World equities must put up contemporary highs earlier than Bitcoin re-enters its bull market, one of many business’s best-known analysts has mentioned.

Lee: Bitcoin Wants To Stop ‘Trendless Macro’ Section

In two tweets starting on September 25, Fundstrat World Advisors founder Tom Lee calmed fears concerning the state of Bitcoin 00 markets.

The biggest cryptocurrency fell 15% this week, inflicting many to lift issues a couple of new protracted bearish part showing.

“It’s overbought and needs to see weaker sentiment. Our (Bitcoin Misery Index) has been saying this since July… and it’s stuck time until S&P 500 ends this ‘trendless macro’ period,” Lee summarized.

As Bitcoinist noted, the S&P 500 shed worth simply earlier than Bitcoin’s personal drop on Tuesday. For Lee and Fundstrat, the 2 are carefully correlated.

“The downturn in (Bitcoin) followed the risk-off selloff in (equities),” he continued in an extra tweet.

This, he added, “reinforces our ‘unpopular’ opinion bitcoin does not do well in a ‘trendless macro’ environment.”

Lee concluded:

“New highs needed in S&P 500 before $BTC can blast off. Why? We think crypto is retail and thus, risk on.”

Analysis: Futures Manipulate BTC Down

Bitcoin’s fall to lows of $8000 prompted varied theories to emerge about how the biggest cryptocurrency may immediately deflate to such an extent after virtually six months of bullish advance.

Some, corresponding to an alleged crash in hashrate, have already confirmed false. Others, such because the impression of Bitcoin futures settlement dates, proceed to be topic to scrutiny.

On Tuesday, simply earlier than the dip, contemporary analysis warned that futures doubtless manipulated markets within the days previous to payouts. That might rationalize this week’s conduct, too, as Friday sees 50% of Bitcoin choices curiosity expire.

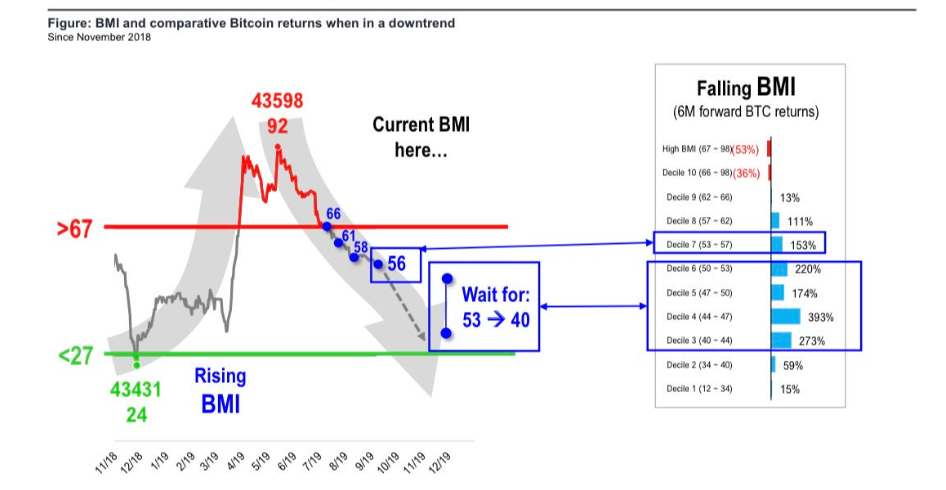

Lee in the meantime informed followers to attend for his Bitcoin Distress Index (BMI) to flash extra bearish. The metric provides an concept of market sentiment, and hit lows in December 2018 when BTC/USD dropped virtually 50% to $3100.

Now at 56, Lee says the best vary for “favorable risk/reward” is between 40 and 53. On the top of the bull market in late June, BMI reached 92 on its scale of 0-100.

At press time on Thursday, Bitcoin traded round $8400, having briefly hit $8600 earlier than abruptly heading decrease. Markets at the moment are at their lowest since June 14.

What do you concentrate on Tom Lee’s newest forecast? Tell us within the feedback beneath!

Pictures through Shutterstock, BMI chart by Fundstrat

The put up Fundstrat’s Tom Lee: Bitcoin Bull Market Will Follow S&P 500 Surge appeared first on Bitcoinist.com.