It’s widespread information within the crypto market that the circulating provide of Tether (USDT) has a direct influence on Bitcoin value. So with Tether’s market cap spiking to a brand new YTD-high proper now, ought to we anticipate BTC to comply with carefully behind? Let’s have a look.

Bitcoin/ Tether Evaluation

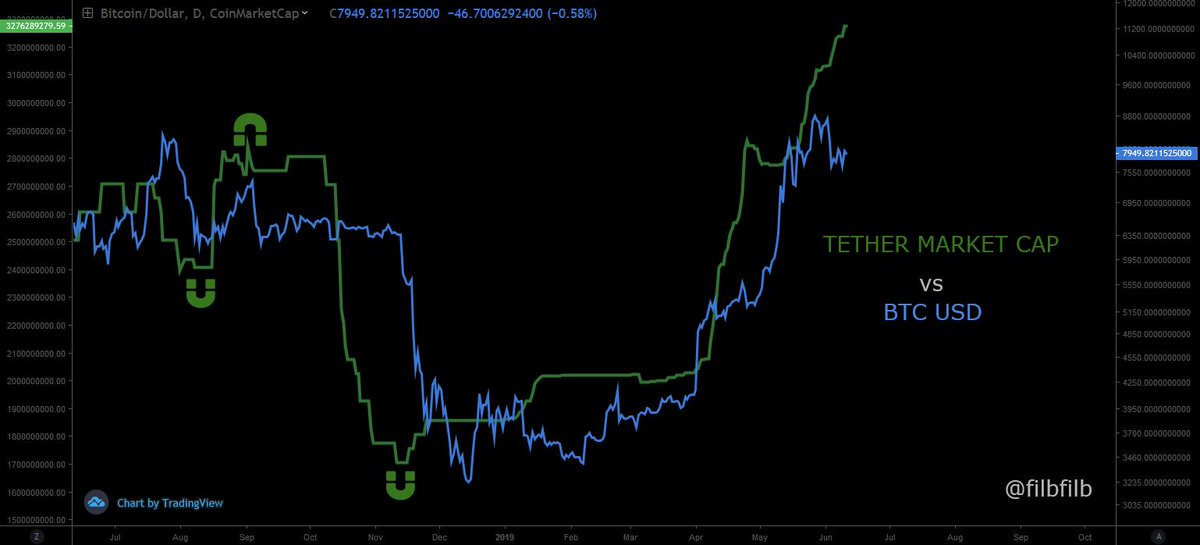

Within the chart above drawn by Bitcoinist’s senior analyst, Filb Filb, we will see a direct relationship between Bitcoin’s value and Tether’s market capital – notably during the last 10 months (blue and inexperienced traces respectively).

On a number of events, Tether’s circulating provide (represented by its market capitalization) has confirmed that it has a delayed magnet-like impact on Bitcoin’s value at any time when it rises or falls. If we check out October final 12 months, we will see that Tether’s market capitalization started to quickly decline forward of the November bear market that despatched BTC packing over 50%. Then, it coincidentally managed to recuperate virtually precisely a month forward of Bitcoin’s rebound off the underside in December. Unusual.

What’s additionally intriguing about this relationship proper now could be that USDT market cap has been rising parabolically during the last 5 weeks as BTC value has climbed after which turned rangebound between the $7,535 and $8,150 ranges.

What we will infer from that is that Tether’s meteoric rise might quickly begin to have one other influence on Bitcoin value. If that is so, we might anticipate to see the primary cryptocurrency break in the direction of a brand new YTD-high over the following few weeks – that’s, if the one-month lag phenomenon repeats.

BTC 4-Hour Chart

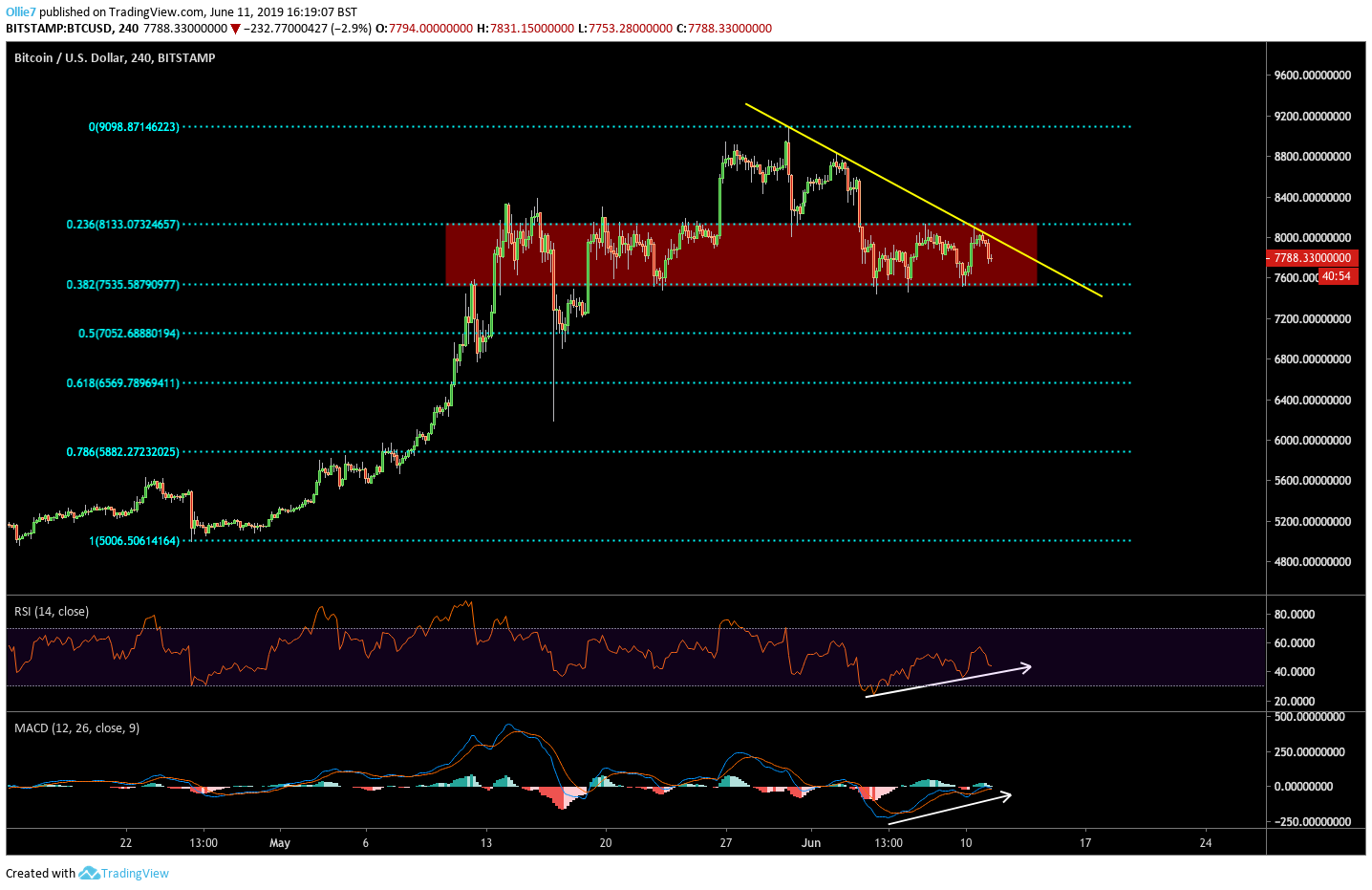

Wanting on the 4-Hour BTC/USD chart we will see additional confirmations that promising bullish momentum is constructing behind bitcoin, regardless of its sideways trajectory.

On the RSI, the indicator line has been making visibly increased lows whereas the value has remained flat. This contradiction is a really bullish sign that BTC consumers are rising stronger and helps the concept that a breakout could occur quickly.

The 2 transferring averages on the MACD indicator have additionally been trending up nicely, and are near breaking above the sign line.

A sloping resistance stage (yellow line) has performed a key position during the last two weeks in holding down bitcoin value from printing a brand new excessive. If we begin to see candles shut above this stage, it should doubtless be an early sign to merchants that BTC/USD has entered into a brand new bullish section and has damaged out of its downtrend.

For now, nevertheless, we will see that the asset nonetheless stays vary sure between the 0.382 and 0.236 Fibonacci ranges. The decrease base help at $7,535 may also be a significant stage within the short-term for propping up BTC value throughout this crucial time.

If consumers fail to defend this stage, then we might probably see Bitcoin fill the CME hole that we checked out final week in a earlier evaluation.

[Disclaimer: The views and opinions of the writer should not be misconstrued as financial advice. For disclosure, the writer holds Bitcoin at the time of writing.]

Photos courtesy of Shutterstock, Tradingview.com

The submit Bitcoin Worth: Does New Tether Market Cap ATH Recommend BTC is Subsequent? appeared first on Bitcoinist.com.