Bitcoin value accomplished the shut of the Each day, Weekly, Month-to-month and Q1 within the inexperienced. Let’s check out the charts to find out what might be anticipated for the primary crypto asset within the close to future.

Bitcoin Value: Each day Chart

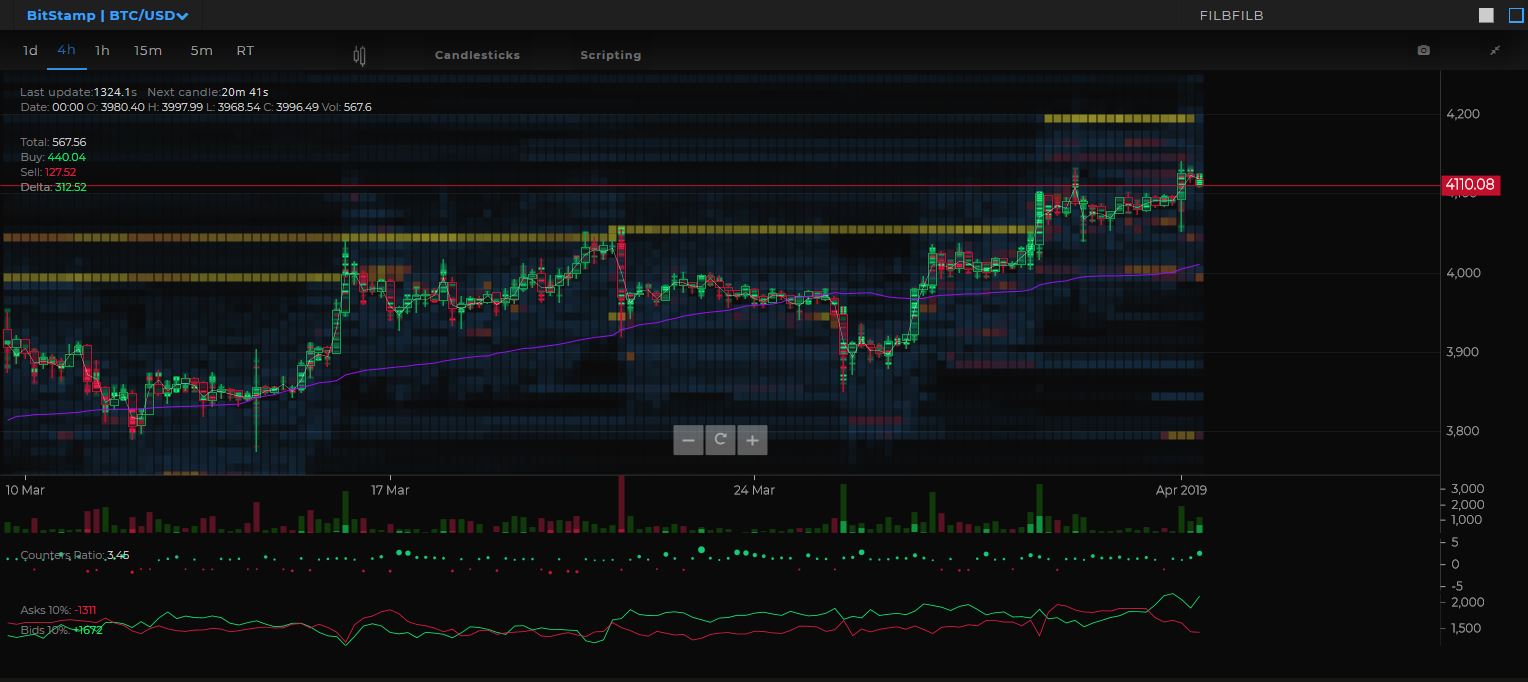

The Each day Chart for Bitcoin value paints an total optimistic image for the bulls. The earlier week’s bear blockade at $4050, which was the duty at hand for the bulls, was finally overcome final Friday.

Bulls weren’t the fools on this April 1st as BTC hit a brand new yearly excessive at $4138.

The $4050 degree itself has already been examined on Saturday and likewise within the early hours previous to the run as much as the excessive – these are encouraging indicators of prior resistance now changing into assist.

The amount profile proven down the best hand facet of the chart illustrates that the Level of Management by way of value the place quantity is traded stays again at $3906. That is additionally the place the 50-day shifting common is discovered.

That is the place the bulls have to step in ought to the bears determine to benefit from the lowering quantity, and efficiently break value down.

General quantity remains to be declining as value is rising, nevertheless. That is usually seen to be bearish divergence so the bulls ought to proceed with relative warning approaching resistance at $4250.

In the meantime, the bulls proceed to consolidate in a bottoming Adam and Eve with an inverse head and shoulders sample inside Eve’s Cup.

Ought to this play out, the bulls will look to interrupt towards the measured transfer targets for each, being $4800- $5000. BTC value must see a excessive quantity get away to set off this transfer on condition that the market is grinding up tentatively on low quantity in a bear market.

Ought to this sample fail to interrupt out, it may show to be crushing for market sentiment and the bulls in the event that they fail to search out assist on the key each day Transferring Common ranges. A transfer to the mid $2000s could then be in play.

Order E-book Evaluation

Trying on the order e book, we will see that there was promoting curiosity artwork $4250 in the identical method that there was at $4050, which served to cap value.

On the 4-hour timeframe, this seems to have been pulled for now, which can be a optimistic signal for the bulls. However it does function a reminder that there’s promoting curiosity above at resistance, which couldn’t be damaged again in December.

Bitcoin Value: Weekly & Month-to-month Charts

The month-to-month chart illustrates that bitcoin value has now moved from 2019 lows of $3320, closing up at $4096 – some 12% for the yr, which is tough to disregard.

It additionally exhibits that BTC closed march above the December 2019 lows and has printed a second increased low on the MACD, simply because the MACD is approaching zero – one other optimistic signal.

The Weekly Chart exhibits that bitcoin value efficiently closed the week above the 20-week shifting common, once more being optimistic. It is usually the closest it’s been to the Bollinger bands, which are actually the tightest they’ve been all through the bear market on the weekly chart, suggesting {that a} large transfer is imminent.

The MACD can be into the ninth week of upper highs and is crossed bullish, however nonetheless beneath zero. Once more, it is a optimistic signal.

Optimistic Indicators for a Backside

In abstract, the Bitcoin and wider crypto markets are displaying all of the optimistic indicators one would anticipate to see of a market that’s looking for a backside and is doing so persistently.

The principle concern is the dearth of significant quantity and a better excessive above $4250 to substantiate that there’s a break within the bearish development total. Fortuitously, we’re at a pivotal level and are about to search out out sooner or later.

Commerce Bitcoin (BTC), Litecoin (LTC) and different cryptocurrencies on on-line Bitcoin foreign exchange dealer platform evolve.markets.

To get obtain updates for the author you’ll be able to observe on Twitter (@filbfilb) and TradingView.

The views and opinions of the author shouldn’t be misconstrued as monetary recommendation. For disclosure, the author holds Bitcoin on the time of writing.

Photographs courtesy of Shutterstock, Tradingview.com, Tensor Charts

The submit Bitcoin Value Evaluation: BTC/USD Able to Break Out or April Fools? appeared first on Bitcoinist.com.