They are saying it’s not what you understand however who you understand. After all, when buying and selling Bitcoin, what you understand is kinda vital too.

Following on from our rundown of on-chain metrics, listed below are a bunch of helpful off-chain indicators that no dealer needs to be with out. And probably just a few extra on-chain metrics too.

Once more, these are compiled from a information by crypto-analyst, Adam Taché.

Mayer A number of

The ‘Mayer Multiple’ is likely one of the hottest metrics and derives from the present worth divided by the 200-day transferring common (200-MA). The common worth is 1.39, and traditionally, when it turns into equal to or larger than 2.four it is going to retrace to below 1.5.

Spent Output Revenue Ratio

The ‘Spent Output Profit Ratio’ (SOPR) tracks earnings or losses made on a spent output and can be utilized as a marker for native tops and bottoms.

Put merely, SOPR is the promoting worth divided by the worth paid and oscillates round a price of 1. In a bear market, values above 1 are rejected, as holders desperately attempt to promote for a revenue, inflicting the provision to ramp up and a worth drop. Conversely, in a bull market, values beneath 1 are rejected, as a result of individuals are reluctant to promote at a loss, constricting provide.

Market Worth Derived Metrics

‘MVRV Ratio’ is a measure of Market Cap/Worth divided by Realised Cap/Worth. Traditionally, an MVRV of lower than 1 signifies capitulation, and a price of larger than 3.7 alerts an over-valuation.

‘MVRV z-score’ is the variety of Normal Deviations between the Market Worth and Realised Worth. Or how strongly indifferent from Realised Worth the Market Worth is. It’s calculated by subtracting the RV from the MV and dividing by the Normal Deviation and tends to go parabolic simply earlier than a protracted downturn.

‘MVDV Ratio’ is the Market Worth divided by the Delta Cap/Worth. Bearish divergences between MVDV and worth at native tops have indicated international tops, and worth of beneath one has signaled international bottoms.

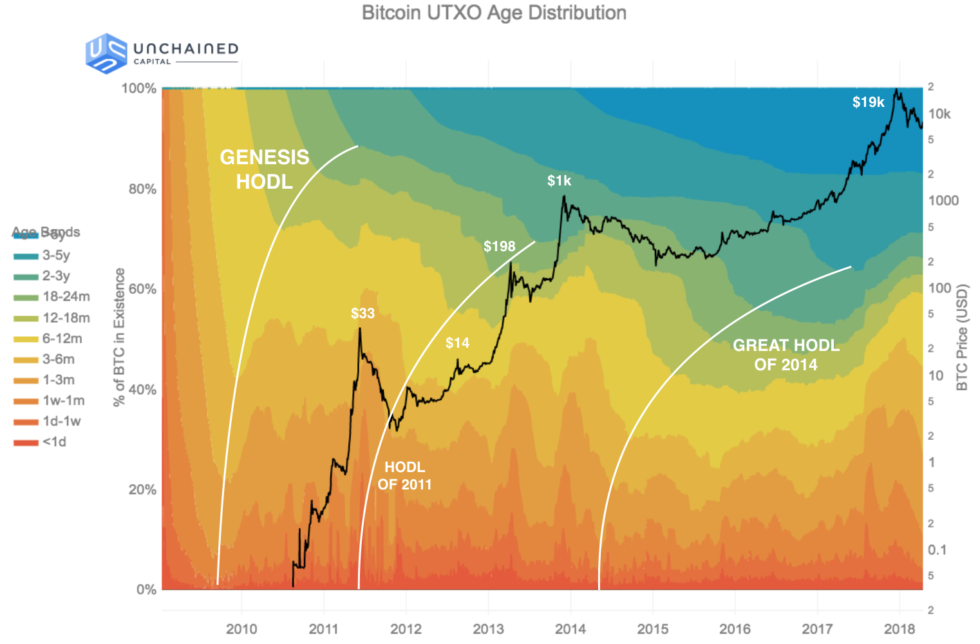

HODL Waves

A ‘HODL Wave’ happens as a consequence of new buyers shopping for into Bitcoin throughout a rally, then holding by way of the downturn into the subsequent market cycle. They measure the age distribution of Bitcoin’s UTXO set and can be utilized to detect HODLer accumulation and capitulation. Although not notably helpful for predicting future strikes, they do make for a pleasant colourful chart.

Dormancy Derived Metrics

There are a selection of market-health indicators primarily based on dormancy.

The ‘Average Dormancy’ is outlined because the ratio between CoinDays Destroyed (CDD) and Quantity (per day). Whereas measuring the time UTXOs stay dormant, it alerts accumulation and distribution and tracks spending habits.

‘Supply-Adjusted Dormancy’ is Common Dormancy divided by Provide, accounting for a bigger potential CDD, the longer that Bitcoin exists.

‘DUA Ratio’ brings UTXO age into the equation utilizing HODL Waves, while ‘Dormancy Flow’ compares worth to spending habits on an annualized foundation. Dormancy Stream is the Market Cap divided by the 365-day MA of Dormancy multiplied by Worth.

Median Spent Output Lifespan

‘Median Spent Output Lifespan’ (MSOL) measures the median lifespan in days for every spent output. It could sign long-term holders lowering positions and be used to find out the provision of circulating cash not too long ago on the market.

Community Momentum

‘Network Momentum’ is a measure of every day transaction worth in BTC, thus eliminating noise from worth. It has been used as a number one indicator for market worth and cycle.

Puell A number of

Lastly, the ‘Puell Multiple’ is the ratio of the Day by day Coin Issuance (in USD) divided by the 365-day Transferring Common of this worth. Nonetheless, after subsequent 12 months’s halving, charges will make up a larger proportion of the miner’s reward. At this level, it could be higher to make use of Mining Income (in USD), quite than Coin Issuance.

The Puell A number of supplies a health-indicator for community safety and may gauge the market from a mining profitability/obligatory sellers perspective.

After all, no listing of Bitcoin metrics can ever be full, as analysts devise new indicators on a regular basis. However together with some (or all) of those into analysis previous to buying and selling may enhance outcomes dramatically.

Suppose you’re able to beat the Bitcoin market with these instruments? Tell us your ideas within the feedback beneath.

Photographs courtesy of Shutterstock, Unchained Capital

The submit Bitcoin Off-Chain Metrics To Enhance Your Buying and selling appeared first on Bitcoinist.com.