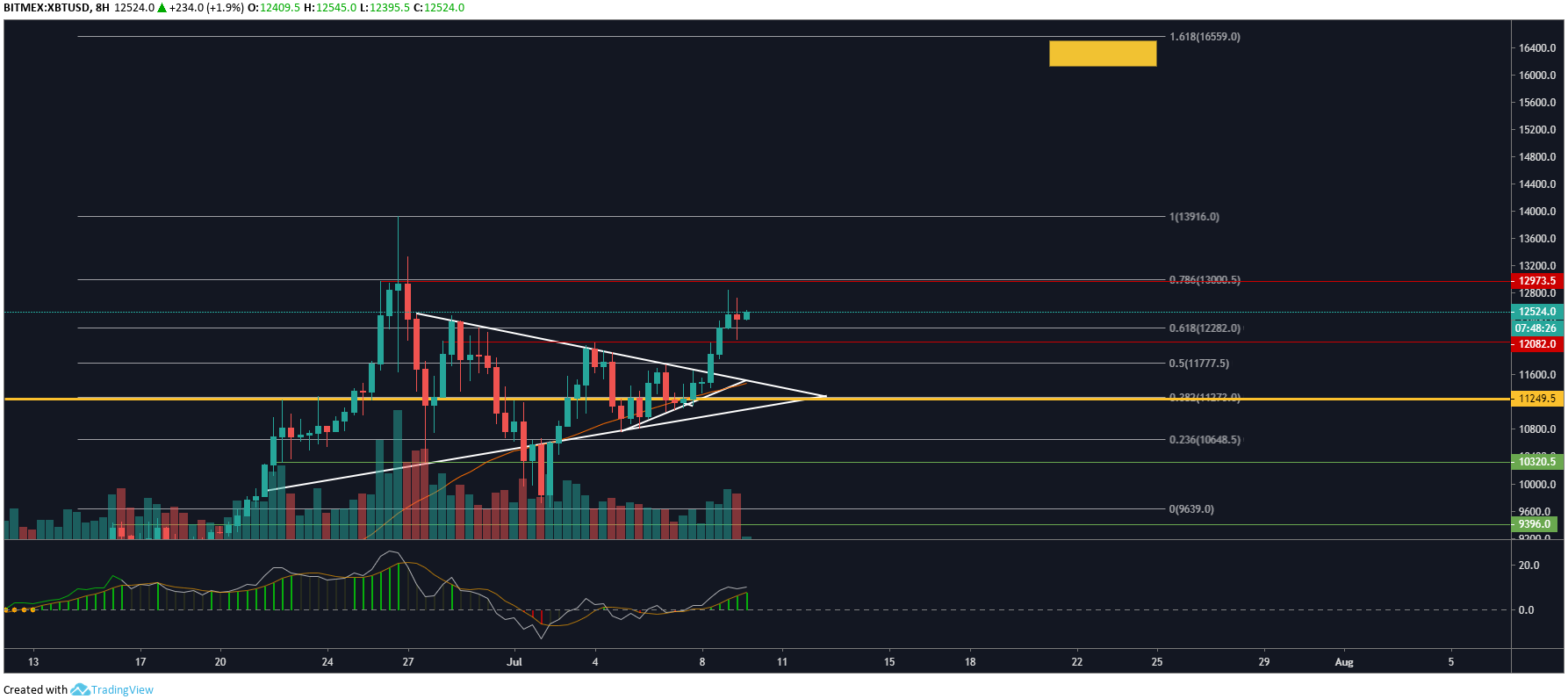

During the last 24 hours, BTC has convincingly damaged to the upside leading to worth ranges hitting the bullish goal set in my earlier Bitcoin worth evaluation piece simply 2 Day in the past. Worth motion appears to be like to now be forming a rising wedge sort sample that ought to see BTC re-test POC round $11,250.

Bitcoin Worth Evaluation 60 Minute Chart

On the 60 Minute Chart for Bitcoin worth evaluation, we will clearly see the latest convincing breakout to the upside that happened on July eighth round 08:00 AM simply over 30 Hours in the past. Each the 50MA and 200EMA have clearly damaged out of the asymmetrical triangle as nicely, clearly exhibiting a transparent breakout has taken place. My first revenue goal of round $12,800 has been hit over the previous couple of hours.

Worth motion has now shaped what seems to be a rising wedge as worth ranges close to a giant resistance level round $12,900. It’s probably that BTC might want to come again all the way down to POC round $11,300 to maintain such unimaginable development, if worth motion breaks down from the rising wedge that is the place I’ll be seeking to re-enter. Please keep in mind the development continues to be very a lot bullish and we might see highs round $13,900 re-tested earlier than any sort of pull-back to POC (Level of Management) ranges highlighted by the yellow line by way of the center of my chart.

BTC Worth Every day Chart

On the Every day chart for Bitcoin worth evaluation, we will see the latest breakout to the upside has precipitated Maxx Momentum indicator (similar to MACD), to cross again over the median to the upside leading to inexperienced bullish momentum returning, which was seen in the course of the prior transfer to present the present excessive of $13,900. Much like the 60 Minute chart POC (Level of Management) sits round $11,250. Usually with such bullish strikes, it’s protected to imagine worth ranges will re-visit POC to maintain such actions.

If Maxx Momentum indicator good points robust momentum again and bulls break the yearly excessive of $13,900 the following wise revenue goal could be round $16,300 situated across the 1.618 Fibonacci stage. One key resistance level arising that can largely dictate if short-term worth ranges have a lot additional upside to return is $12,900 which is at present the 0.786 Fibonacci stage. There seems to be a lot of resting orders at this stage which means a considerable quantity of quantity could be required to interrupt this stage.

Key Worth Vary Not To Be Ignored

As soon as the important thing resistance level round $12,900 is damaged there’s little or no resistance between that time and ranges near BTC’s ATH round $20,00Zero which means worth motion will probably transfer extraordinarily shortly while round these worth ranges. It’s vital to grasp that anybody caught up inside this worth motion will probably face to the wrath of the market maker whose final aim is to liquidate each shorts and longs, which means massive wicks and unpredictable worth motion will probably happen at this level. Now we have seen this occur many instances.

Do you assume BTC will break key resistance round $12,900 over the approaching days? or do you assume worth ranges have to return again to POC round $11,250? Go away your ideas about this Bitcoin worth evaluation within the feedback beneath!

Pictures through Shutterstock, Tradingview

The submit Bitcoin Worth Evaluation: Bulls Win Compelling Breakout appeared first on Bitcoinist.com.