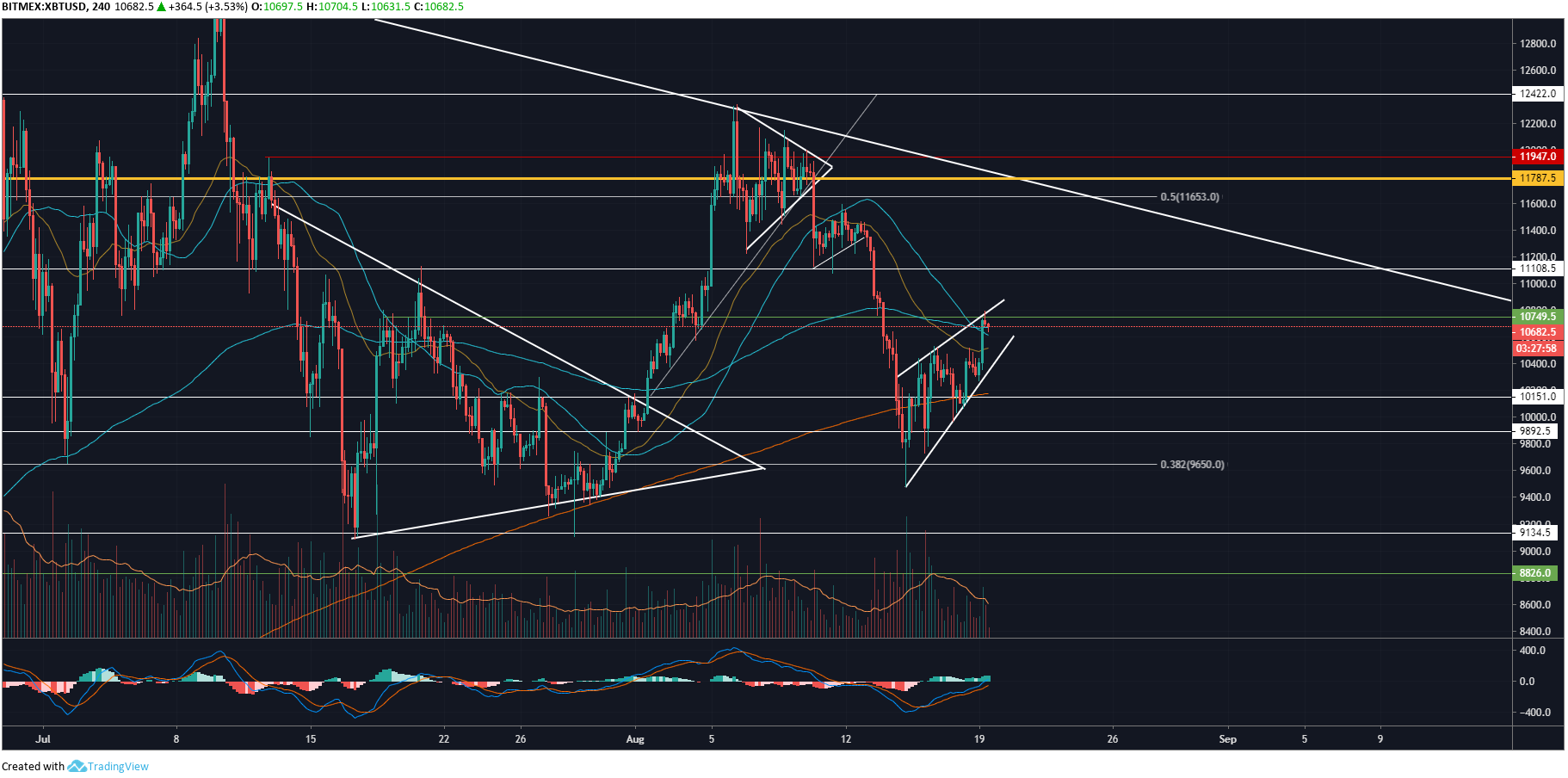

Bitcoin might be seen bouncing off the 0.382 Fibonacci stage round $9,600 as value motion visibly creates an ascending wedge. Many bearish indicators level in direction of a break-down and decrease low within the coming days.

Bitcoin 1-Hour Evaluation

On the 1 hour chart for XBT/USD, we are able to see an ascending wedge has shaped because of the bounce off the 0.382 Fibonacci stage round $9,600. This buying and selling sample is inherently bearish, and there’s no purpose to problem that bias right here. The ascending wedge now has three larger highs and three larger lows indicating the buying and selling sample has now been shaped, and a break-down will seemingly occur within the coming hours and days.

Quantity may be very sporadic at finest with shopping for stress rapidly really fizzling out and returning again to stagnant quantity predominantly in favour of the bears. POC (Level of Management) at $10,400 acts as short-term help. If this stage is damaged, we’ll know that value ranges have dropped out of the ascending wedge and can seemingly re-test the 0.382 Fibonacci stage or create a decrease low round $8,800, as talked about in my earlier evaluation on Bitcoin.

The present Bitcoin market value sits between each the 50 MA and the 200 EMA indicating consolidation which is obvious by the ascending wedge. Value ranges have now returned to each their 50 and 200-day averages, which is often a sign of a big transfer forward as sometimes cash will dump/pump, return again to their 50 and 200-day averages, after which repeat the cycle.

4-Hour Evaluation

On the Four hour chart for XBT/USD, we are able to see the descending quantity inside the newest ascending wedge. This can be a bearish signal as value motion is rising but quantity is falling that means the rising value motion is unsustainable. Quantity has additionally been descending all through the final 6-Eight weeks. MACD has simply re-tested the median line at 0.Zero regardless of reducing quantity making it seemingly MACD will reject crossing over the median line and create a decrease low.

We should always count on Bitcoin value ranges to break-down out of the ascending wedge over the approaching days, break under $9,600 and proceed to create a decrease low round $8,800. Nevertheless, if sufficient shopping for quantity enters then there’s an opportunity key resistance at $11,100 might be damaged. It will signify the beginning of a brand new bullish short-term development.

To conclude, bitcoin is at a choice level because it trades near the 200 EMA. We all know if $11,100 is damaged then additional upside is anticipated. Adversely, if $9,600 is damaged we all know to count on additional draw back and maybe a decrease low.

Do you suppose BTC will create a decrease low over the approaching days and weeks? Please go away your ideas within the feedback under!

This text is strictly for academic functions and shouldn’t be construed as monetary recommendation.

Photos through Shutterstock, XBT/USD charts by Tradingview

The put up Bitcoin Value Evaluation: Rising Wedge May Drive BTC to $8.8K appeared first on Bitcoinist.com.