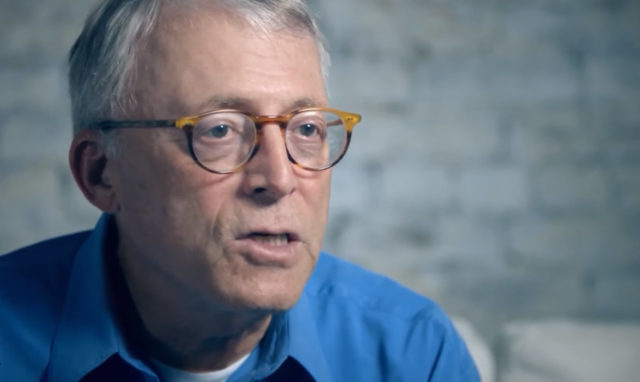

Bitcoin worth is within the “definition” of a descending triangle however the potential for upside stays, veteran dealer Peter Brandt has mentioned in contemporary recommendation for buyers.

Brandt Urges Warning On Brief-Time period Bitcoin

In a sequence of social media updates on September 7, Brandt, who’s effectively generally known as a bullish Bitcoin proponent, mentioned that whereas downward strain was evident, a breakout might nonetheless happen.

“Bitcoin meets the definition of a descending triangle. Don’t let newbie chartists tell you different,” he wrote, commenting on two latest BTC/USD charts.

He continued:

“There have been numerous occasions over the years when prices blew out of the upside of a descending triangle.”

Brandt applies classical charting strategies to Bitcoin markets, a practise which continues to earn him criticism from some who consider Bitcoin doesn’t conform to them.

Beneath present circumstances, Bitcoin will most probably exit the triangle via the longer horizontal aspect – on this case falling decrease.

“Right-angled triangles imply (but do not demand) a resolution thru the horizontal boundary,” he reiterated.

Time To Lengthy BTC?

At this level, Brandt continued that he was lengthy on BTC, given the relative worth suppression in contrast with latest months. The dealer has holdings of between 10 and 100 BTC, he revealed.

As Bitcoinist reported, Bitcoin’s technical energy seems rising at odds with its lackluster worth efficiency over the previous weeks.

For instance, the cryptocurrency’s community hashrate continues to hit new all-time highs, this week coming inside placing distance of 100 quintillion hashes per second.

The metric suggests Bitcoin’s safety and profitability are at unprecedented ranges, capping a renaissance which started at first of 2019.

Amongst analysts in the meantime, others painted the same image to Brandt. Mia Tam, an more and more standard forecaster on Twitter, additionally eyed a step downwards for BTC/USD on Monday, this nonetheless giving method to upside afterwards.

General opinion factors to a number of occasions influencing Bitcoin for the remainder of the 12 months. The primary, later this month, is the long-awaited debut of Bakkt’s bodily Bitcoin futures.

With institutional curiosity unleashed, consideration will then focus on October’s determination on whether or not to permit two Bitcoin exchange-traded funds (ETFs) to hit the market.

The latter have seen repeated delays and rejections from US regulators, with operators looking for to get their merchandise the stamp of approval since March 2017.

What do you consider the quick time period for Bitcoin costs? Tell us within the feedback beneath!

Pictures through Shutterstock, cryptoconsulting.information

The put up Bitcoin Price In ‘Descending Triangle’ As Brandt Reveals Long Positions appeared first on Bitcoinist.com.