Analysts have been repeatedly (and incorrectly) calling the Bitcoin worth backside for over a yr now, just about since costs began falling. So earlier than diving headlong again into its murky waters, how can we be certain issues are completely different this time?

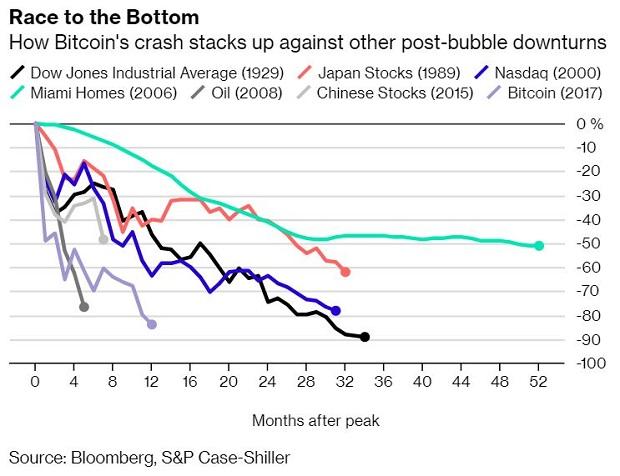

Comparability To Different Bubble Bottoms

A method is perhaps to take a look at nice bottoms from historical past (I’m gonna allow you to make your personal jokes) for comparability. That might look like an affordable place to begin, at any charge. So what do we discover?

By way of worth, bitcoin worth has misplaced extra from its peak than all of those bubbles apart from the Dow Jones Industrial Common from 1929. And by way of pace, we might have hit backside more durable than all however Oil (2008) and Chinese language Shares (2015).

Of those examples, the NASDAQ bounced again exhausting, to double within the 5 years after backside. Nonetheless, the Japanese inventory market crash led to a interval of financial stagnation often called the misplaced decade/rating. So it appears there is no such thing as a consensus on learn how to decide bottoms, and the way they are going to then play out.

And anyway, if Bitcoin was incomparable to some other bubble, why examine bottoms?

Comparability To Bitcoin Bubble Bottoms

Maybe we’d be higher off making comparisons with earlier Bitcoin bubbles and bottoms? Though now we have much less knowledge to go on, this isn’t the primary Bitcoin bubble, and not less than we’re evaluating like for like.

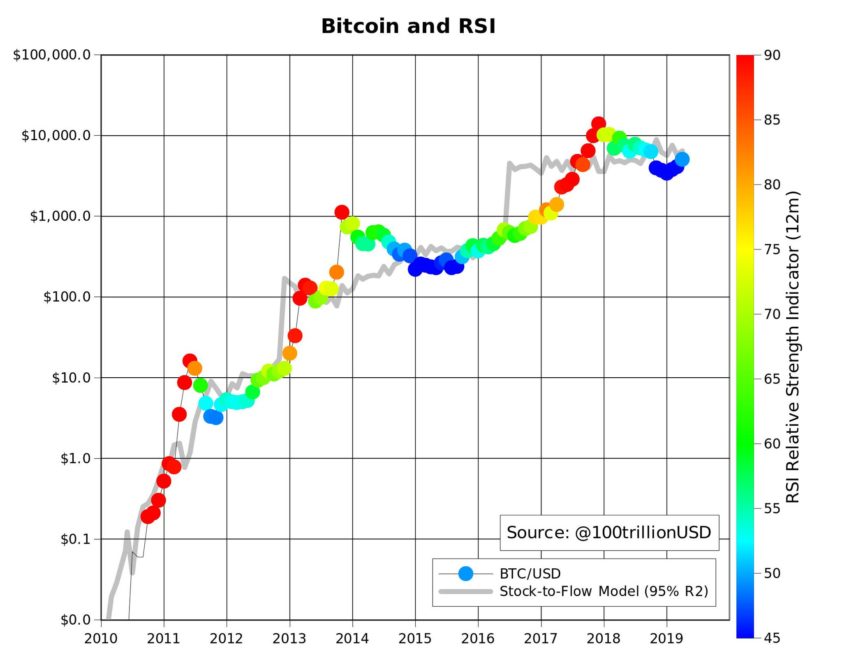

So, of Bitcoin’s 4 bubbles (and not less than three bottoms) to date, how does this one examine?

Nicely, we’ve misplaced 84% of worth from the height, which is inside the 83%-94% vary of earlier bottoms. In response to veteran dealer, Peter Brandt, the present chart is a tough analog of 2015’s ‘double bottom’, suggesting that one other potential parabolic breakout might occur once more if historical past does certainly rhyme.

A chart of Relative Energy Indicator (RSI) from analyst, plan₿, exhibits a worth of 50 and rising. That is additionally corresponding to 2015’s backside.

The analyst additionally re-iterated a tweet from final month of 5 key indicators why bitcoin wouldn’t drop beneath $2000. All the indicators have turn out to be even stronger prior to now month, which introduced BTC a month nearer to subsequent years reward halving. The halving has additionally traditionally seen massive worth will increase within the yr operating as much as it.

However all the indicators and historic knowledge on the earth can not ‘guarantee’ that bitcoin has bottomed. They do nonetheless, ‘indicate’ fairly clearly that issues might certainly be completely different this time.

Current features and the next holding of those positions have made bitcoin a nice place to play once more. By the point the BTC/USD backside has been really confirmed, bitcoin worth might be nicely on its approach again upwards. So do you make the leap? Proper now, the water’s pretty.

Do you assume bitcoin worth has bottomed? Share your ideas beneath!

Pictures by way of Shutterstock

The publish How Can We Be Positive That Bitcoin Worth Has Bottomed? appeared first on Bitcoinist.com.