Bitcoin is up well over 50% for the year, despite an ongoing selloff cutting the recent rally down to size. The cryptocurrency also rose by over 200% from its Black Thursday low, as investors took flight away from cash and poured capital into hard assets.

But now that the dollar is reversing, and claims of the dollar’s debasement are being called “greatly exaggerated,” inflation fearing investors may be taking some BTC profit now that cash isn’t so scary after all.

Bitcoin Pulls Back After Inflation-Fearing, Hard Asset Rally

The recent economic climate has been the perfect storm for Bitcoin and cryptocurrencies. Precious metals also had their time to shine, but some of the luster has since worn off from the gold rush.

High wealth investors are finally considering Bitcoin alongside gold, as a reverse asset. Nasdaq-listed firm MicroStrategy recently disclosed a 21,000 BTC purchase to bolster its reserves and prepare for a future where the value of cash falls by comparison.

The Fed is aiming for just a 2% inflation rate to prevent the dollar’s value from dwindling too fast, but with the way money is being injected into markets, things may pick up in pace.

RELATED READING | GOING DIGITAL: BITCOIN BEATS GOLD AND SILVER IN YEAR-TO-DATE RETURNS

Talk of using Bitcoin as a hedge against inflation really caught wind once billionaire hedge fund manager Paul Tudor Jones revealed a 2% net worth investment in the cryptocurrency. Since then institutional have taken note of the asset’s use as a hedge against inflation.

Other companies are expected to take MicroStrategy’s lead. Small-time retail investors are doing the same, as the wallets holding 1 BTC have grown significantly over the last few months and is still climbing.

But suddenly, despite the feverishly bullish sentiment and extreme greed in the crypto market, Bitcoin has been crashing. And its reason for weakness could be due to the dollar strengthening.

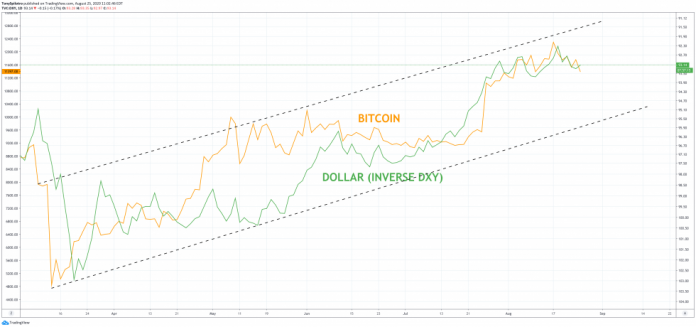

Bitcoin Versus Inverse DXY Dollar Currency Index | Source: TradingView

Dollar Demise Claims “Greatly Exaggerated,” Recovery Could Be Behind Crypto Crash

Sentiment in the dollar recently reached a point where reversals take place. There are also several technical analysis signals and indicators that suggest the dollar will soon stage a strong recovery. Reversal candles are appearing on weekly timeframes, at the bottom of a large, bullish wedge breakout.

The TD Sequential on the weekly is also on an 8-count, suggesting that there could be one more week of downside in the dollar before the bounce takes off.

DXY Dollar Currency Index Reversal In Progress | Source: TradingView

The dollar’s strength comes after months of weakness as the world turned bearish on the dollar due to the United States’ ongoing stimulus efforts and failure to contain the pandemic.

The United States also has a pivotal election coming, so investors are particularly cautious with any investments right now. Fearing the worst, investors may be cashing out Bitcoin and other assets like stocks, metals, and more, preparing for a flight of safety into the safest haven of all: the dollar.

RELATED READING | BITCOIN, ETHEREUM, AND MAJOR CRYPTOS FALL AS DOLLAR FINALLY REVERSES

The dollar has long been the global reserve currency and the most dominant of all fiat currencies. Although it has been challenged recently by the yuan, gold, and Bitcoin, its reign of supremacy is likely to continue.

As analysts state, any claims of its untimely demise have been “greatly exaggerated.”

Featured image from Deposit Photos. Charts via TradingView