Digital Currency resource Manager, Grayscale Investments, possessed a record in 2018, with institutions and retirement accounts comprising the lion’s share year. What’s more, they are increasingly deciding on Bitcoin over other altcoin offerings whilst the cryptocurrency market flatlines.

A Challenging, Yet Record 12 Months

According to Grayscale’s Q4 report, 2018 saw investment that is new Grayscale hit an archive most of $359.5 million; very nearly triple that of 2017’s bull-run. But, quarter on quarter, inflows paid down over 60 % on average to just $31.1 million in Q4.

The break down of this figure demonstrates cost falls together with basic market slowdown, are changing the investor profile that is average. As Grayscale Managing Director, Michael Sonnenshein, explained:

It had been in no way our most useful quarter, however it’s undoubtedly crucial to acknowledge that regardless of the cost decreases investors were earnestly involved.

‘Return of the Bitcoin Maximalist’

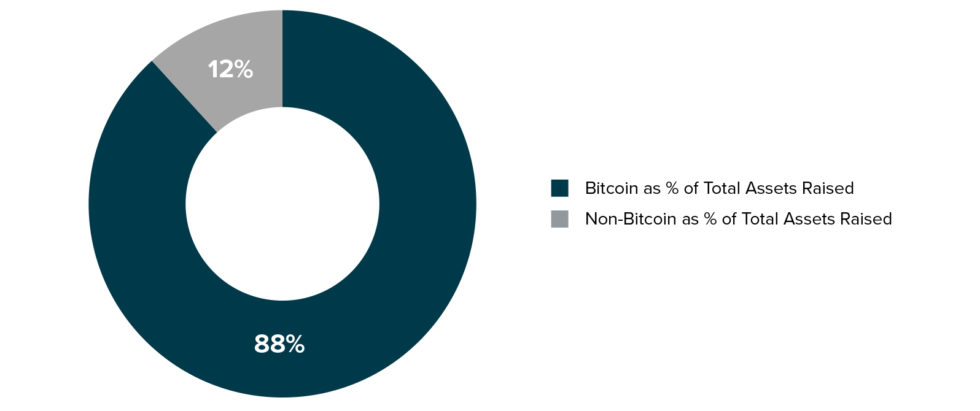

Of this inflow, 88 % originated in bitcoin investment, and 12 % from non-bitcoin investment.

This is in comparison to 67 percent and 33 % bitcoin to alts through 2018, suggesting that investors are increasingly choosing Bitcoin once the bear market continues.

Grayscale records that the takeaway that is key their Q4 information is that there’s increasing appetite due to their bitcoin item in comparison to other altcoins.

Return associated with Bitcoin Maximalist. Grayscale Bitcoin Trust (f/k/a Bitcoin Investment Trust) endured out this quarter, attracting the capital that is most within the Grayscale family of products despite further price declines in the digital asset market. In the quarter that is fourth 88per cent of inflows had been into Grayscale Bitcoin Trust, while 12percent had been into items associated with other electronic assets.

Saving For The Grey Dollar

Individual investors can purchase and hold Grayscale’s flagship Bitcoin Trust (GBTC) product via brokerage your retirement reports. Thus giving investors experience of bitcoin cost 00 movements without really purchasing any, which will be extremely difficult through your retirement cars typically.

While such investors made up 15 percent of Grayscale’s inflows that are total 2018 ($53.9 million), this leapt to 40% when it comes to just Q4 (around $12 million).

Institutional investors accounted for 50 % of Q4 investment (66percent on the entire of 2018), and household workplaces and accredited investors composed the remainder.

This shows that typical investors are employing the bear market to get for your retirement, going for a view that is long-term the leads of BTC.

Institutional Holdings

The other indicator from all of these outcomes is bigger organizations are slowly accumulating their core positions that are strategic the marketplace.

This is unquestionably echoed by Grayscale Founder, and CEO of (Grayscale moms and dad business) Digital Currency Group, Barry Silbert. As Bitcoinist reported yesterday, Silbert is anticipating 2019 to become a point that is tipping institutional investment, and expects costs to “snap back hard” when this occurs.

Grayscale may be the biggest cryptocurrency asset supervisor on earth, keeping $793.6 million of customer funds.

Meanwhile, early in the day this week saw the investment that is first cryptocurrency of US public pension funds. Two funds representing servants that are public Fairfax County, anchored a $40 million investment launched by Morgan Creek Digital.

Why do you consider your retirement funds are making use of Bitcoin? Share your thoughts below!

Images thanks to Shutterstock, grayscale.co

The post Grayscale Q4 Report Finds Institutional Investors going back to ‘Bitcoin Maximalism’ appeared first on Bitcoinist.com.