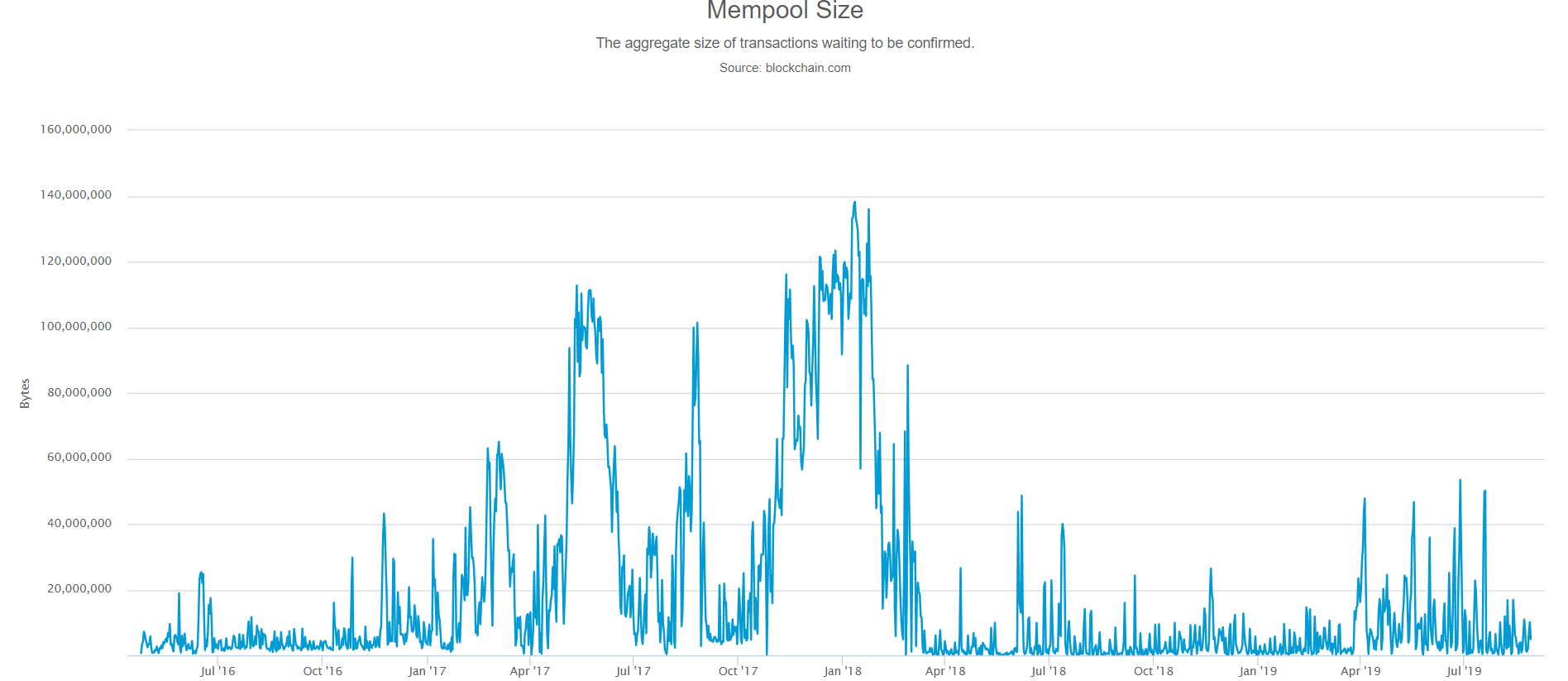

The Bitcoin community has had a couple of points with charges over the previous few years. Due to Bitcoin’s restricted blocksize, numerous customers attempting to all ship transactions directly will congest the community. Transactions that don’t get confirmed get saved in a queue referred to as the mempool.

Miners will usually mine these transactions that pay the best price, so folks can leap to the entrance of the queue by paying a sufficiently excessive price. It ends in a blind bidding warfare of types, the place everybody is consistently paying a little bit bit extra to have their transaction confirmed first.

The median Bitcoin charges as we speak are considerably lower than the charges customers skilled the primary time Bitcoin hovered round $10okay and above. In accordance with BitInfoCharts, median charges as we speak are $0.58. In comparison with charges in December 2017 of $10 to $25, that’s considerably much less. Nevertheless, there’s a very obvious motive for this. There isn’t as a lot of a requirement to make use of Bitcoin.

The scale of the Bitcoin mempool is, roughly, 88% decrease than what it was in December 2017. The % lower in mempool measurement and median charges is almost the identical.

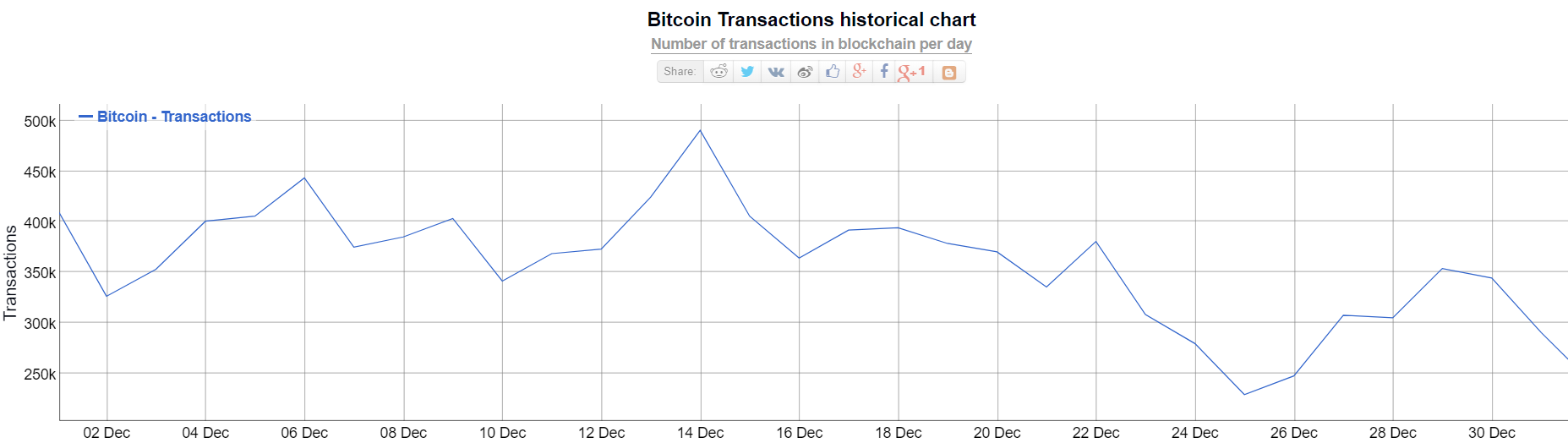

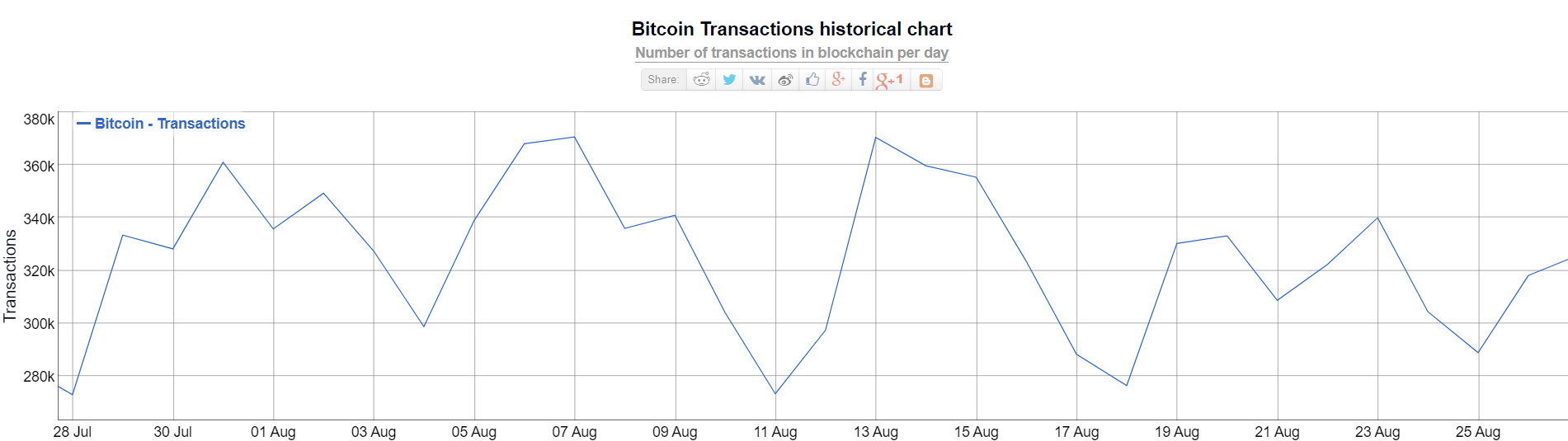

On high of this lower in mempool measurement, Bitcoin has additionally seen a lower within the variety of transactions getting confirmed per day.

These charts present that in Dec. 2017, the typical variety of transactions confirmed per day was someplace between 350okay and 400okay. This final month, Aug 2019 had a mean of 300okay to 350okay transactions. So whereas the charges could also be decrease, there are additionally fewer transactions taking place on the blockchain.

Scaling by way of effectivity

Additions to Bitcoin like Segwit and the Lightning Community had the aim of serving to the community scale in a secure method. Nevertheless, neither has made sufficient of a dent to let Bitcoin develop.

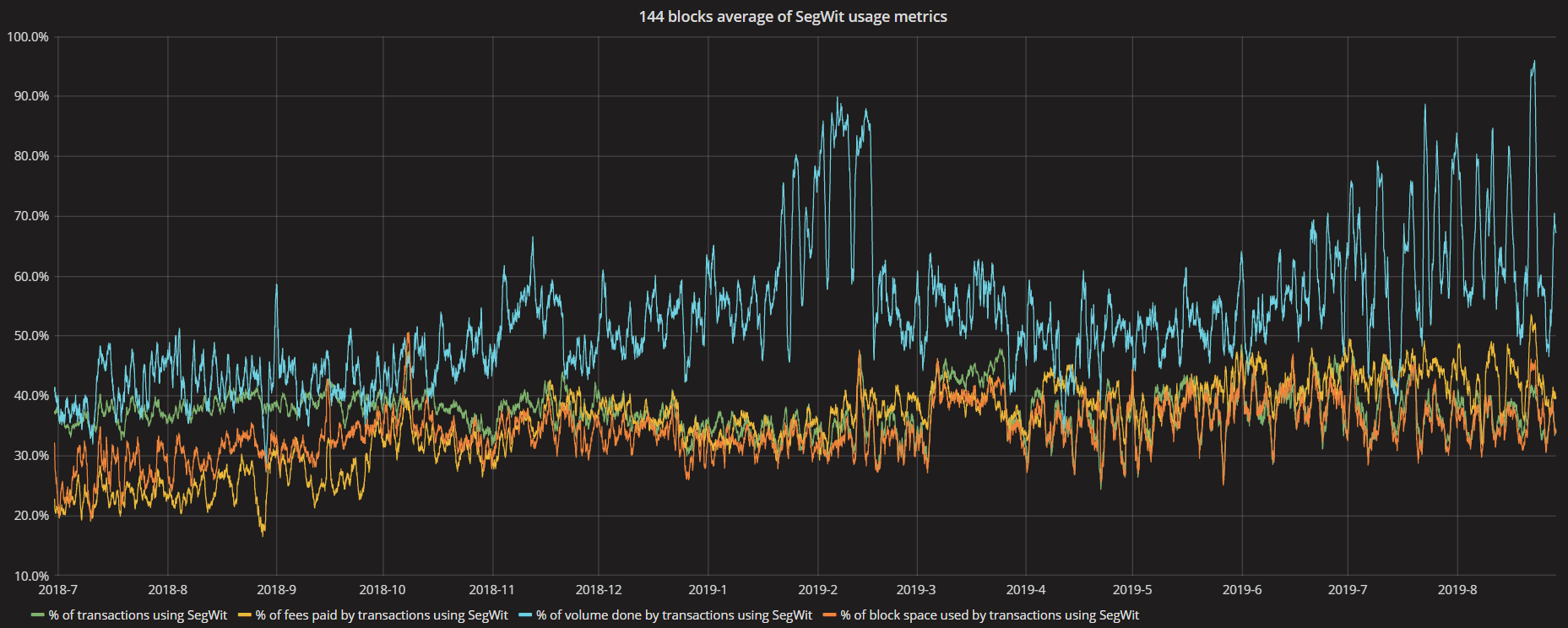

Segwit is a change added in Aug 2017, permitting for extra transactions to get confirmed match into every block. If 100% of Bitcoin customers used Segwit, we might get an efficient throughput improve of 1.8x. Regardless of being lively for over two years, Segwit utilization has by no means gone above 50%. As well as, that share has been stalled out between 35-45% for the previous 15 months. On the chart under, the inexperienced line denotes the proportion of transactions that use Segwit.

Layer Two options aimed to facilitate transactions off-chain, taking the stress off the primary blockchain. The Lightning Community noticed some strong development in it’s first few months, however nonetheless has a number of large design points to unravel earlier than will probably be wherever close to mass adoption. As well as, the LN has been shrinking for the reason that starting of the summer time. You’ll be able to learn concerning the present state of the lightning community right here.

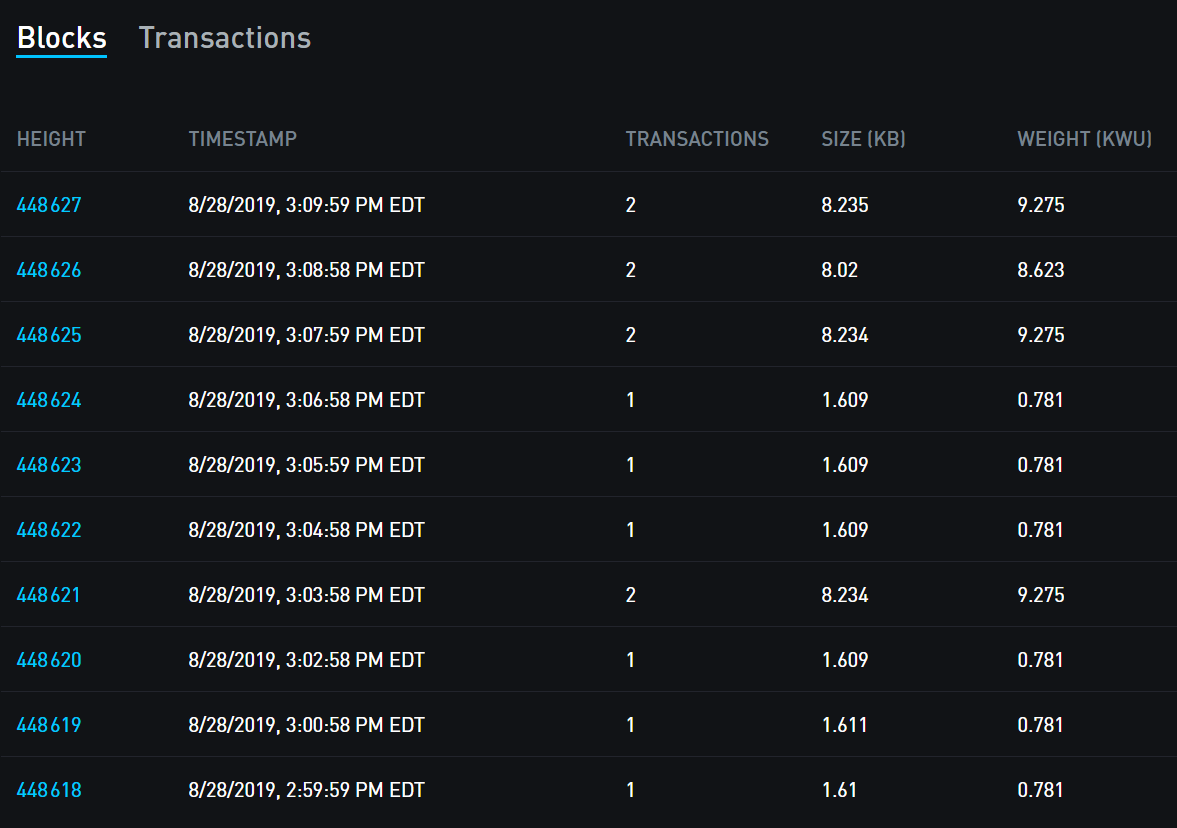

Extra centralized options comparable to Blockstream’s Liquid has additionally launched previously 18 months, however have seen little to no consumer adoption. Wanting on the Liquid explorer, the community is processing only one or 2 transactions per block.

To be usable for your entire world, Bitcoin might want to remedy it’s scaling points. That could be fixing present points current within the present scaling plan or implementing different options.

What do you concentrate on Bitcoin’s present scaling technique? Will modifications should be made, or will the builders remedy lots of the points going through the community? Tell us within the feedback under!

Photos courtesy of Bitinfocharts, p2sh.information, Blockstream

The put up Bitcoin Charges At the moment Over 88% Much less Than December 2017 appeared first on Bitcoinist.com.