The Chicago Board Choices Trade (CBOE) has introduced it is going to now not provide any new Bitcoin futures contracts shifting ahead amid declining volumes. However because the derivatives product was USD settled, many commentators are bullish on the information.

No New CBOE Bitcoin Futures Contracts

The Chicago Futures Exchanges (CFE) of the The Chicago Board Choices Trade (CBOE) has revealed it is going to now not provide any new contracts for its cash-sttled XBT Bitcoin futures product shifting ahead.

Nonetheless, present contracts will nonetheless be accessible for buying and selling, the most recent of that are set to run out in June 2019. The alternate will now consider whether or not XBT futures and presumably different digital spinoff merchandise will see the sunshine of day sooner or later.

“CFE is not adding a Cboe Bitcoin (USD) (“XBT”) futures contract for buying and selling in March 2019,” the official announcement reads.

CFE is assessing its method with respect to the way it plans to proceed to supply digital asset derivatives for buying and selling. Whereas it considers its subsequent steps, CFE doesn’t at present intend to listing extra XBT futures contracts for buying and selling. Presently listed XBT futures contracts stay accessible for buying and selling.

The announcement might not come as a shock given the declining volumes of XBT that was rolled out to a lot fanfare in December 2017 – when Bitcoin worth hit its historic all time excessive of almost $20,000 USD.

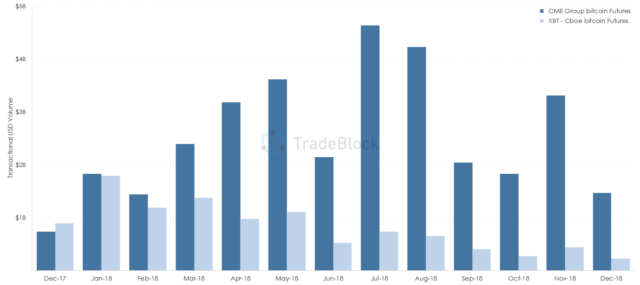

Since launch, XBT has been dropping floor to Bitcoin futures from The Chicago Mercantile Trade (CME), whose quantity has dwarfed XBT’s in latest month regardless of beginning neck and neck.

Final month, Bitcoinist reported that the 2 merchandise have hit yearly lows by way of quantity. Although CME’s BTC futures nonetheless noticed roughly $1.5 billion in month-to-month quantity for December 2018 in comparison with a paltry $250 million from the CBOE.

In actual fact, XBT has by no means damaged the $2 billion mark in its historical past. Then again, CME’s bitcoin futures noticed a document excessive quantity of almost $5 billion in July 2018 and have constantly proven to be extra common amongst merchants, significantly in latest months.

Market Selected the Higher Contract

XBT’s falling volumes is probably going why the CBOE determined to cede the market to CME, although no official purpose was given.

On the similar time, commentators reacted to the information with some predicting a constructive impact in the marketplace because the XBT product was cash-settled.

“Simply put, the costs of continuance outweigh the benefits in $$$ terms,” wrote Twitter consumer Robin H. Justice. “My sentiments: good riddance. All bitcoin futures should be settled physically so the insider power money cheaters find it more risky and expensive to play futures off spot and vice versa.”

One other commentator merely acknowledged that the “market chose the better contract.”

Bitcoin investor Hint Mayer sarcastically added that he desires costs to stay decrease for longer, hinting that the tip of cash-settled bitcoin futures might begin the thaw of ‘crypto winter.’

“I sure hope CBOE, with USD settled Bitcoin futures, does not think that mild crypto [winter] may be coming to an end,” he wrote.” Want it colder! Currently, all-time excessive Bitcoin quantity. Consequently, present of low cost BTC to HODLers of Final Resort.”

Bitcoin peaked in worth when the CBOE futures launched. When the futures finish in June we will then begin the subsequent bull run.

— Tony Gallippi (@TonyGallippi) March 15, 2019

https://platform.twitter.com/widgets.js

BitPay co-founder Tony Gallippi additionally believes that this might set the stage for the subsequent bull run because the bitcoin bear market has coincided with XBT.

What’s extra, a number of new bitcoin futures merchandise –a few of which can be settled in precise bitcoin–are anticipated to go stay a while this 12 months. Companies comparable to Bakkt, ErisX, Nasdaq, and CoinFLEX are set to launch their digital asset buying and selling platforms over the subsequent few months.

It will likely be attention-grabbing to look at how the bodily bitcoin-settled merchandise, particularly, will have an effect on bitcoin worth 00 as soon as they go stay.

Do you assume the removing of cash-settled bitcoin futures could have a constructive impact in the marketplace? Share your ideas beneath!

Photographs courtesy of Shutterstock, Tradeblock

The put up CBOE Stops Providing Bitcoin Futures (And That’s Most likely a Good Factor) appeared first on Bitcoinist.com.