Bitcoin value bear market “likely ended at $3000,” well-known analyst Tom Lee has declared as his ‘Bitcoin Misery Index’ (‘BMI’) sentiment device reaches three-year highs.

BMI Says Bull Market

Lee, who’s well-known amongst cryptocurrency merchants as a serious bullish voice on Bitcoin and makes common mainstream media appearances, highlighted his decidedly un-miserable Index readings on social media April 11.

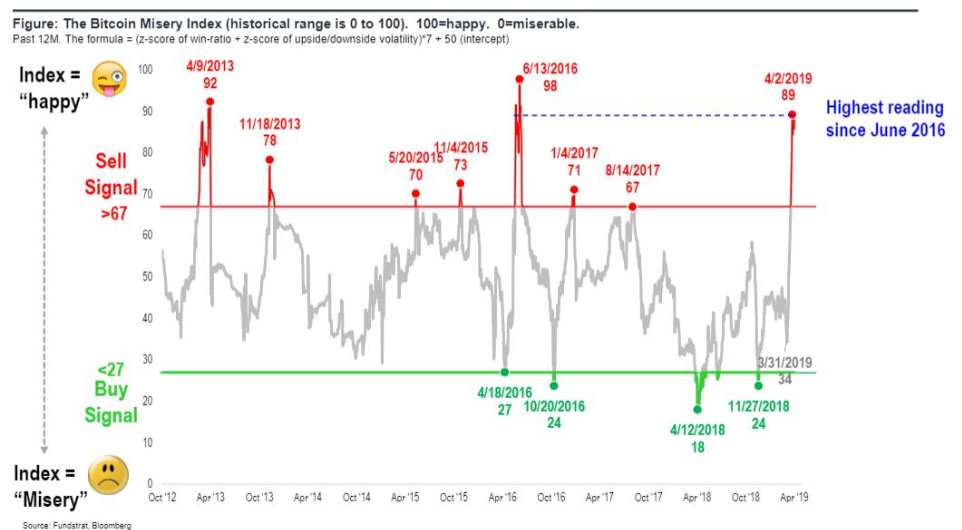

Lee’s BMI provides a rating of 0-100 for Bitcoin value, telling merchants when to purchase and when to promote primarily based on general market ‘misery.’

A rating of 27 or under constitutes ‘buy,’ whereas something greater than 67 conversely instructs the reader to promote.

After Bitcoin value 00 rose $1300 in days to hit $5330 final week, the BMI noticed a dramatic awakening. Having beforehand languished at 34 on the finish of March, its newest studying is 89 – the best since June 2016.

$3K Was Bitcoin Worth ‘Bottom’

For Lee, this brings blended alerts, the Fundstrat senior analyst following within the footsteps of veteran dealer Tone Vays in declaring the bullish momentum behind Bitcoin might not imply an unequivocal reversal.

In contrast to Vays, nevertheless, he steered that the principle message behind Bitcoin value was that it was unlikely to drop under $3000 any longer – whereas Vays has saved as much as $1000 in play.

“The main takeway (sic) is that BMI reaching 67 is further evidence the bear market for Bitcoin likely ended at $3,000,” Lee summarized.

The upturn seemingly caught Lee, together with many others, abruptly. Previous to the surge, Lee had even pledged to cease giving Bitcoin value forecasts.

“Because of the inherent volatility in crypto, we will cease to provide any timeframes for the realization of fair value,” he instructed Fundstrat shoppers in December.

Eyes On $5900

Additionally perking up are numerous Bitcoin community indicators and exterior measures, including weight to the idea that the biggest cryptocurrency’s darkest days are actually behind reasonably than forward of it.

As Bitcoinist reported earlier this week, the reemergence of the so-called ‘Kimchi Premium’ – a surcharge for Bitcoin purchases on South Korean exchanges – excited commentators. Like Lee’s excessive BMI readings, the Premium has solely appeared in Bitcoin bull markets.

The phenomenon carefully adopted recent motion from China, the place merchants gave the impression to be sidestepping highly-restrictive regulatory buildings to put money into cryptocurrency through stablecoin Tether, additionally at a premium in fiat phrases.

At press time Friday, Bitcoin value has recovered modestly to almost $5100 by means of the day after falling from highs of $5440.

Aside from momentary blips, Bitcoin has now held onto assist at $5000 since April 5. Bitcoinist on Wednesday projected a short-term value goal of round $5900.

What do you concentrate on the Bitcoin value and Bitcoin Distress Index? Tell us within the feedback under!

Photographs through Tradingview.com, Shutterstock

The publish Bullish Sign? Bitcoin Worth ‘Misery Index’ Flashes 3-Yr Excessive appeared first on Bitcoinist.com.