The most recent rally of Bitcoin’s worth has brought on the quantity of CME Bitcoin futures contracts to surge, buying and selling upwards of $683 million. This marks a rise of round 950 p.c because the starting of the month.

CME Bitcoin Futures Quantity Soars

Main derivatives market CME Group has seen a large improve within the variety of Bitcoin Futures contracts, fueled by the most recent worth rally.

Yesterday, April 4th, CME traded upwards of $563 million price of Bitcoin futures contracts.

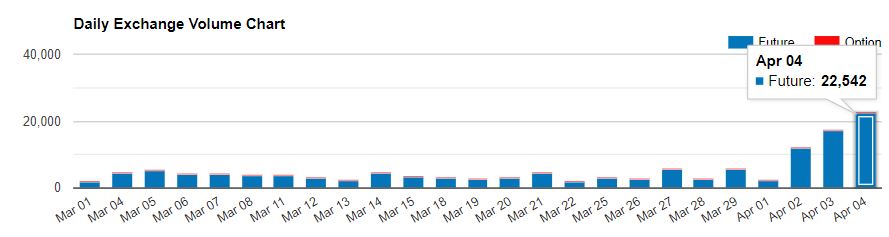

The entire variety of contracts traded on the platform was 22,542. In keeping with the contract specs, every one among them represents 5 BTC. Provided that Bitcoin was buying and selling at round $5,000 all through the day, this offers us a complete quantity of round $563 million.

Extra curiously, the quantity traded on April 4th is roughly 950 p.c increased in comparison with that originally of the month, when solely 2162 contracts have been traded

Bitcoinist reported that CME noticed a every day all-time excessive of over 18,000 contracts buying and selling on February 19th. Apparently, curiosity in Bitcoin futures contracts is growing, as in early February CME recorded the bottom volumes since launch.

Important A part of the Market

Nevertheless, they’re nonetheless an essential a part of the market as it’s. In keeping with information analytics firm Messari, the highest 10 cryptocurrency exchanges traded round $684 million price of Bitcoin yesterday.

Talking on the matter was Mati Greenspan, senior market analyst at eToro, who mentioned:

Although Wall Avenue’s contracts are solely paper, and never settled in bitcoin, they’re nonetheless a major a part of this market now.

CME Group’s bitcoin futures contracts are settled in cash. It implies that upon the expiration of every contract, the dealer will obtain the contract’s equal worth as a substitute of an precise Bitcoin. In different phrases, they permit merchants to take a position on the motion of the worth.

That is the precise reverse of what ICE’s Bakkt is planning on doing. Bakkt shall be launching physically-delivered Bitcoin futures contracts. Not like CME’s contract, merchants who use Bakkt will truly obtain bitcoin on the contract’s expiry date.

Whereas Bakkt continues to be struggling to accumulate its regulatory clearance, rivals within the area have already began to emerge. Coinflex, a platform backed by Digital Foreign money Group and Polychain Capital, has already introduced itself because the world’s first physically-delivered cryptocurrency futures alternate.

Different marquee traders within the agency embody Dragonfly Capital Companions, and Buying and selling Applied sciences.

What do you consider the surging quantity of CME Bitcoin Futures Contracts? Don’t hesitate to tell us within the feedback under!

Photographs by way of Shutterstock

The submit CME Bitcoin Futures Quantity Skyrockets 950% Since April 1st appeared first on Bitcoinist.com.