Bitcoin’s bettering fundamentals and the arrival of institutional traders might influence the volatility and value motion of future rallies and corrections.

The Nature of Bitcoin Rallies will Change

Aaron Brown, the writer of a just lately revealed op-ed in Bloomberg, believes that the subsequent sustained Bitcoin rally might be extra measured as will probably be propelled by fundamentals and international monetary occasions moderately than FOMO.

Based on Brown, the increase and bust nature of the cryptocurrency market isn’t prone to change instantly and if future value motion mirrors earlier bull markets then Bitcoin might rise to $60,000 to $400,000 earlier than declining sharply.

Brown argues that the final two rallies in 2013 and 2017 have been primarily pushed by retail traders and that 2019 is totally different as the present $260 billion cryptocurrency market cap is far bigger than it was in 2013 ($1 billion) and 2015 ($three billion).

Moreover, immediately there are considerably extra cryptocurrency traders and in 2018 greater than $30 billion of institutional and funding capital went towards constructing new platforms.

There may be additionally extra readability on the regulatory entrance and with main establishments like Fb, Goldman Sachs, JPMorgan Chase, and Constancy investing within the sector, Bitcoin’s value motion might be extra measured in 2019.

Although the general panorama seems strong, Brown cautions that this doesn’t negate the potential of a bubble and crash however because the sector matures so does the potential of the market offering ‘predictable’ returns with the occasional 20% correction as an alternative of the drastic 85% corrections which usually happen on the finish of Bitcoin’s bull cycles.

Bitcoin Choices Contracts Present Helpful Perception

Trying into Bitcoin choices knowledge supplies a bit foresight into how Bitcoin value 00 motion might differ in 2019. In November 2017 Bitcoin contracts traded with an implied volatility above 300% and traders believed there was a 25% probability that Bitcoin might achieve above $10,000.

At the moment, BTC is sort of the identical value it was round November 2017 and the identical contract sells at roughly an 85% implied volatility which implies there’s a 15% probability of Bitcoin overtaking $10,000 in a month.

Accordingly, if Bitcoin reaches $10,000 then the anticipated excessive is round $11,000 and if it doesn’t then the anticipated value is round $7,500. Whereas this can be a dangerous wager, it pales compared to the chance traders took on in 2017.

Market Correlations Matter

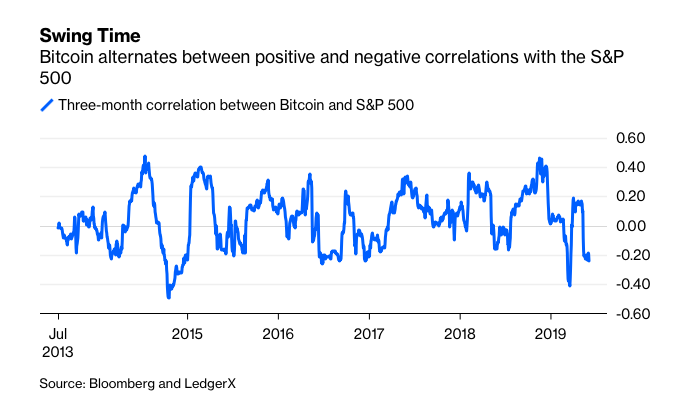

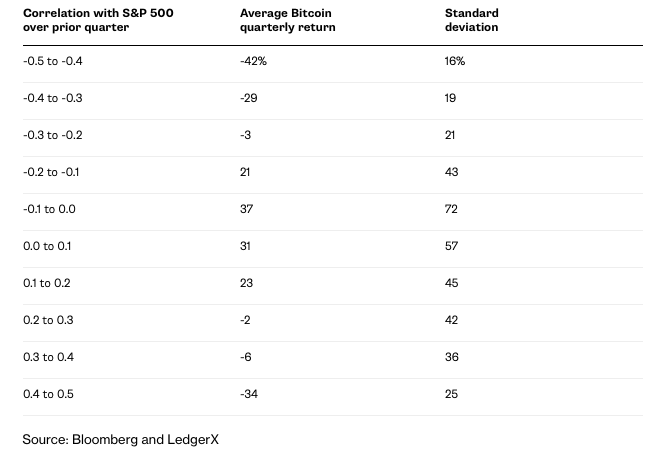

Bitcoin’s correlation to the S&P 500 Index additionally supplies some steering on 2019 value motion. When the correlation is nearer to zero for 1 / 4, Bitcoin tends to common excessive returns within the following quarter however volatility additionally will increase.

Alternatively, when Bitcoin responds to market fundamentals, whatever the correlation, the typical returns are usually decrease and even detrimental.

As proven by the chart above, Bitcoin’s present correlation with the S&P 500 is close to -0.2 and that is an space the place volatility has not reached extremes prior to now. Brown additionally identified that since mid-2018 Bitcoin’s correlation to the S&P 500 solely hovered close to zero for a few months within the first few months of 2019 whereas the correlations have been close to zero from September 2017 to January 2018.

Based on Brown, Bitcoin seems to flip between constructive and detrimental correlations with the S&P500 and intense value will increase are inclined to happen when the correlation is close to zero.

Because of this, Brown believes that the upcoming cycle might be totally different and he expects that over the summer season costs will react to information about market fundamentals as an alternative of FOMO.

What do you concentrate on Aaron Brown’s idea? Share your ideas within the feedback beneath!

Photographs by way of Shutterstock, Coveware.com

The publish Bloomberg: Bitcoin Worth Might Hit $400Okay Attributable to Fundamentals, Not FOMO appeared first on Bitcoinist.com.