Bitcoin mining large Bitmain has much less optimistic information as bitcoin worth reclaims $6000 and the hash charge continues its regular climb. Its inside mining operations present a discount of 88% of hash energy up to now month.

Bitmain On A Steadily Downwards Trajectory

Beleaguered Bitcoin mining-rig producer, Bitmain, simply can’t appear to catch a break today. As an early participant within the Bitcoin saga, its made a fortune by way of promoting {hardware} and its personal dominant mining operations. How occasions have modified.

Placing its eggs in Bitcoin Money’s basket turned out to be a spectacularly unhealthy transfer, resulting in the eventual firing of co-founder and CEO, Jihan Wu. This and the repercussions of 2018’s common malaise within the cryptocurrency markets have seen IPO plans repeatedly delayed.

The information of this mining energy discount is simply the newest indicator of the corporate’s decline.

88% Sounds Like A Lot

That’s as a result of 88 p.c is quite a bit.

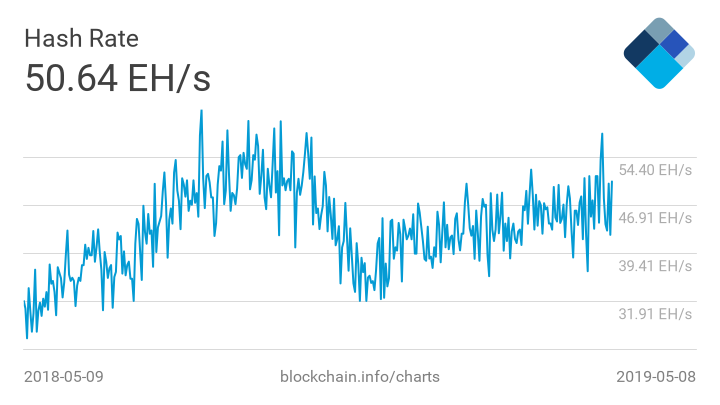

Bitmain began revealing the hash charge of its owned machines in July 2018. On the time it stood at 1692 PH/s, rising to 2339 PH/s in October of that 12 months. The general decline within the Bitcoin community’s whole computing energy introduced figures down from November 2018 till March this 12 months. However final month, Bitmain reported wholesome figures of 2072 PH/s.

This month, the reported hash charge of all Bitmain-owned {hardware} was simply 237.29 quadrillion hashes per second. This equates to a drop in Bitmain’s share of the community’s whole computing energy from 4% to 0.4%.

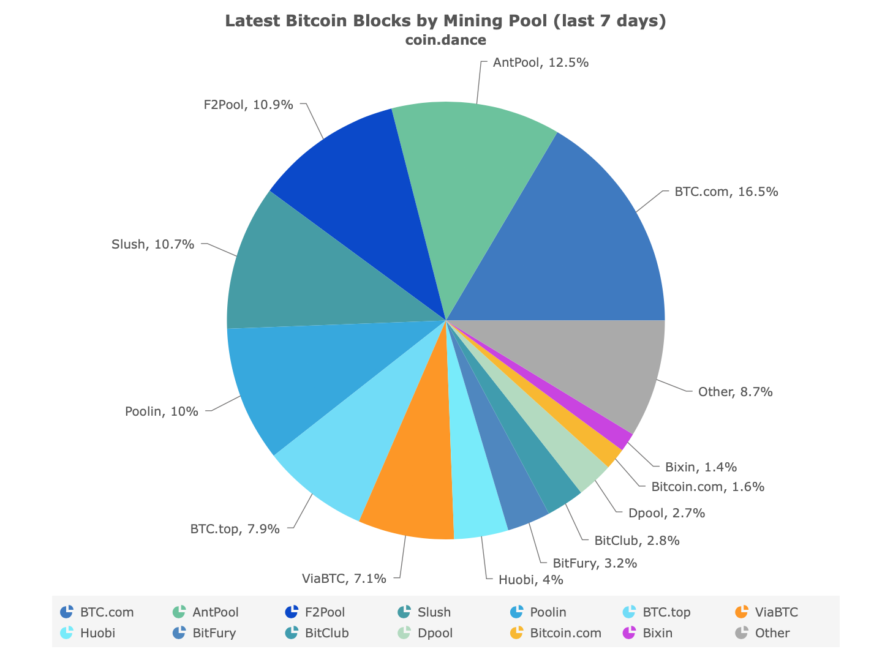

Consequently, the proportion of blocks mined by the 2 Bitmain-controlled swimming pools, BTC.com and Antpool have fallen to 30%. Final June, these swimming pools had been mining 42% of all Bitcoin blocks.

Whole Bitcoin Hash Price Continues To Climb

Whereas Bitmain’s share is dwindling, the entire hashing energy of the Bitcoin community continues to climb. The beginning of the month noticed a 6-month excessive (the community’s 4th highest degree ever), and the general development has been of rising weekly-averages for the reason that lows of December 2018.

Bitmain’s loss is Bitcoin’s acquire nevertheless, because the discount in dominance implies that the entire community is changing into extra decentralized.

Bitcoinist reported in January that the extent of decentralization was such, that simply six transaction confirmations had been sufficient to ensure towards double-spending. This information might nicely have lowered that determine even additional.

In outcome, the rising decentralization and competitors amongst miners ought to make the community much more strong and extra enticing for traders.

Is Bitmain’s mining monopoly formally lifeless? Share your ideas beneath!

Photos through Shutterstock, Blockchain.information, coin.dance

The put up Bitmain Dropping 88% Market Share is Turning Out Nice For Bitcoin (BTC) appeared first on Bitcoinist.com.