The attraction of Proof-of-Stake (PoS) cryptocurrency of incomes annual rewards could also be a fallacy and a tax burden, concludes BitGo’s Ben Davenport.

The Attraction Of Proof-Of-Stake Is A Fallacy

BitGo and Beluga co-founder, Ben Davenport, has simply revealed a report analyzing the impact of taxes on PoS tokens. He makes stark conclusions relating to the taxman’s impression on potential returns from the cash.

One of many key sights to PoS cash is the chance to stake your holdings and earn an annual reward of between four and 15%. However as Davenport writes, there is just one place that this cash can come from: individuals who don’t stake their cash.

So when you maintain one in every of these cash, it’s in your greatest pursuits to stake. In any other case, your share will get continuously diluted. After all, if all holders stake all of the cash, then everybody maintains the identical general share. Due to this fact, with PoS, you need to work/stake your cash, simply to interrupt even.

However The Taxman Makes It Even Worse

Regardless of needing to get the staking rewards merely to not lose out financially, many tax businesses nonetheless contemplate any yield as earnings. One might debate whether or not these are taxable, or are merely analogous to inventory dividends on shareholdings. Nevertheless, the elemental distinction goes again to the rewards solely being paid for staking, which means that work is being executed to obtain them.

So you need to stake to obtain the rewards, simply to interrupt even, after which the taxman will take more money off you for the pleasure… in cash!

It’s received to be a fairly superb coin to be value that. And naturally, you wouldn’t dream of not declaring taxes.

How Dangerous Can It Be?

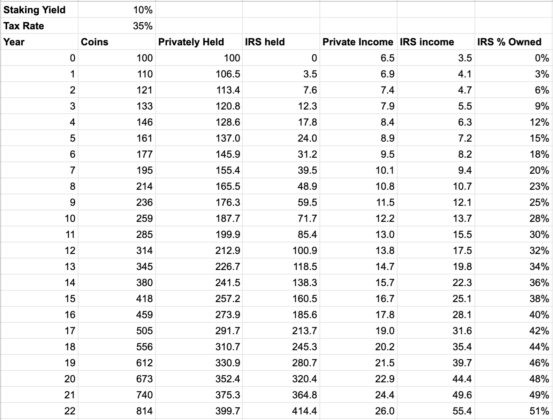

Davenport outlines an fascinating thought experiment, pondering the implications of the tax authority accepting fee within the PoS coin.

It assumed a 10% annual return, 35% tax price, and that every one holders are staking 100% of their cash. It additionally assumed that the tax authority was a dedicated holder, who by no means sells.

The tax authority share continues to extend, and after 22 years, it owns over half of the market cap.

After all, in actuality, the tax authority doesn’t settle for the token as fee, so holders want to seek out new consumers, resulting in downward stress on worth.

So when tax is taken into account, proof-of-stake cash can truly result in unfavorable returns in actual phrases.

Do you agree with the findings on PoS coin returns? Share your ideas under!

Pictures through Shutterstock, Medium.com/@bendavenport

The submit Burnt At The Stake: Why PoS Cryptocurrency Might Go away You Feeling Taxed appeared first on Bitcoinist.com.