Governor of the Financial institution of England Mark Carney put ahead the concept of changing the U.S. greenback with a central bank-issued cryptocurrency like Fb’s Libra.

Carney Proposes The Artificial Hegemonic Foreign money

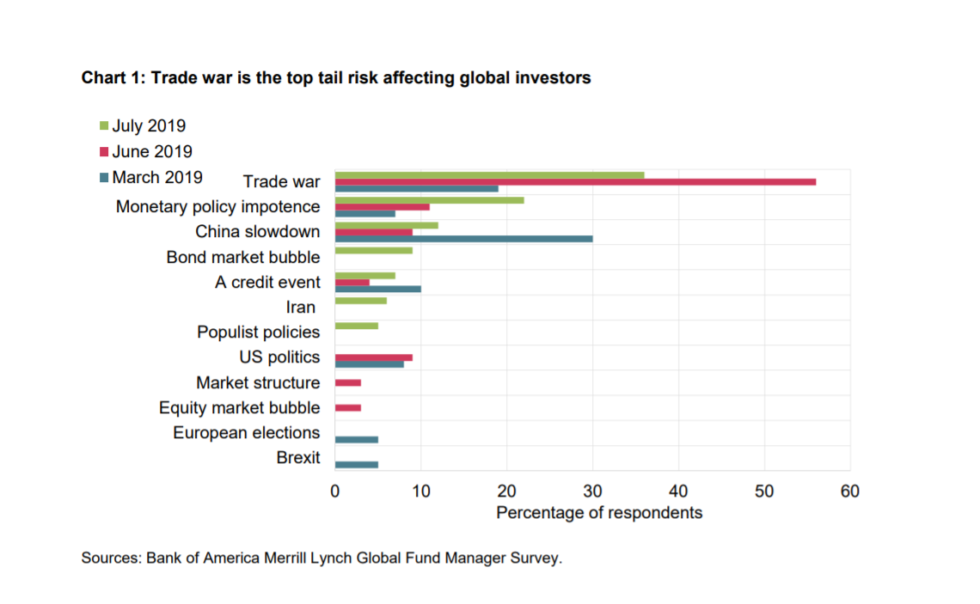

On August 23, 2019, whereas addressing the Federal Reserve Symposium in Jackson Gap, Wyoming, Carney described how Brexit uncertainties, persistent world commerce tensions, and general weaker enterprise exercise are deteriorating the worldwide economic system.

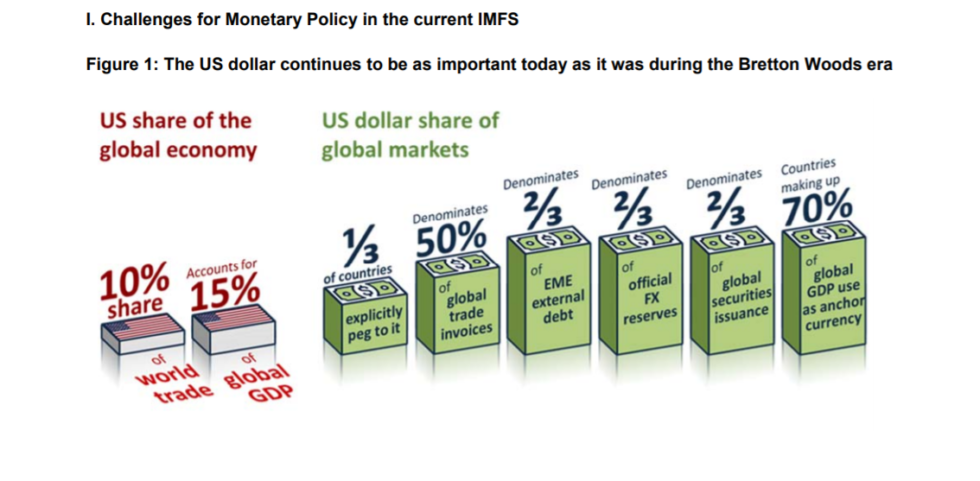

Carney additionally underlined that, due to globalization and the widespread dominance of the U.S. greenback, U.S. developments have vital worldwide implications when it comes to commerce and monetary situations, together with in nations with comparatively little direct publicity to the U.S. economic system. The BOE Governor explains,

“In particular, growing dominant currency pricing (DCP) is reducing the shock-absorbing properties of flexible exchange rates and altering the inflation-output volatility trade-off facing monetary policymakers. And most fundamentally, a destabilizing asymmetry at the heart of the IMFS is growing. While the world economy is being reordered, the US dollar remains as important as when Bretton Woods collapsed.”

He additionally warned that these dynamics had elevated the dangers of a “global liquidity trap.”

The Worldwide and Financial System Requires Enchancment

Thus, given the brand new financial setting, Carney referred to as for radically bettering the construction of the present IMFS (worldwide financial and monetary system). And to create a greater IMFS, he suggested nations to think about each alternative, together with these offered by new applied sciences.

As reported earlier by Bitcoinist, the financial institution governor had already expressed his openness to the concept of a central bank-issued cryptocurrency.

Now, in his speech on the Federal Reserve Symposium, Carney was extra particular. He put ahead the concept of a Artificial Hegemonic Foreign money (SHC) offered by the general public sector, “perhaps through a network of digital currencies.” He said,

“An SHC could dampen the domineering influence of the US dollar on global trade. If the share of trade invoiced in SHC were to rise, shocks in the US would have less potent spillovers through exchange rates, and trade would become less synchronized across countries.”

To strengthen his case, the CBE chief highlighted that retail transactions more and more happen on-line by digital funds. And the excessive prices of each home and cross-border digital funds are boosting innovation. For instance, Carney talked about Fb’s Libra. And he identified,

“Technology has the potential to disrupt the network externalities that prevent the incumbent global reserve currency from being displaced.”

Do you assume a central-bank-issued Artificial Hegemonic Digital Foreign money will overthrow the united statesDollar? Tell us within the feedback under.

Pictures courtesy of Shutterstock, Financial institution of England, Financial institution of America Merrill Lynch World Fund Supervisor

The put up BoE Governor Mark Carney Proposes World Cryptocurrency appeared first on Bitcoinist.com.