The sensible contract of LEO, the ERC20 token issued by iFinex’s subsidiary Unus Sed Leo, allegedly has deliberate flaws in it to permit for enormous fraud, crypto analysis agency Cointelligence says.

Bitfinex May Have Developed an Evil Code for LEO

Crypto analysis and evaluation agency, Cointelligence, has cited findings that Bitfinex might have intentionally created a sensible contract for the LEO ERC20 token which opens the floodgates for potential fraud.

Bitfinex LEO ERC20 token proprietor can’t solely print or mint limitless new tokens but in addition they’ll delete anybody’s cash together with however not restricted to those on centralized or decentralized trade, scorching or chilly storage, {hardware} or software program pockets, and/or paper or mind pockets.

Bitfinex LEO token proprietor can’t solely burn anybody’s $LEO but in addition they’ll carry on #minting limitless new tokens.

as promised @Bitfinexed pic.twitter.com/oDyEjXmf8K

— Bi od (@heybiod) July 1, 2019

https://platform.twitter.com/widgets.js

LEO token, which was launched by Bitfinex on Might 10 of this yr, permits the entity behind it to doubtlessly exert limitless management over the coin, which may depart room for a multi-billion greenback fraud.

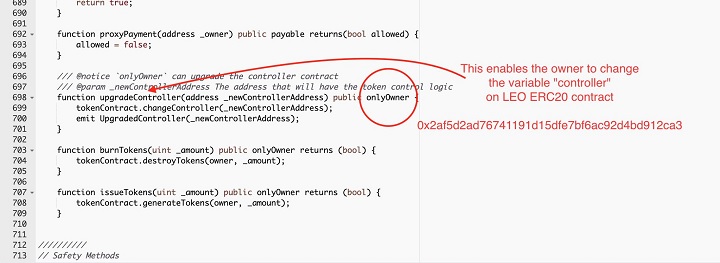

Cointelligence breaks down the code components that exhibit how the token may be manipulated by the proprietor in each method. Thus, the controller contract permits the entity behind the token to switch, concern, approve, burn, and alter the controller itself. Within the latter case, the present handle that controls the LEO ERC20 contract could also be effortlessly upgraded to any handle by the proprietor.

As soon as the controller is modified, the proprietor can carry on minting tokens with out finish or delete anybody’s tokens in a blink of a watch. This may be achieved by means of code features like “generateTokens” or “destroyTokens.”

Cointelligence even simulated these actions by mirroring the LEO’s code on Ethereum. They found that the tokens might be certainly minted and deleted by the proprietor at any level.

Is This Actually an Difficulty?

Whereas the “fraud” time period isn’t unusual for Bitfinex, which has been repeatedly accused of minting USDT with out holding the USD equal in its reserves, some say the story with LEO has gone too far.

Bitfinex CTO Paolo Ardoino defined within the Twitter thread:

For safety and future proof causes we left the flexibility additionally to improve the Token Contract. That’s actually a key characteristic for a contract that may reside lot of years. Minting extra tokens would simply not make sense for Finex… like taking pictures our foot.

Nonetheless, the reply didn’t persuade the LEO skeptics.

On the opposite facet, some Twitter customers argue that EOS and TRON are only some examples of entities that might do the identical with their tokens, and no one complains about it. A consumer concluded in a similar way:

How does this grow to be information each few months. So many cash are mintable and burnable. As much as you if you happen to belief the individuals in cost with that energy. Even when a coin isn’t, the staff behind can migrate to a brand new contract which is mintable.

Is the LEO code certainly a difficulty that ought to preserve crypto buyers away from the token? Tell us your ideas within the remark part beneath!

Photographs courtesy of Cointelligence, Shutterstock, Twitter, @heybiod

The put up Bitfinex’s LEO Token Permits Multi-Billion Greenback Fraud, Cointelligence Claims appeared first on Bitcoinist.com.