Bitcoin’s principal forks – Bitcoin Money ABC (BCH) and Bitcoin Money SV (BSV) – have a number of components of a medium of change asset, however they nonetheless don’t expertise the identical adoption stage.

Bitcoin Forks Are Hardly ever Used as Technique of Alternate

On Monday, July 29, crypto evaluation agency Coinmetrics printed a report that compares Bitcoin with its principal forks, BCH and BSV. The latter ones got here out to unravel the deviation of Bitcoin’s major use case. The biggest cryptocurrency by market cap has develop into a retailer of worth, whereas it was designed for use as peer-to-peer (P2P) digital cash.

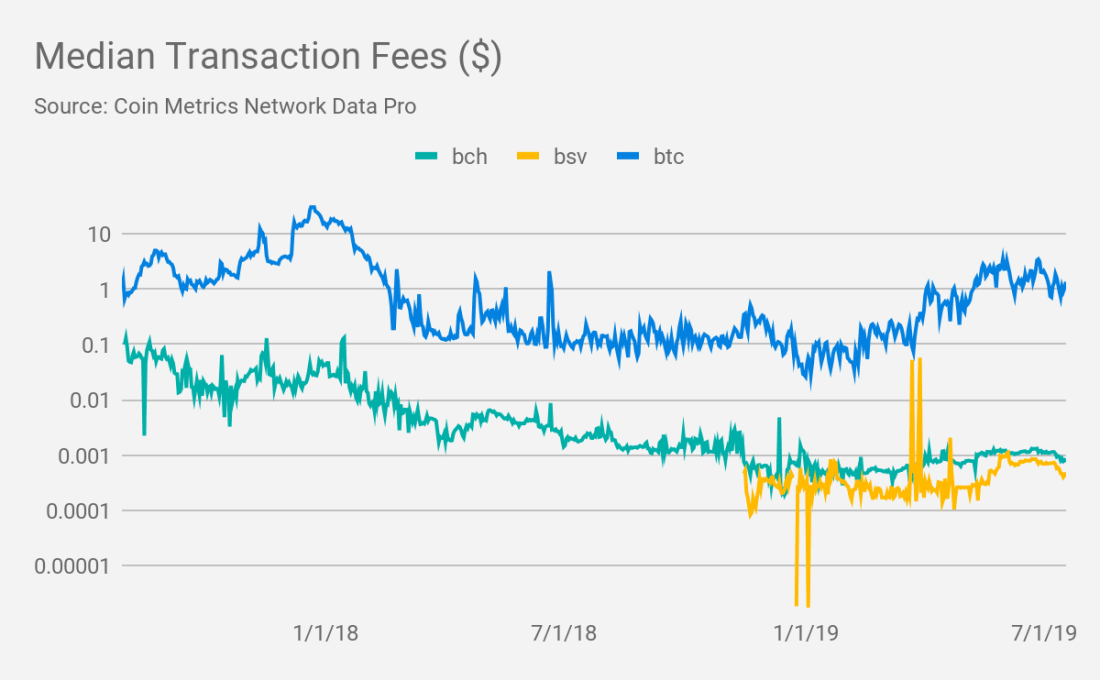

Each BCH and BSV elevated the block dimension to include extra transactions right into a single block, which finally led to decrease charges. Whereas these options allow extra flexibility, neither of the 2 forks has loved the identical reputation and adoption as Bitcoin. Furthermore, BTC is extra typically as a method of change, regardless of the transaction time and charges.

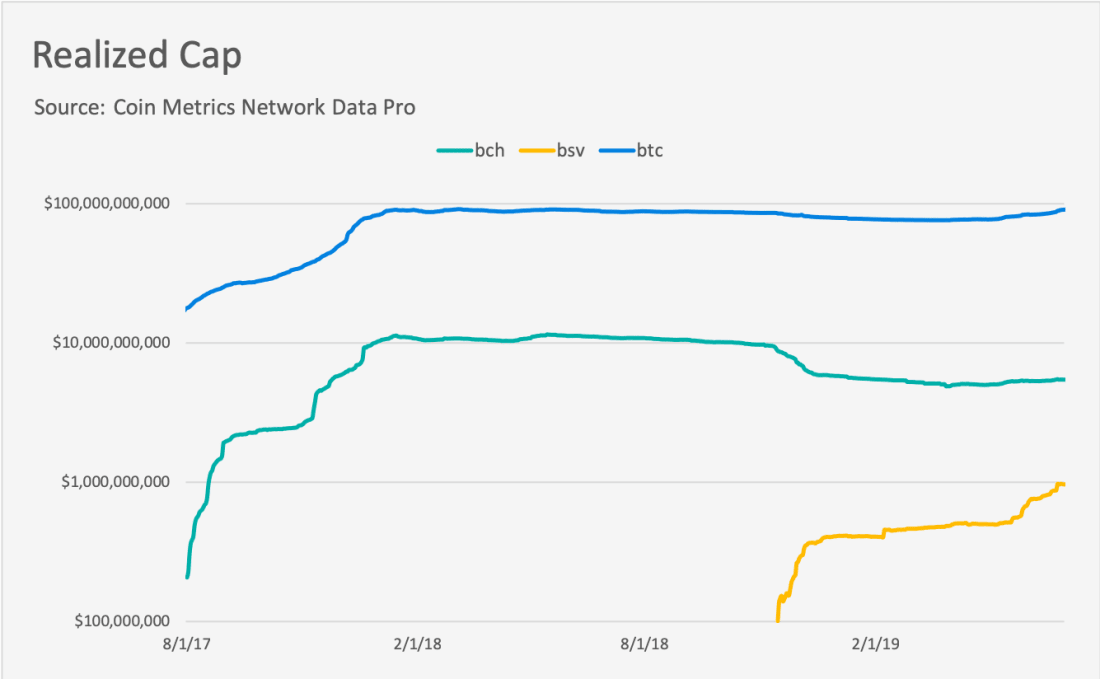

Bitcoin’s realized cap is nearly $100 billion. On the opposite aspect, the realized cap of BCH and BSV is under $10 billion and about $1 billion, respectively. For these unfamiliar, realized cap is a market cap-like metric that excludes cash that could be misplaced.

Thus, Bitcoin’s dimension is greater than ten instances larger than BCH and 100 instances larger than BSV.

Each forks have a mean transaction payment of zero USD as of immediately. BTC’s payment declined to $0.03 early this yr, although it has maintained between $1 and $three during the last months.

Regardless of every little thing, the charges don’t assist a lot. Furthermore, virtually zero charges have a destructive aspect, as they are going to go away miners with smaller rewards when block reward issuance drops.

OP-RETURN Transactions

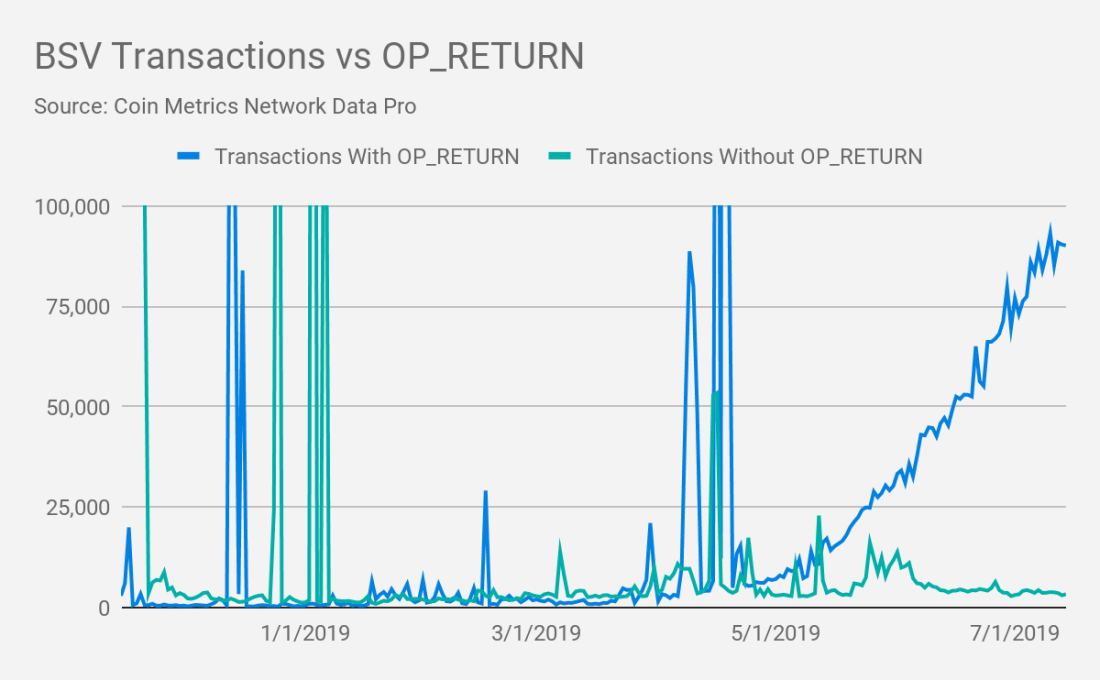

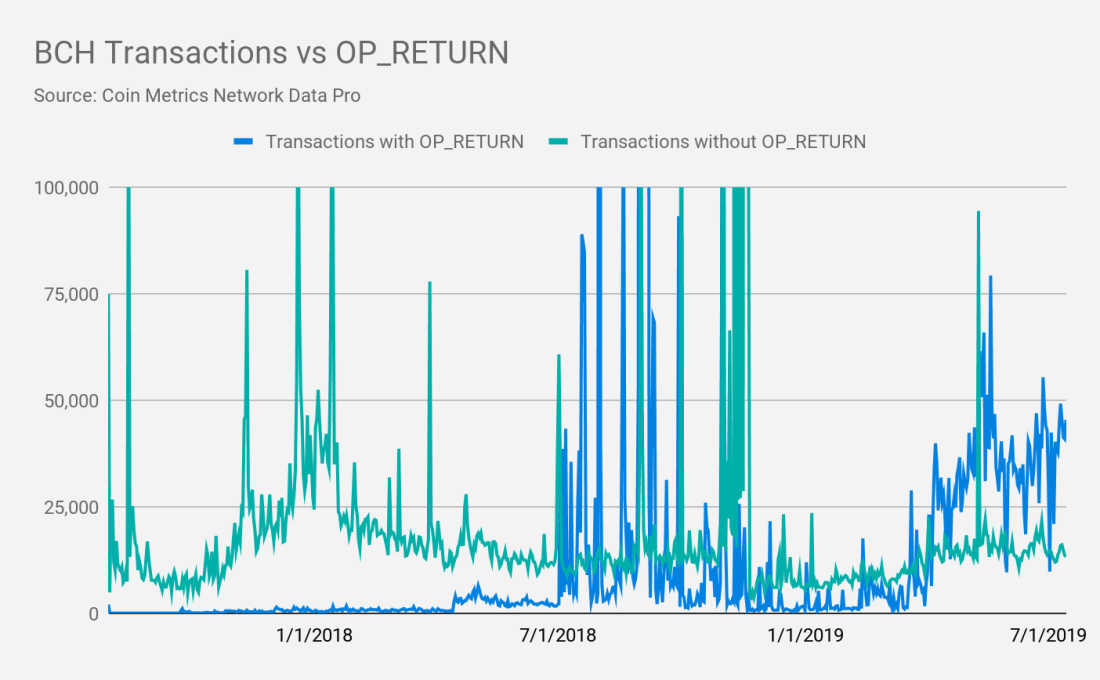

As well as, BSV and BCH have additionally deviated from their goal of appearing as a medium of change, as extra transactions are used to retailer information on blockchain for numerous functions. Typically, there isn’t any associated financial transaction in any way. On BSV’s community, 94% of OP_RETURN transactions derive from a single climate app referred to as WeatherSV. The Bitcoin SV fork really eliminated the dimensions restrict on OP_RETURN messages.

Thus, the share of BSV transactions with OP_RETURN is growing daily.

The identical is true about Bitcoin Money ABC:

In conclusion, regardless of the decrease charges and larger block dimension, BCH and BSV can not compete with BTC in the mean time. The forks don’t even use that additional block area many of the instances. BCH and BSV typically act as an information storage instrument quite than a medium of change.

Do you assume BCH or BSV will have the ability to take a big market share of Bitcoin? Share your ideas within the feedback part!

Photographs by way of Shutterstock, coinmetrics.substack.com

The submit Bitcoin Nonetheless Fully Dominates BCH and BSV, New Analysis Reveals appeared first on Bitcoinist.com.