The world’s largest cryptocurrency asset supervisor, Grayscale Investments, noticed its worth of Belongings Below Administration (AUM) prime $1 Billion yesterday. Worth features throughout the crypto spectrum noticed the worth of Grayscale’s bitcoin holdings alone bounce to $999.1 Million.

Tweet The Good Information From The Rooftops

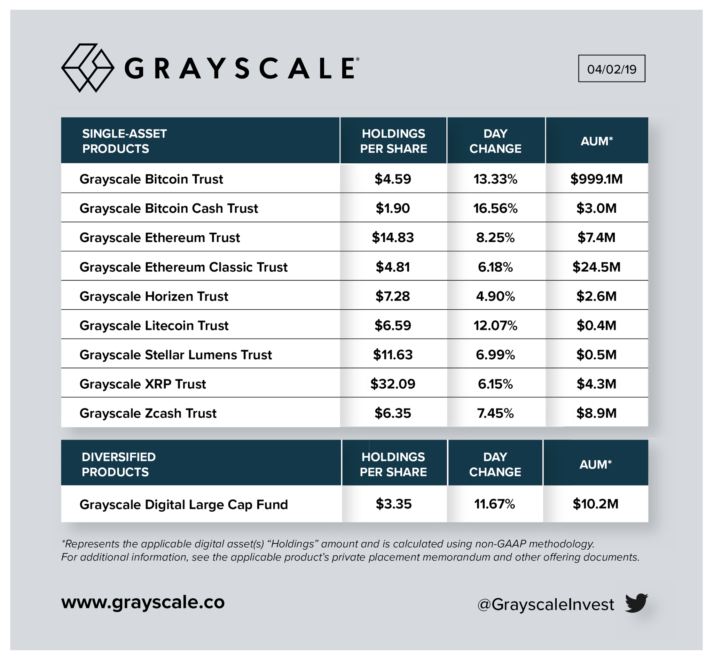

Grayscale tweeted to announce the milestone, publishing a breakdown of particular person merchandise, and a headline worth of $1.1 billion. Really totalling particular person quoted product property yields $1.0609 billion, so maybe there was additionally some rounding in play.

“Grayscale’s assets under management grew to over $1 billion today,” famous Bitcoin investor and Grayscale CEO, Barry Silbert.

As seen within the chart, the overwhelming majority (almost 95%) of the property lie within the Grayscale Bitcoin Belief. Bitcoinist reported this tendency in direction of Bitcoin-maximalism earlier this 12 months, and if something it appears to have elevated.

Apart from bitcoin, probably the most important holdings are within the Ethereum, Ethereum Basic, and Money trusts, and the Digital Massive Cap Fund.

What A Distinction A Day Makes

After all, that was yesterday.

At time of press, bitcoin value has seen additional spectacular 24-hour features as soon as once more retest the $5,000 mark. Accordingly, shares within the Grayscale Bitcoin Belief (GBTC) closed at $5.74, up from $4.71. Every share is value just below 1 mBTC (0.98409), though precise share value fluctuates with the market.

A fast (and really tough) ready-reckoning, means that holdings per share within the GBTC are actually round $4.88. This brings the property beneath administration worth for simply this product to greater than all the cross-currency holdings yesterday ($1.0622 billion).

Who is aware of the place tomorrow will take us?

Crypto-Thaw Crowns A Report Yr

The recents indicators of a possible finish to the lengthy crypto-winter are the icing on the cake of a document 2018 for Grayscale. Regardless of (or maybe due to) crypto’s large value crash from its late 2017, Grayscale continued to seek out funding figures climbing.

In December, analysis from Diar recommended that Grayscale had been quietly accumulating over 1% of Bitcoin’s circulating provide. Regardless of a slight drop-off in funding throughout This fall, the corporate posted document influx ranges for the 12 months.

Will 2019 be an excellent 12 months for Grayscale’s portfolio? Share your predictions beneath!

Pictures vis Shutterstock, Grayscale

The submit Bitcoin Worth Boosts Grayscale Digital Asset Fund to Over $1 Billion appeared first on Bitcoinist.com.