Wall Avenue giants corresponding to Goldman Sachs are more and more liable to being left behind as cryptocurrency funds are the quickest rising section of the hedge fund business.

Cryptocurrency Hedge Funds Are Rising the Quickest

A couple of months in the past, Wall Avenue gave the impression to be embracing Bitcoin, and giants corresponding to Goldman Sachs and Morgan Stanley have been creating infrastructures to commerce Bitcoin. However then, after the worth of digital cash collapsed final yr, Wall Avenue prime bosses bought chilly ft and shelved their initiatives.

Now, 2019 Bitcoin financial exercise is hitting contemporary highs and its worth is rebounding. Nevertheless, Wall Avenue shouldn’t be reacting to grab the chance. The Avenue writes,

But large U.S. banks like JPMorgan Chase, Goldman Sachs Group and Financial institution of New York Mellon that dominate Wall Avenue buying and selling in every little thing from bonds, shares, commodities, and overseas exchanges are more and more liable to lacking out resulting from their very own reluctance to leap into the cryptocurrency market.

Wall Avenue executives’ excuses abound, starting from lack of federal rules to the potential of nefarious actions executed utilizing cryptocurrencies.

One other Wall Avenue concern is regulators’ inertia. A number of key initiatives that may assist to set off an explosive growth of the crypto market have but to obtain regulatory approval.

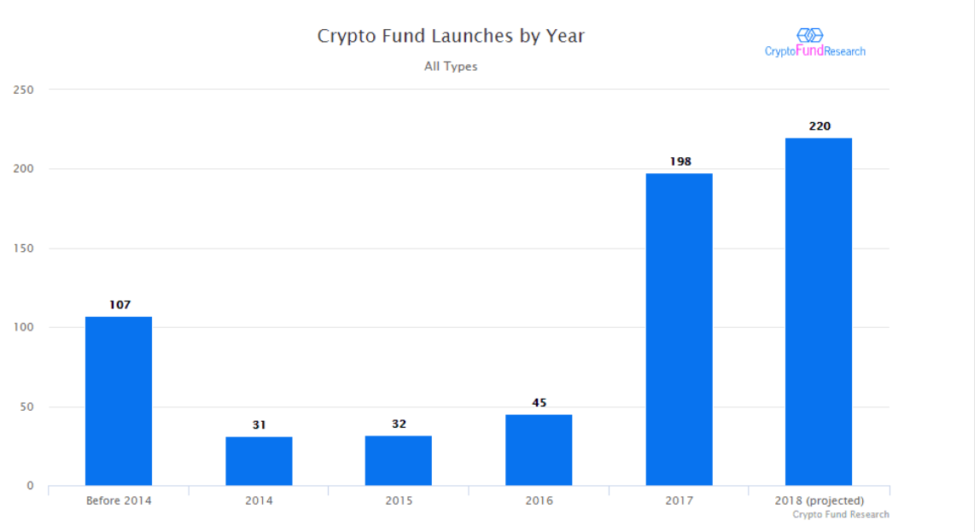

Nonetheless, buyers proceed to inject cash into the crypto market. Thus, spite the 2018 crypto winter, worldwide, the speed at which new crypto-related funds have been launched elevated. The Crypto Fund Analysis underlines, “We are on pace for a record 200+ new launches for 2018, including crypto hedge funds, crypto venture funds, and crypto private equity.”

Granted, monetary devices specializing in the nascent crypto belongings market are nonetheless small. “All crypto funds combined make up less than 1% of total hedge fund assets,” in accordance with a Crypto Fund Analysis report, which specifies,

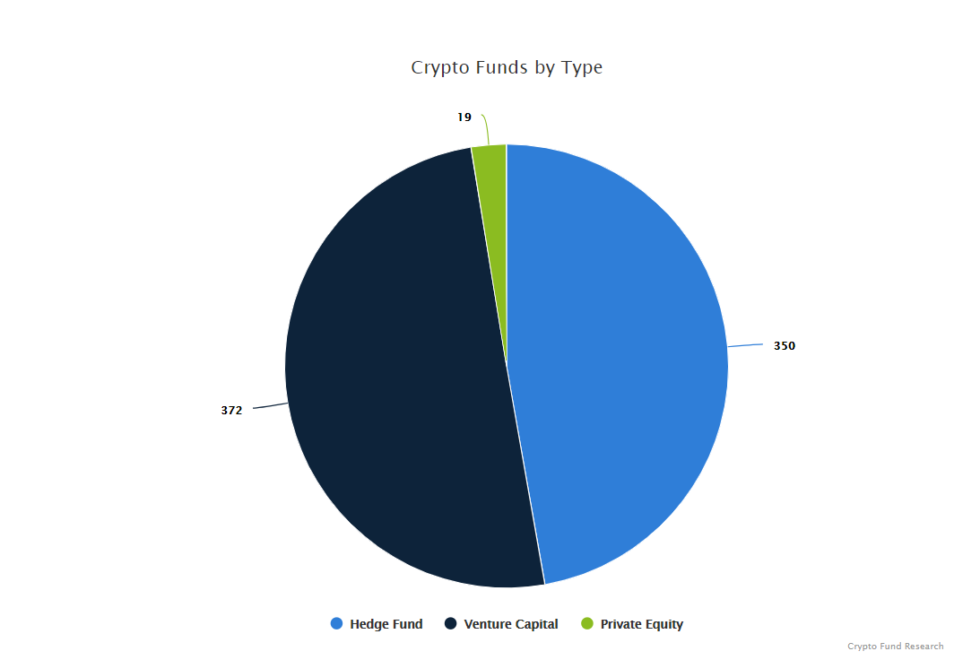

There are at present greater than 700 cryptocurrency/blockchain funding funds. The bulk are arrange as hedge enterprise capital funds, whereas a big quantity are hedge funds or hybrid funds. There are additionally a handful of crypto ETFs and crypto non-public fairness funds.

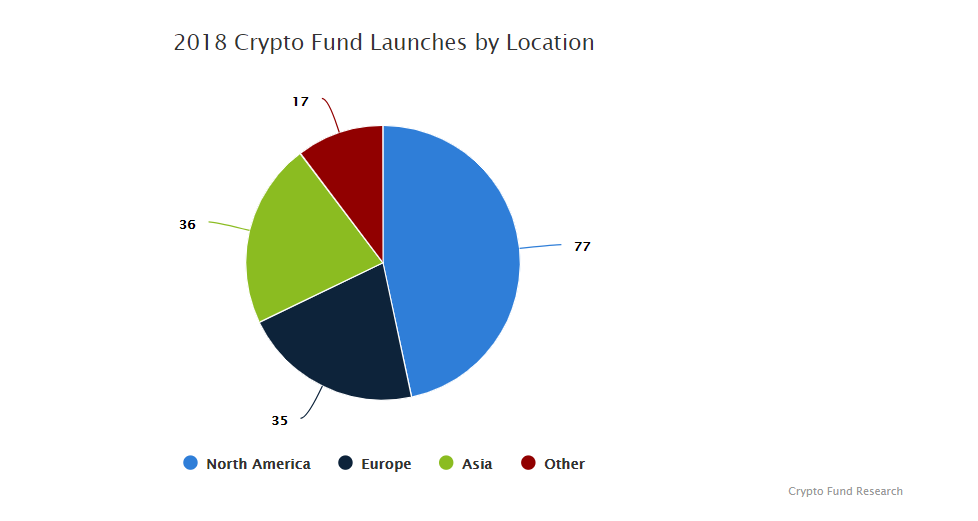

The US is the nation have been most crypto funds have been launched. Nevertheless, the launching of latest crypto funds can also be more and more occurring in Europe, Asia, offshore (Cayman Islands), and Mexico. See the excellent checklist of crypto fund launches right here.

The Crypto Fund Analysis report concludes,

Crypto hedge funds are the quickest rising section of the hedge fund business.

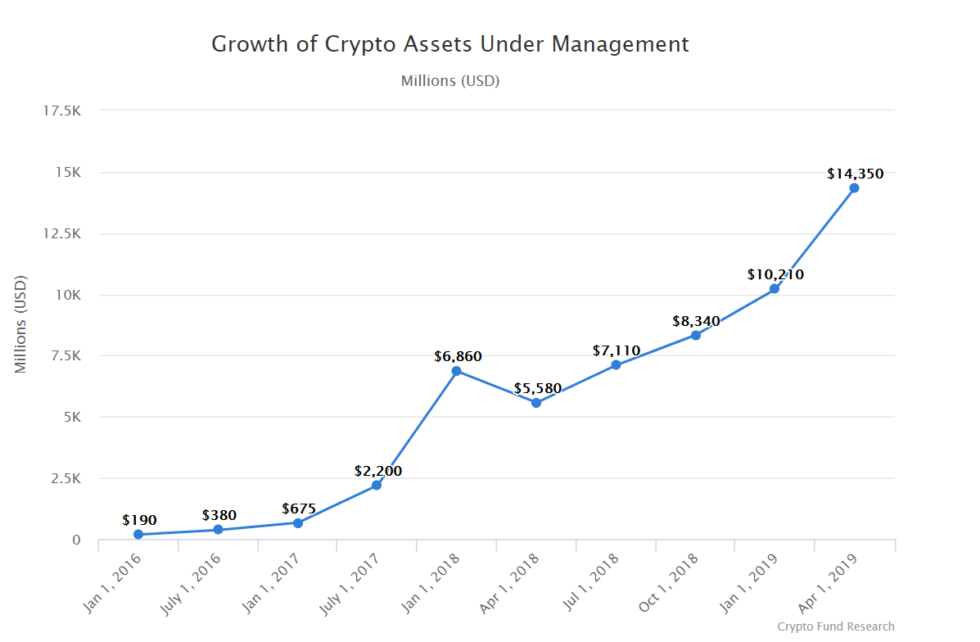

Furthermore, crypto belongings beneath administration proceed to develop, because the graph under reveals:

Bitcoin-Based mostly Startups Are Springing Up

Then again, smaller however visionary corporations proceed creating new Bitcoin-related options.

As an example, Coinbase is now launching an answer that provides monetary buyers the chance to earn curiosity on particular cryptocurrencies they maintain.

Moreover, Sq. is looking for expertise to workers groups that may work on the crypto house. To draw candidates, Sq. gives to pay builders and crypto engineers in bitcoin.

Furthermore, assist to extend the expansion of the general crypto market would possibly not directly come from social media large Fb. In impact, Fb is reportedly planning to make use of cryptocurrency know-how to switch cash by way of Whatsapp.

Ross Sandler, an web analyst at Barclays, Fb believes Fb’s cryptocurrency “could possibly be a part of a multibillion-dollar income alternative. In keeping with CNBC,

Sandler forecasted as a lot as $19 billion in further income by 2021 from ‘Facebook Coin.’ Conservatively, the agency sees a base-case of an incremental $three billion in income from a profitable cryptocurrency implementation.

What do you concentrate on Wall Avenue’s inertia in the direction of the crypto business? Tell us within the feedback under!

Photographs by way of Crypto Fund Analysis, Shutterstock

The put up Goldman Sachs ‘Missing Out’ as Crypto Fund Belongings Soar to $15 Billion appeared first on Bitcoinist.com.