Investor curiosity in Bitcoin is growing everywhere in the world. Most lately, impressed by Bitcoin’s newest “amazing run,” Agecroft Companions Founder and CEO Don Steinbrugge predicted that Bitcoin can be held in quite a lot of hedge fund portfolios.

Bitcoin Is a “Fantastic Technology”

In a CNBC interview, on August 6, 2019, Steinbrugge described the cryptocurrency as a “fantastic technology.” He additionally praised Bitcoin as a hedge in opposition to inflation.

He identified that presently, BTC was “fairly expensive.” And like many monetary consultants, he finds it difficult to pinpoint Bitcoin’s worth. Nevertheless, he forecast,

“Bitcoin is here to stay. Long term it will be part of a lot of hedge fund portfolios.”

The CNBC interview additionally touched on the uncertainty ensuing from the continuing commerce wars and imminent financial wars.

Certainly, many observers see Bitcoin’s current value rally as a response to persistent considerations surrounding the present commerce warfare between the U.S. and China. Now, the commerce warfare threatens to spill over into financial insurance policies, additional fueling uncertainty.

And as anticipated in periods of economic insecurity, each the values of each gold and Bitcoin have been boosted by the commerce warfare escalation.

BTC to Change into a Darling of Hedge Fund Managers

Thus, Steinbrugge joins a collection of hedge fund managers and buyers who’re already taking steps in direction of integrating Bitcoin into their portfolios.

One in every of these buyers is Invoice Miller, the founding father of Miller Worth Companions. In 2017, he allotted half of his hedge fund to BTC. Consequently, Miller reported, he earned 46 % income within the first half of 2019.

Most lately, in July 2019, London-based Prime Issue Capital turned the primary monetary agency to acquire approval from the UK’s Monetary Conduct Authority to launch a crypto hedge fund.

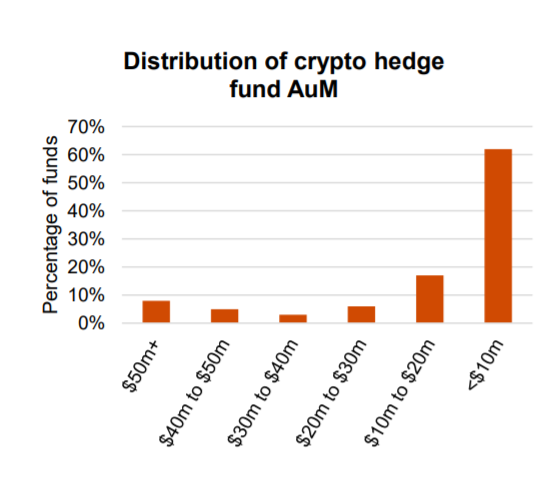

In accordance with a PwC’s “2019 Crypto Hedge Fund Report,” there are about 150 energetic crypto hedge funds, collectively comprising USD 1 billion in property below administration (AuM). These property exclude crypto index funds and crypto enterprise capital funds.

Do you assume hedge fund managers will proceed so as to add BTC to their portfolios? Tell us your ideas within the feedback beneath.

Pictures through Shutterstock, Twitter/CNBC, PwC,

The publish Bitcoin Will Be In ‘A Lot of Hedge Fund Portfolios’: Funding CEO appeared first on Bitcoinist.com.