Bitcoin value accomplished a formidable week final week with beneficial properties of 30%, rising from lows of $4053 to weekly highs of $5345. With many calling an finish of the bear market, we take a wanting on the outlook for the market going into the second week of April.

Weekly Chart

The weekly bitcoin value 00 chart reveals that BTC/USD accomplished a formidable seventh consecutive weekly inexperienced candle, accompanied by the best quantity of 2019.

The MACD stays crossed bullish and is quickly transferring in the direction of being constructive, having been bearish since mid-Could 2018.

There may be nonetheless a void in VPVR, which illustrates the value the place quantity traded. This means that Bitcoin nonetheless has some room to run increased, which is one thing we now have beforehand mentioned with the $5k value vary being open floor.

The 50-week transferring common capped the preliminary try to interrupt out of the bull market in mid-2015 earlier than urgent value again all the way down to the 200 week transferring common assist. There may be definitely a case for anticipating one thing comparable in 2019.

Ought to this happen, the 200 WMA would almost definitely lie round $3800. This may imply a 78.6% retracement of the transfer we’ve seen in 2019. However a transfer like this is able to seemingly take a while to play out.

Day by day Chart

Trying on the each day chart early on Monday, bitcoin value made an try to interrupt increased, which has since been pushed again down right into a bearish taking pictures star candle, which is within the strategy of forming on the each day candle. There may be nevertheless, loads of time for the bulls to seek out their toes with the US markets but to open.

The MACD continues to development increased above zero, however there are indicators of the bullish momentum fading, with a decrease excessive being printed on the histogram. Quantity is starting to return to ranges seen forward of the breakout. Value appreciation on lowering quantity is usually thought-about a bearish signal.

Ought to BTC/USD look to retrace within the quick time period, the 50% Fibonacci degree of $4355 would almost definitely be the realm of curiosity for the bulls, with the breakout degree and 61.8% retracement of $4120 being the subsequent goal.

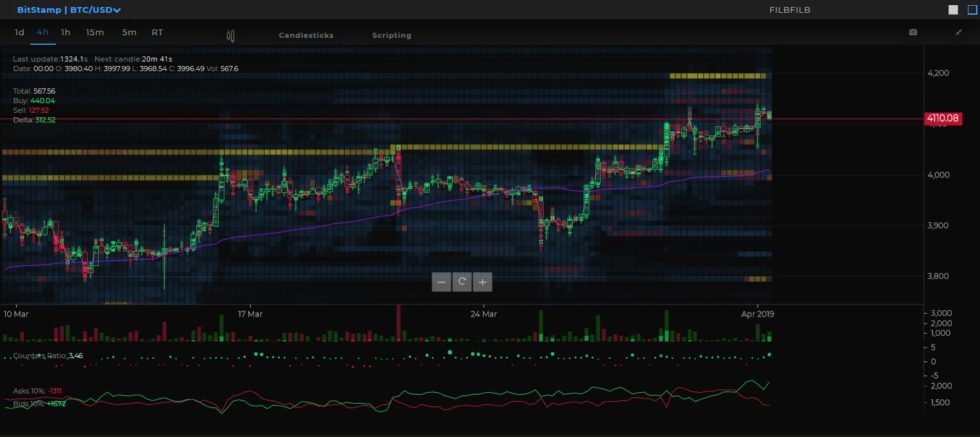

1-Hour Order Guide Evaluation

Trying on the order e-book, bitcoin has a block of shopping for curiosity across the $4800 value level. And on decrease time frames, we will see that there’s nonetheless a usually bullish ascending triangle sample within the value motion, which is constructive forward of the US shut with an absence of sizable promote orders seen overhead.

Trying Forward

Regardless of the selloff on Monday morning, bitcoin value has managed to take care of above $5100.

Holding floor above the $5,100 deal with early within the week will likely be key to persevering with bullish momentum and any try to discover the remaining value quantity void within the VPVR.

Though it appears unlikely at this stage, a break to the upside may see BTC rapidly push on in the direction of the $5500 – $5700 value vary, attractive new patrons into the market.

A breakdown in value momentum would deliver those that have already taken revenue again into the market, alongside new potential patrons. So it might be cheap to count on an honest bounce again as much as the $5,000 degree fairly rapidly.

Commerce Bitcoin (BTC), Litecoin (LTC) and different cryptocurrencies on on-line Bitcoin foreign exchange dealer platform evolve.markets.

To get obtain updates for the author you may observe on Twitter (@filbfilb) and TradingView.

The views and opinions of the author shouldn’t be misconstrued as monetary recommendation. For disclosure, the author holds Bitcoin on the time of writing.

Photographs courtesy of Shutterstock, Tradingview.com, Tensor Charts

The publish Bitcoin Value Evaluation: BTC/USD Caps 7-Week Successful Streak appeared first on Bitcoinist.com.