Everybody needs to know what course bitcoin costs will go subsequent. Crypto analysts are continually scrambling to seek out new technical indicators to offer them the heads up however new knowledge suggests there could possibly be different influences which can be affecting the value too.

Bitcoin Retailer of Worth or Hypothesis Car?

Evaluation of various buying and selling patterns around the globe may provide insights as to what course bitcoin costs will take subsequent. That’s in accordance with new analysis from crypto-centric monetary knowledge agency, Digital Belongings Information.

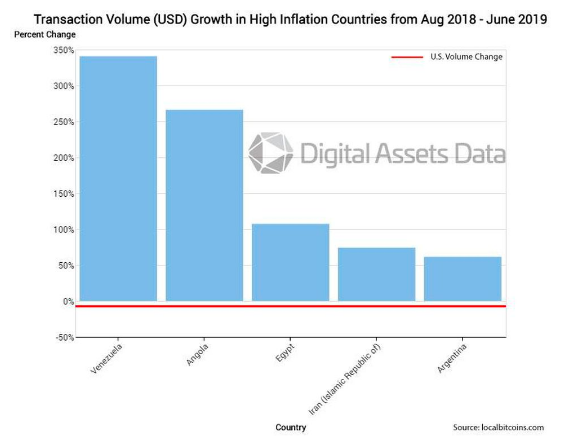

BTC costs are at the moment up 170% because the starting of the yr, which has revived hopes of a subsequent main bull run that would eclipse the 2017 surge to its giddy heights of $20ok. The brand new knowledge reveals that bitcoin is used as a retailer of worth and different to fiat in nations with excessive inflation. Conversely, in accordance with Forbes, it’s considered a buying and selling car for hypothesis in nations with decrease inflation.

Chief govt and co-founder of Digital Belongings Information, Mike Alfred, informed the outlet:

We discovered that in creating nations and locations the place financial coverage and banks are much less steady, bitcoin buying and selling quantity continued to rise even because the bitcoin value was falling. Whereas that is at the moment taking place in smaller economies, if there was instability within the developed world, maybe via a significant recession or spike in unemployment, there could possibly be a major surge in curiosity in bitcoin, leading to a possible constructive catalyst for the bitcoin value.

The findings have been primarily based on native peer to look buying and selling on the LocalBitcoins platform, which revealed buying and selling in excessive inflation nations usually moved independently from BTC value.

Through the bear market of 2018, bitcoin quantity fell round 70% in low inflation nations however elevated 60% in excessive inflation ones in accordance with the report. Alfred added:

There’s a restrict to how a lot nations can borrow, how a lot they will spend, and the way a lot cash they will print. The market will ultimately determine it will probably’t take any extra stimulus. It appears like a home of playing cards proper now and if it falls, bitcoin may see a surge of curiosity as we’ve seen in much less steady nations around the globe.

BTC Again Up Right this moment

From an intraday low of $9,500 bitcoin pumped again into 5 figures in the present day to hit the 200 transferring common on the hourly chart at $10,180. It has remained at this degree for the previous few hours and is at the moment buying and selling at 00. Analysts predict extra volatility because the week progresses.

Do totally different nations have an effect on the value swings of bitcoin? Add your ideas under.

Pictures through Shutterstock, DigitalAssetsData

The put up How Geographical Buying and selling Traits May Affect Bitcoin Value Motion appeared first on Bitcoinist.com.