Regardless of dropping by about $1,000, Bitcoin remains to be method forward of even a few of the most optimistic value projections and detailed value forecast fashions. Here’s a take a look at how Friday’s ‘flash crash’ hasn’t derailed Bitcoin in the long run.

Present Bitcoin Worth Nonetheless Leads $1 Million S2F Mannequin

Tweeting on Saturday (Could 18, 2019) Bitcoin analyst “planB” confirmed how even at $7,300, BTC nonetheless leads the stock-to-flow (S2F) mannequin about $1,000 on the highway to hitting $1 million per coin.

#bitcoin at $7300 .. $1000 above S2F mannequin worth

pic.twitter.com/2VkSiP4Oc0

— planB (@100trillionUSD) Could 18, 2019

https://platform.twitter.com/widgets.js

PlanB’s S2F mannequin posits that shortage and worth have a direct relationship with shortage being a measure of inventory circulate (SF). The evaluation additionally takes into consideration vital parameters like Bitcoin block reward halving which happens each 4 years till all 21 million BTC are mined.

Based on the mannequin, by the point of the following halving which is in Could 2020, BTC’s SF ought to double from its present worth of 25 to 50. This doubling would carry BTC’s SF nearer to that of commodities like gold.

BTC permabulls like Max Keiser say Bitcoin has the potential to achieve a fraction of the gold market capitalization, which is someplace in round $eight trillion. The S2F mannequin predicts that by 2020, BTC ought to have a market value of $55,000 primarily based on an SF worth of 50.

S2F hinges closely on shortage which for BTC takes on one other dimension given {that a} portion of the 21 million complete token provide isn’t even attainable since some BTC are endlessly misplaced.

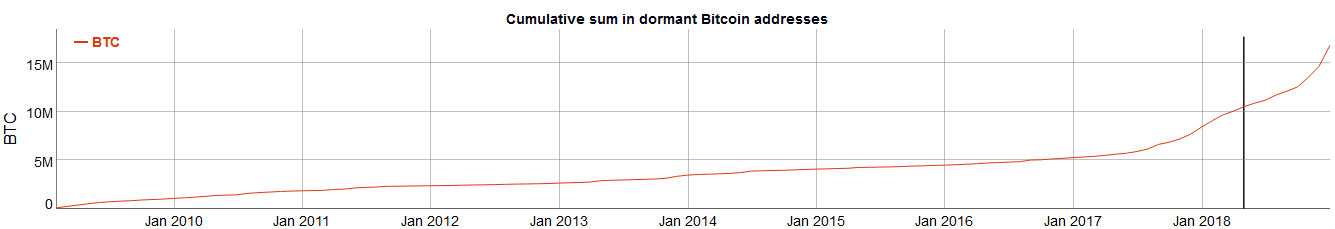

Knowledge from BitInfoCharts reveals that there are about 16.82 million BTC held in dormant Bitcoin addresses. Between cumulated BTC mud and misplaced personal keys, there are about 10.5 million BTC that haven’t moved in over a yr.

Good Pullback?

Earlier than the Friday value drop, there had been the speak of a potential retracement within the BTC value motion to the mid-$6,000 degree. These predictions hinged on huge revenue taking above $7,000, creating one other entry level for a brand new BTC accumulation in preparation for a recent upward swing.

Within the short-term, there may be an expectation that BTC may slip additional downwards maybe to the 50-day or 200-day transferring common help ranges. This places a potential downward slide between $4,500 and $5,500.

Nonetheless, such a transfer would imply breaking the $6,400 help degree which characterised BTC buying and selling for many of 2018. Solely the fallout from the Bitcoin Money civil conflict in November 2018 efficiently took BTC under that value degree.

Do you suppose the flash crash adversely affected Bitcoin’s parabolic advance? Tell us within the feedback under.

Photographs through Twitter @100trillionUSD and BitInfoCharts.com, Shutterstock

The publish Bitcoin is Entrance Operating Inventory to Move Worth Mannequin at $7300 appeared first on Bitcoinist.com.