Yesterday, the Federal Reserve (Fed) stated it will restart shopping for bonds within the open market. Additionally, it’ll proceed its in a single day funding operations till January of subsequent 12 months.

Fed’s Money Injection Is Already Routine

For the Fed, pouring cash into the markets is already routine. It appears that evidently policymakers are attempting to persuade the general public that there’s nothing improper with their easing measures. Nevertheless, what we get is cheaper cash that devalues at a good quicker paste.

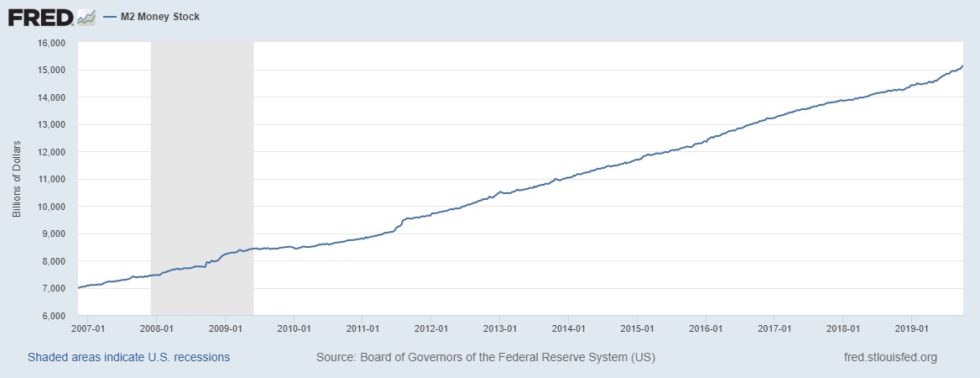

Final month, the M2 financial provide exceeded the $15 trillion mark.

Elsewhere, the M1 cash provide – a narrower definition of cash that features its most liquid kind – is about to the touch the $four trillion mark quickly.

For former congressman Ron Paul, the Fed’s intervention available in the market is a type of financial socialism, because the central financial institution is making an attempt to plan the worth of cash via manipulations moderately than letting the markets resolve it.

[youtube https://www.youtube.com/watch?v=F1UuNfA8abY?feature=oembed&w=500&h=281]

On Friday, the Fed introduced it will begin buying about $60 billion in Treasury bonds each month till a minimum of the second quarter of 2020. Additionally, it’ll lengthen the repo operations from the tip of November to a minimum of the tip of subsequent January. The Fed explained:

“These actions are purely technical measures to support the effective implementation of the FOMC’s monetary policy, and do not represent a change in the stance of monetary policy.”

Bitcoin Is Amongst Superb Belongings to Protect Worth

The Fed is making an attempt to persuade the general public that we shouldn’t name its measures quantitative easing and that its final steps usually are not even a part of financial coverage. For the central financial institution, shopping for bonds and injecting cash into the repo market are obligatory measures to guard the financial system and mitigate potential dangers, particularly amid the Sino-US commerce battle.

Dallas Fed President Robert Kaplan told the media:

“It is not intended to create more accommodation or create more stimulus. This is not intended to have any impact on monetary policy. It’s not designed that way.”

Nevertheless, economists argue that that is the purest type of QE and ought to be handled as such. Normally, QE is the results of a disaster however it appears the Fed doesn’t need the general public to comprehend there’s a downside with the financial system.

Nonetheless, the figures are insane. On Thursday, the New York Fed added $88.1 billion via the repo market, and another $82.7 billion on Friday.

Whereas the Fed is experimenting, Bitcoin stays a super asset to protect worth and steer clear of a devaluing foreign money.

Do you assume the Fed is doing an excessive amount of? Share your ideas within the feedback part!

Pictures through Bitcoinist Media Library, Fed, CNBC TV

The submit Fed’s Hidden QE Becomes Norm; Bitcoin to the Rescue appeared first on Bitcoinist.com.