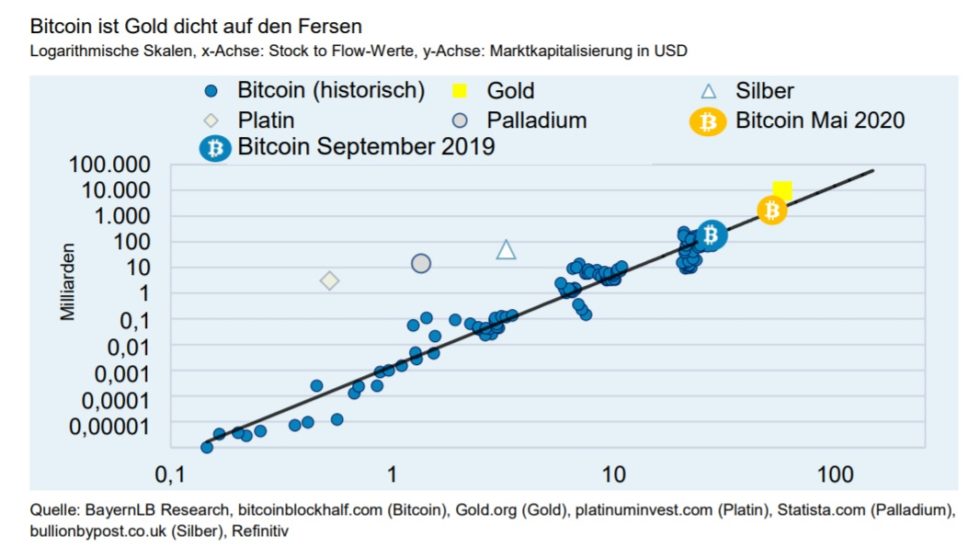

Final month, German state-owned financial institution Bayerische Landesbank, also called BayernLB, published a report that discusses Bitcoin’s stock-to-flow ratio. The authors concluded that Bitcoin is “designed as an ultra-hard type of money.”

Inventory-to-Movement: Bitcoin Vs Gold

Apparently, BayernLB authors relied on the stock-to-flow mannequin beforehand proposed by Twitter consumer PlanB.

For these unfamiliar, the stock-to-flow ratio refers back to the provide of a commodity or asset divided by the quantity produced yearly. This measure factors to the abundance or shortage of a commodity. In different phrases, the ratio exhibits the variety of years required to realize the present provide contemplating the present manufacturing fee. Gold is considered the commodity with the best stock-to-flow ratio. Nonetheless, Bitcoin will grow to be even scarcer than gold, which could a bullish indicator in the long run.

Nonetheless, the authors suggest utilizing warning when making predictions based mostly on the mannequin. Even one of the best statistical mannequin can fail miserably in anticipating the long run, the report notes. Apart from this, the subsequent Bitcoin halving, which ought to occur subsequent yr, represents a problem for the mannequin.

Gold has not too long ago benefited from central banks’ aggressive easing plans. At the start of September, the worth of gold hit the best stage in about 5 years. The dear steel, which acts as a safe-haven asset, enjoys the bullish for months additionally as a result of it has a excessive stock-to-flow ratio.

Regardless that Bitcoin had its worst month since November 2018, the most important digital forex by market cap ought to have the ability to attain an identical excessive inventory to stream worth as gold has proper now. In actual fact, Bitcoin will grow to be scarcer than the steel, the report says.

BTC Shortage Is a Bullish Signal

BayernLB sees a powerful correlation between Bitcoin’s value and its inventory to stream ratio. The authors had been impressed by Twitter consumer PlanB, who used the identical mannequin to estimate that the coin’s market cap is heading in the direction of $100 trillion after 2028.

The determine is much less life like in present phrases, as $100 trillion exceeds the present worth of all fiat currencies mixed. Nonetheless, there may be undoubtedly a correlation between the dynamic of an asset’s stock-to-flow ratio and its value.

Do you suppose that Bitcoin’s growing stock-to-flow ratio will push its value to new document ranges? Share your ideas within the feedback part!

Pictures through Shutterstock, BayernBL

The submit German State-Owned Bank Calls Bitcoin ‘Ultra Hard Type of Money’ appeared first on Bitcoinist.com.