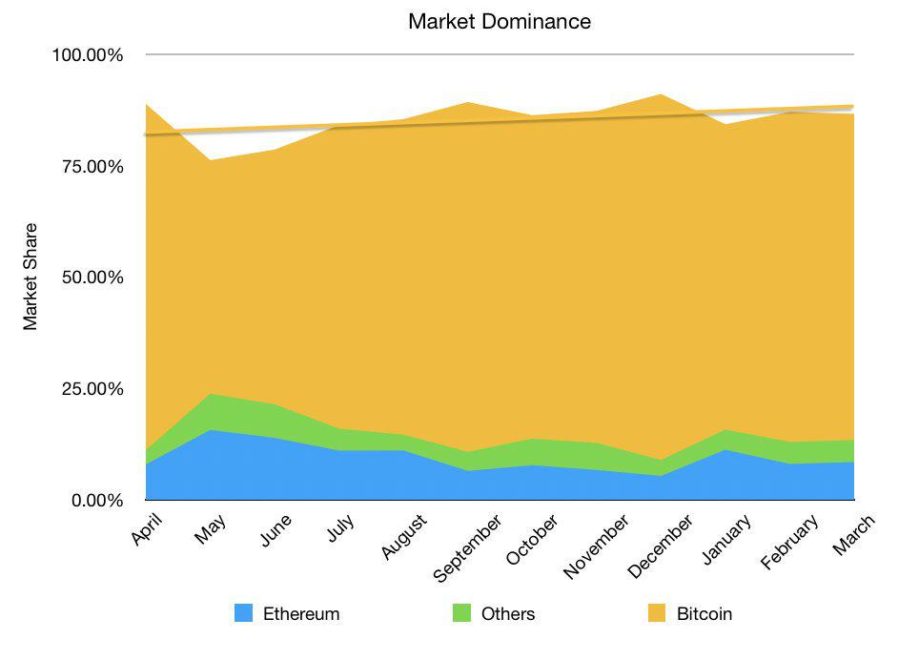

Bitcoin market dominance or BTC’s share of the whole market cap will not be one of the simplest ways to get an correct image of the market, in keeping with new analysis.

Market Share vs Market Dominance

There are specific Bitcoin metrics that all of us perceive; the worth, the circulating provide, the market cap. After which there’s market dominance, which is BTC’s share of the whole market cap of all cryptocurrencies. However what if we’ve all been flawed on this final one?

When contemplating Bitcoin’s ‘Market Dominance’, we usually go to the measure utilized by CoinMarketCap. However while evaluating BTC to the whole market cap definitely offers us market share, perhaps ‘dominance’ ought to embody different components?

That was the idea John-Paul Thorbjornsen investigated, after feeling the present 50% ‘dominance’ rating didn’t give a real illustration. A greater reflection of Bitcoin’s dominance, he steered, may embody some measure of liquidity, or day by day buying and selling quantity.

Pareto Distribution and Energy Regulation

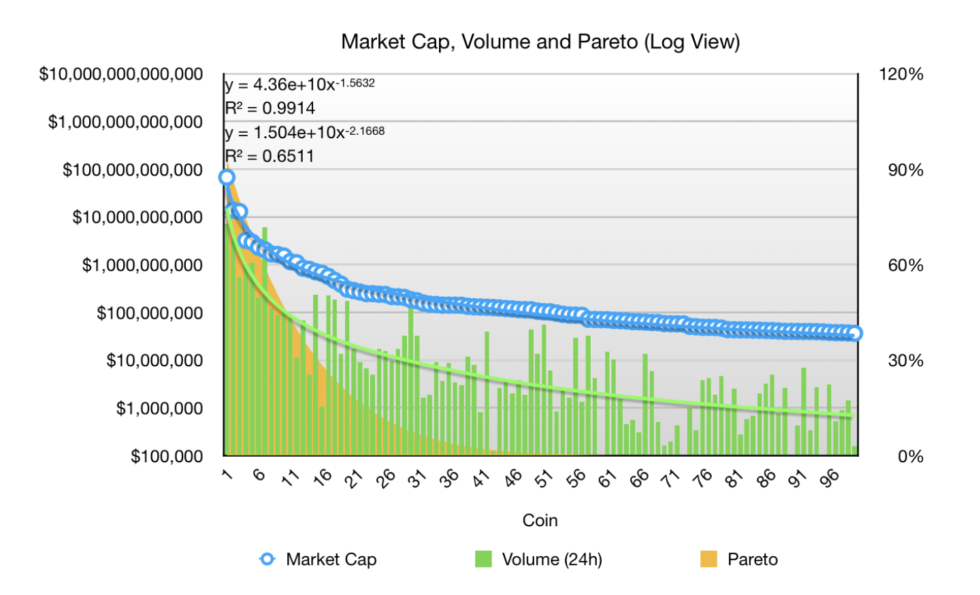

His analysis revolved across the Pareto precept or 80/20 rule. This states that 80% of the results come from 20% of the causes. Or on this case that 20% of cryptocurrencies ought to dominate 80% of the market. This precept usually happens in nature the place the rule of equilibrium abounds. As a free market, cryptocurrency buying and selling might nicely comply with this sample, which is a type of Energy Regulation.

Thorbjornsen in contrast the highest 100 cryptocurrencies by market cap on a logarithmic scale. He discovered that whereas there was some type of Energy Regulation, volumes didn’t correlate nicely. Some cash had lower than 0.1% of market cap in day by day quantity, indicating a trapped market or synthetic market cap.

Quantity-Weighted Market Dominance

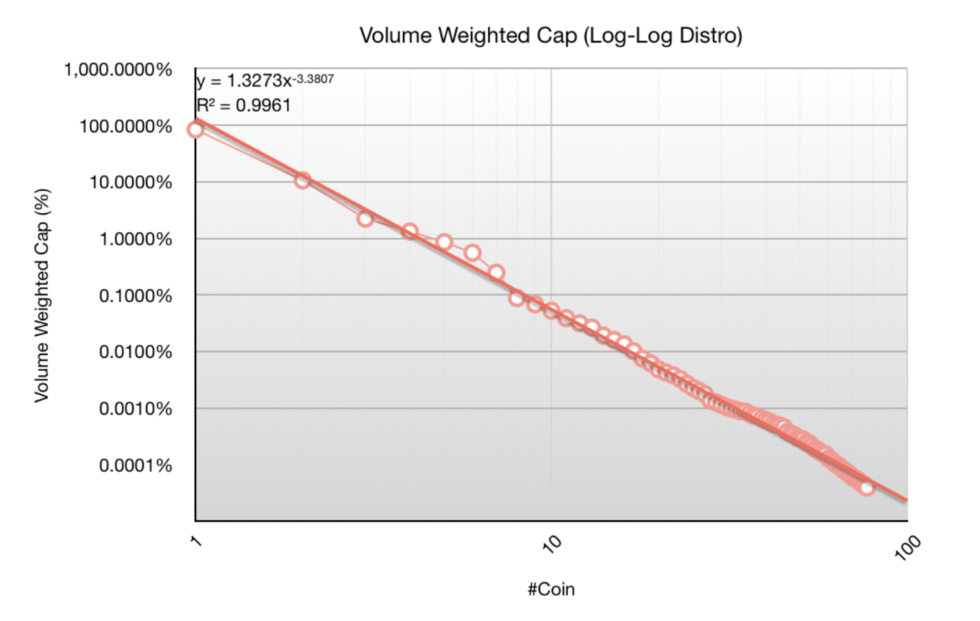

When Thorbjornsen multiplied the amount by the market cap (Quantity-Weighted Cap), he discovered a a lot larger correlation. Eradicating the underside third of the cash (to right for ‘Page 1 Effect’), strongly steered that this was certainly a Energy Regulation distribution.

Calculating a brand new measure of Bitcoin Dominance utilizing this metric, confirmed a degree constantly over 80%. In actual fact, contemplating solely the highest 5 cryptocurrencies, Bitcoin (the 20%) dominates over 85% of the market. This suits the Pareto distribution speculation initially steered.

The King Is Useless, Lengthy Reside The King

So ought to all of us overlook about CoinMarketCap’s ‘market dominance’ metric?

Effectively no, though it may be higher renamed ‘market (cap) share.’ As a metric, it may be helpful. In Bitcoinist’s newest article on the topic, decrease Bitcoin market dominance index has truly traditionally coincided with the next bitcoin value.

However sooner or later, when speaking about true market dominance, it could most likely be smart to think about the volume-weighted cap as a extra correct measure. Significantly when the liquidity and quantity of some altcoins are nearly non-existent.

Does this new approach to measure market dominance paint a extra correct image? Tell us beneath!

Photos courtesy of Shutterstock, medium.com/@jpthor

The publish Bitcoin Market Dominance is Really Over 80%, New Analysis Finds appeared first on Bitcoinist.com.