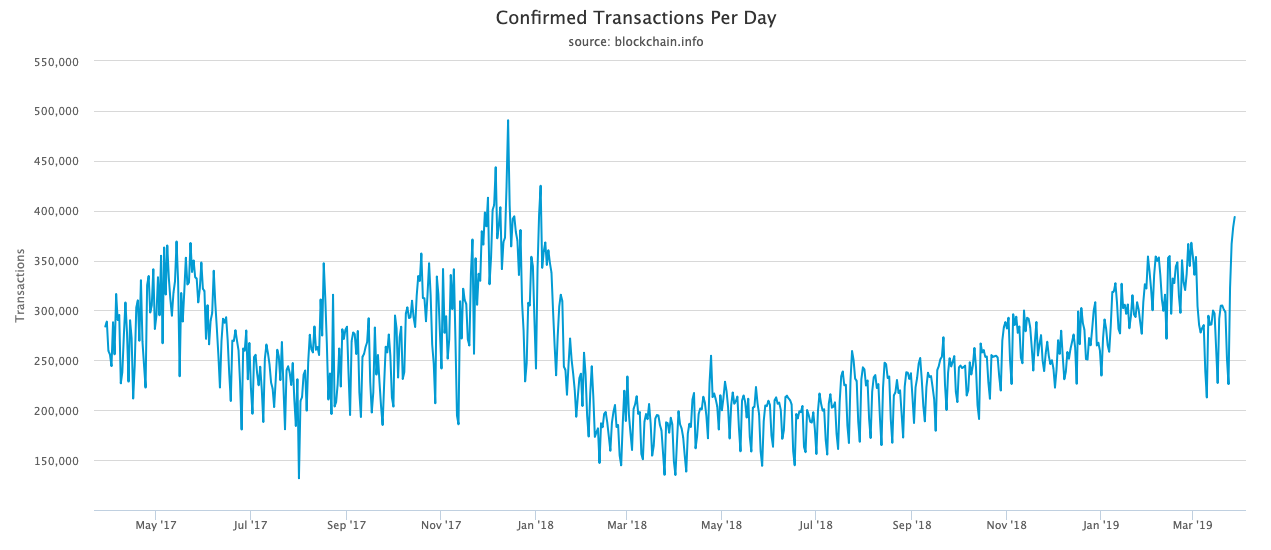

The 15-month lengthy bear market isn’t affecting Bitcoin adoption and utilization, new information reveals, as on-chain transactions have hit their highest since early January 2018.

Bitcoin Utilization Has Been Climbing for 15 Months

Bitcoin community utilization continues to rise opposite to the drop in bitcoin value since its historic run-up to almost $20,000.

The most recent information from Blockchain reveals the most recent spike to almost 400,000 confirmed on-chain transactions in a interval of 24 hours. That is the best community exercise since BTC value was properly above $10,000 USD in early January 2018.

It’s additionally value noting that the proportion of Bitcoin funds made utilizing Segregated Witness (SegWit) has additionally been step by step since its activation in summer season 2017. These now comprise almost half of all on-chain Bitcoin transactions, in line with the most recent information.

SegWit has confirmed to be a profitable step in mitigating transaction charges on the Bitcoin community. Since peaking in December 2017, the price of utilizing Bitcoin has been at report lows regardless of the community processing extra transactions on common.

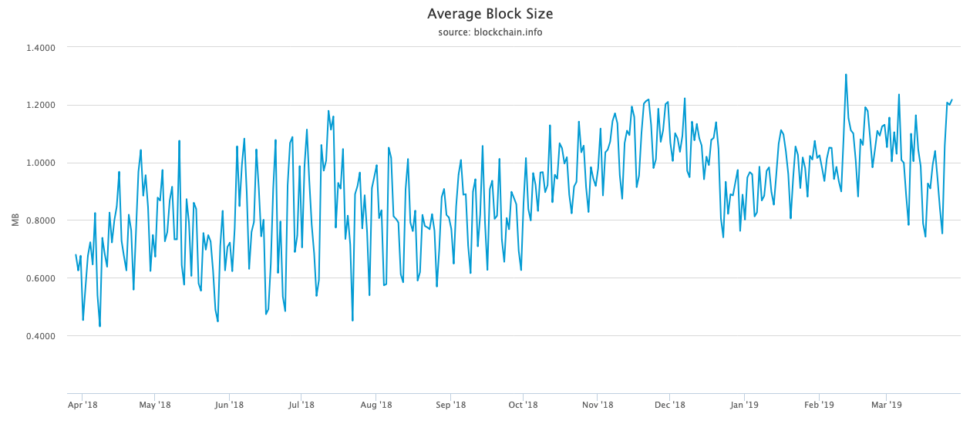

1MB+ Bitcoin Block Dimension is the New Regular

The BTC community is now additionally frequently producing blocks over the 1MB block dimension restrict that was in place earlier than SegWit activation that made 4MB blocks attainable.

The most recent day by day common block dimension, for instance, has spiked to 1.2MB, although blocks properly over 2MB and higher at the moment are fairly frequent.

Earlier this week, Bitcoinist reported that unbiased rankings company Weiss Scores, has upgraded Bitcoin’s tech/adoption score to an ‘A’ in gentle of rising community metrics.

Weiss famous:

Since February 2018, the quantity of consumer (on-chain) transactions among the many ten most generally used cryptocurrencies has grown by 245 p.c.

The company additionally notes that Bitcoin is a “proven leader in adoption” and that “its value is not controlled by monetary authorities, and it can be a safe haven in times of turmoil.”

Not like [gold], it prices nearly nothing to retailer or transport.

VeriBlock Doubtless Behind the Spike

Certainly, rising community utilization, along with some notable adoption milestones in current weeks, has stored the BTC value buyoant, significantly as of late.

Nevertheless, some analysts have as soon as once more famous that VeriBlock could also be accountable for the spike in block dimension and transaction rely.

As Bitcoinist reported final month, Veriblock is a startup that makes use of Bitcoin’s OP_RETURN outputs to embed extra information for his or her ‘proof-of-proof’ miners. Regardless, Bitcoin’s community is open-access, due to this fact, anybody can use it for no matter motive so long as the miner charges are paid.

Earlier this yer, Casa CTO Jameson Lopp was one of many first individuals to level out that the startup comprised a big share of on-chain transactions.

“VeriBlock miners posted 783,000 transactions to Bitcoin’s blockchain in December and are on track for 1,500,000 in January,” he wrote

In the meantime, developer Nic Carter, famous at this time the increasing mempool – the scale of the cache of Bitcoin’s unconfirmed transactions – is rising quickly, one thing which pushes up charges.

Mempool filling up. Veriblock again to 20% of Bitcoin transactions. The period of low charges will not final endlessly. Consolidate your inputs when you nonetheless have time. pic.twitter.com/N4FVD33MHn

— nic carter (@nic__carter) March 29, 2019

https://platform.twitter.com/widgets.js

“The era of low fees won’t last forever. Consolidate your inputs while you still have time,” he warned on social media.

Is BTC value beginning to meet up with rising community statistics? Do these metrics recommend actual adoption is happening? Share your ideas beneath!

Pictures courtesy of blockchain.com, Shutterstock

The publish Bitcoin On-Chain Every day Transactions Spike to 15-Month Excessive appeared first on Bitcoinist.com.