Bitcoin might be in for a 2-month lull going by historic knowledge of BTC’s month-to-month efficiency since 2010.

August is Traditionally Worst Month for Bitcoin Value

In a tweet by “Cane Island Crypto” on Wednesday (June 19, 2019) the bitcoin analyst revealed a development which exhibits a cooling interval for bull rallies between August and September. This conclusion comes from inspecting the median BTC month-to-month returns since 2010.

https://twitter.com/nsquaredcrypto/standing/1141376159575347201/picture/1

In accordance with the info, August has been bitcoin’s worst-performing month between 2010 and 2018. With the month lower than eight weeks away, the development would possibly repeat itself inflicting a short lived lull in BTC’s bullish advance.

Earlier than then, BTC would possibly push on to succeed in even newer highs in 2019. Based mostly on the proof, April, June, and July have seen constructive aggregated value actions since 2010.

Thus, if the development holds via, then bitcoin might probably be in for a continuation of its sizzling 2019 streak. July, nevertheless, holds the bottom constructive aggregated median bitcoin return underneath the interval being thought-about.

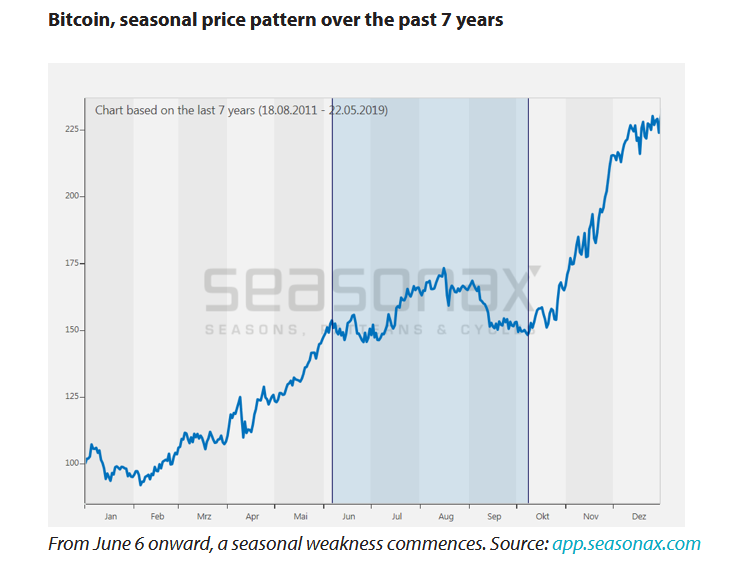

Bitcoin has at all times appeared to undergo seasonal summer season declines often lasting from June 6 to October eight on the typical. In accordance with Seasonax – a buying and selling evaluation platform – BTC’s annualized summer season declines during the last seven years stands at greater than 13%.

This historic development might play nicely into expectations of a slight BTC value retrace espoused in current weeks by the likes of Hint Mayer and Tuur Demeester. Each commentators see BTC experiencing a value dip to someplace in mid-$6k to mid-$7k area.

Bullish MACD Cross Contradicts Historic Forecast

Whereas historical past predicts summer season doldrums for BTC, technical indicators appear to color a unique image. In a tweet printed by Filbfilb, senior analyst at Bitcoinist, bitcoin is about to see its third month-to-month bullish MACD crossover of all time.

Bitcoin is about to have its third month-to-month bullish MACD cross of all time.

Its labored out fairly nicely previously.

pic.twitter.com/5UtrPJPsGL

— fil₿fil₿ (@filbfilb) June 20, 2019

https://platform.twitter.com/widgets.js

The final bullish MACD cross occurred on the back-end of 2016 which culminated within the late 2017 bull run that noticed BTC nearly high $20,000. So even when a slight lull happens between August and September, BTC, total, appears poised to enter a long-term part of parabolic advance.

The upcoming bullish MACD cross is the newest indicator to level in direction of a long-term bull development for the top-ranked cryptocurrency. Such is the optimism that BTC bulls are making daring end-of-year value predictions.

As beforehand reported by Bitcoinist, Tom Lee of Fundstrat expects bitcoin to succeed in $40,000 inside the coming months. Lee’s forecast, nevertheless, hinges of the transfer above $10,000 triggering a return FOMO amongst retail traders.

Will the bitcoin summer season weak spot development proceed in 2019? Tell us your ideas within the remark part beneath.

Photos through Twitter @nsquaredcrypto , @filbfilb and Seasonax.com.

The publish Historic Information Suggests August is Finest Time to Purchase Bitcoin appeared first on Bitcoinist.com.