The worldwide debt has reached the astronomic quantity of USD 243 trillion. And now the inventory market is changing into gloomier. Towards this background, some traders and monetary specialists are turning their focus to Bitcoin and speculating in regards to the causes of the renewed curiosity within the cryptocurrency.

Is Mounting Debt Inflicting “Pessimism about stocks and Spiking Bitcoin fever?”

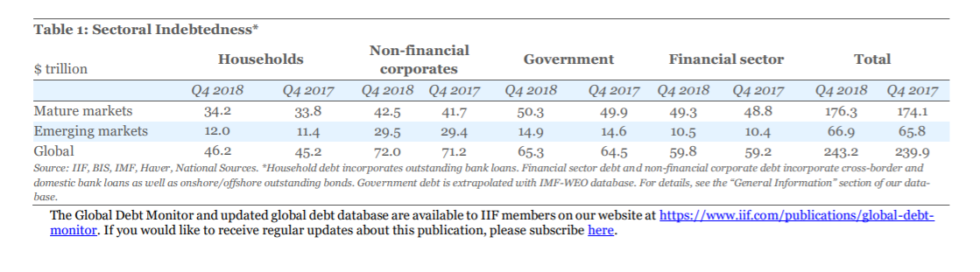

World debt has elevated over 50 p.c because the final monetary debacle of 10 years in the past. In keeping with the Institute of Worldwide Finance (IIF), though the worldwide debt slowed sharply in 2018, the worldwide debt has now amassed “a global debt mountain” of $243 trillion USD.

World Debt Monitor: “Only” $3.Three trillion was added to the worldwide #debt mountain final yr, bringing the full at over $243 trillion. pic.twitter.com/8xe4r7WuJp

— IIF (@IIF) April 2, 2019

https://platform.twitter.com/widgets.js

In its report of April 2, 2019, the FII particulars how every sector has contributed to the worldwide debt within the desk under:

In parallel, bitcoin worth has lately led a spectacular rally of cryptocurrencies, whereas heavyweight Wall Road corporations have elevated their involvement within the crypto market. Thus, main monetary specialists and traders are actually serious about discovering out whether or not there may be an intersection between the mounting international debt and the current spike in BTC worth 00.

Robert Burgess, a former international editor accountable for monetary markets for Bloomberg, writes in regards to the implications of the $3.Three trillion added to the full international debt, and highlights on this context,

The pessimism about shares and spiking Bitcoin fever.

Four Causes Explaining Bitcoin’s Current Surge in Worth

Burgess underlines that though inventory costs have elevated barely, they’ve remained principally flat since early 2018. And, in distinction, he remarks on the optimistic views which might be beginning to prevail amongst cryptocurrency fans following bitcoin’s worth surge of 23 p.c to smash by way of the $5,000 mark. He writes,

As if on cue, crypto promoters had been predicting much more positive factors, with one saying Bitcoin will certainly attain $7,000 in brief order.

Burgess admits that no one is aware of for certain what’s propelling and sustaining bitcoin’s worth surge to over $5,000. Nonetheless, on this regard, Richardson GMP, considered one of Canada’s main administration corporations, has prompt the next components:

1) A brief masking/squeeze that was triggered when Bitcoin lately moved above $4,000;

2) A blockchain convention in Seoul;

3) An change of kilos for Bitcoin by British residents in case Brexit goes horribly fallacious;

4) An April Fools’ Day story on an obscure crypto web site claiming the U.S. Securities and Change Fee authorised Bitcoin exchange-traded funds.

Nonetheless, whatever the ballooning international debt or some other purpose inflicting Bitcoin’s constructive worth actions, the newest rally reveals proof that large cash is beginning to leap onto the Bitcoin bandwagon. As Tom Lee of Fundstrat World Advisors lately put it,

Bitcoin had a tough 2018, and for a lot of 2019, it has been steadily climbing and from what we will collect, it’s as a result of there are plenty of constructive issues going down. A number of the previous whale wallets are shopping for Bitcoin.

Do you suppose mounting international debt impacts bitcoin worth? Tell us within the feedback under!

Pictures courtesy of World Debt Monitor by way of Institute of Worldwide Finance, Shutterstock

The put up Bitcoin Fever Pushed By Shares ‘Pessimism’ As World Debt Hits $243 Trillion appeared first on Bitcoinist.com.