The inflation price in Brazil, the world’s ninth largest financial system, spiked to its highest degree in 4 years, driving extra individuals to Bitcoin, as indicated by the current rise in Bitcoin buying and selling volumes.

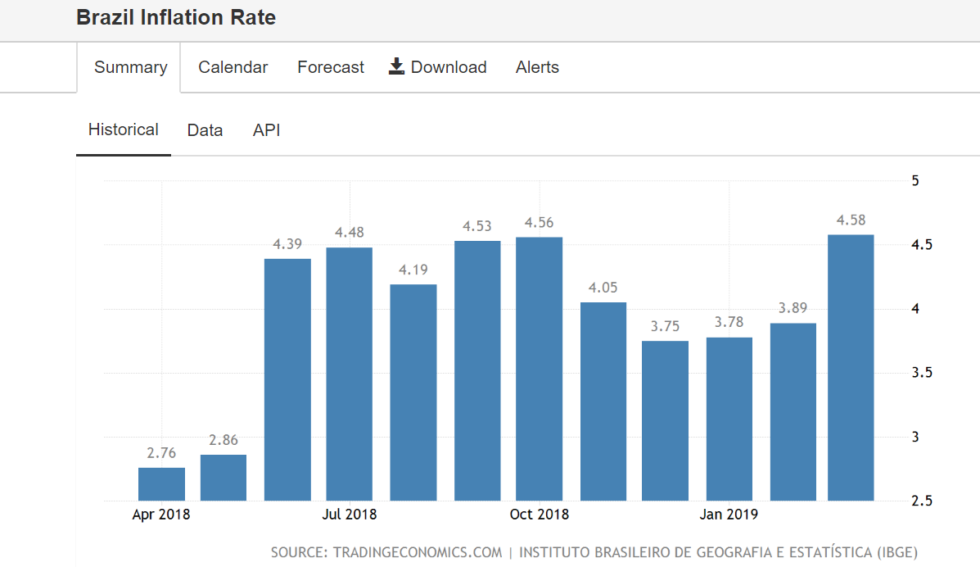

Inflation in Brazil Hits 4.5%

President Jair Messias Bolsonaro took workplace on January 1, 2019. Since then, Brazil’s inflation price has proven an upward pattern. The Rios Occasions writes,

“The latest result of the IPCA was the highest for the month of March since 2015. The IPCA, which measures the country’s official inflation, rose by 0.43 percent in February, and 0.09 percent in March of last year.”

Because of this, the Brazilian Statistics and Geography Institute (IBGE) experiences that the cumulated inflation price for the final 12 months reached 4.58 p.c.

Financial Woes Correlated With Rising Bitcoin Exercise

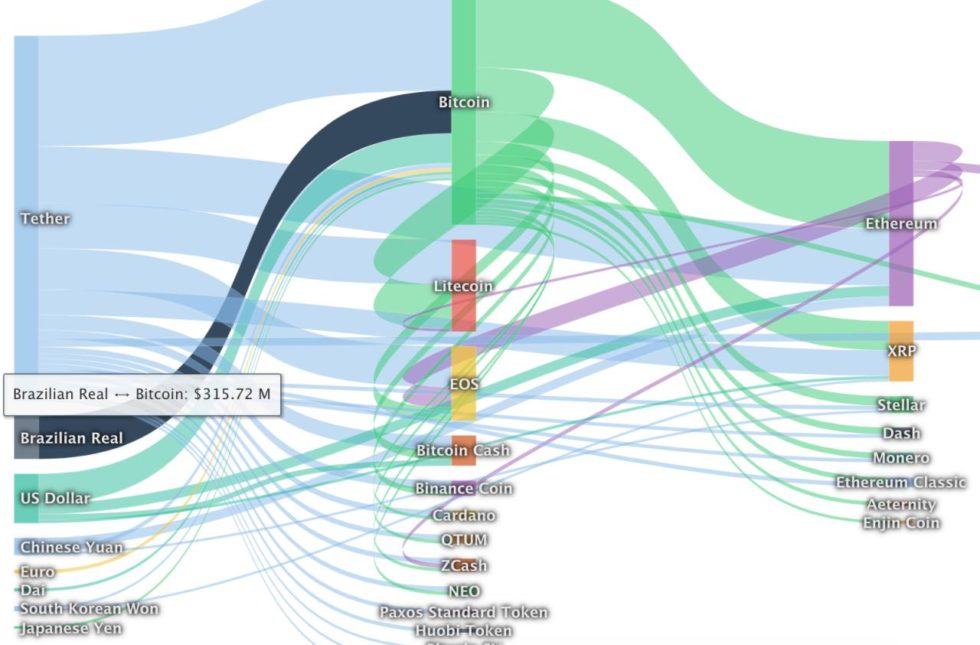

Just a few days earlier than the announcement of the inflation upsurge, coincidentally, Cointrader Monitor, a monitoring device that analyzes Bitcoin value actions within the nation, tweeted that Brazilian cryptocurrency exchanges traded greater than 100,000 BTC on April 10, 2019.

In the meantime, the Actual has seen among the greatest fiat inflows into bitcoin comprising $315 million over the previous 24 hours, based on information from Coinlib.

Neighboring Argentina Catching Bitcoin Fever

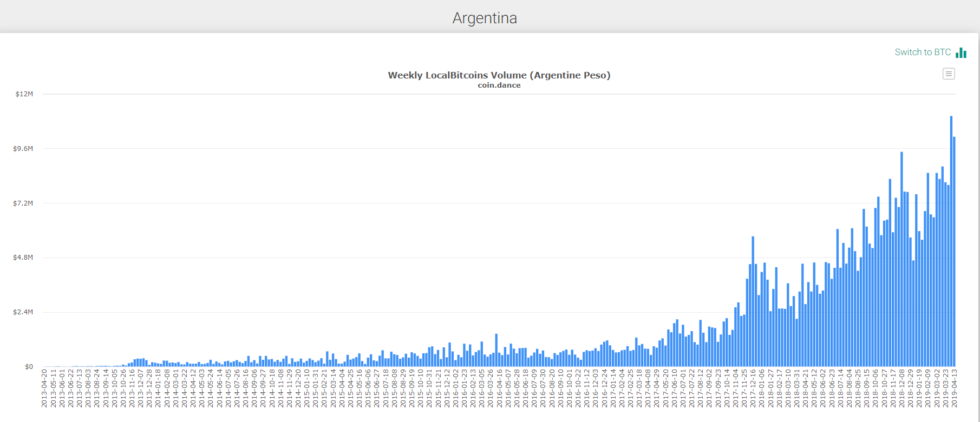

The sustained rise within the normal value degree of products and companies, mixed with different financial woes, isn’t solely afflicting Brazil but additionally Argentina.

Argentina is the second largest financial system in Latin America, behind its neighbor Brazil.

Many have proposed that financial issues are inflicting the rise of Bitcoin buying and selling volumes to extend dramatically. For instance, The Rio Occasions wrote,

A hunch within the financial system is probably going the explanation for the rise of cryptocurrencies in Brazil.

In Argentina, the financial scenario is far grimmer. Argentina’s central financial institution has been pressured to tighten financial coverage thrice within the final month. However, inflation continues to be accelerating at a price of practically 55 p.c. Bloomberg writes:

The inflation price rose to virtually 55 p.c in March, with client costs rising 4.7 p.c within the month, exceeding the entire forecasts in a Bloomberg survey of analysts.

For the final a number of weeks, traders in Argentina have additionally been turning their focus to the cryptocurrency, as information launched by LocalBitcoins exhibits.

Equally, buying and selling quantity on peer-to-peer trade LocalBitcoins has additionally been surging throughout in Mexico, following US President Donald Trump’s risk of clamping down on remittances by unlawful immigrants.

In such financial conditions, the cryptocurrency is changing into more and more enticing primarily as a result of Bitcoin, amongst different attributes, is inherently borderless and inflation-resistant — as solely 21 million digital cash will ever be created, by the 12 months 2140.

Do you assume Brazil’s inflationary pattern contributes to its current upswing in Bitcoin buying and selling exercise? Tell us within the feedback under!

Photos courtesy of by way of LocalBitcoins/coin.dance, Shutterstock

The publish Brazil: Highest Inflation in Four Years Propels Bitcoin Quantity to File Highs appeared first on Bitcoinist.com.