Crypto analysts and traders are rising more and more giddy about an impending golden cross on Bitcoin’s 3-day worth chart.

Is a Pattern Reversal on the Playing cards?

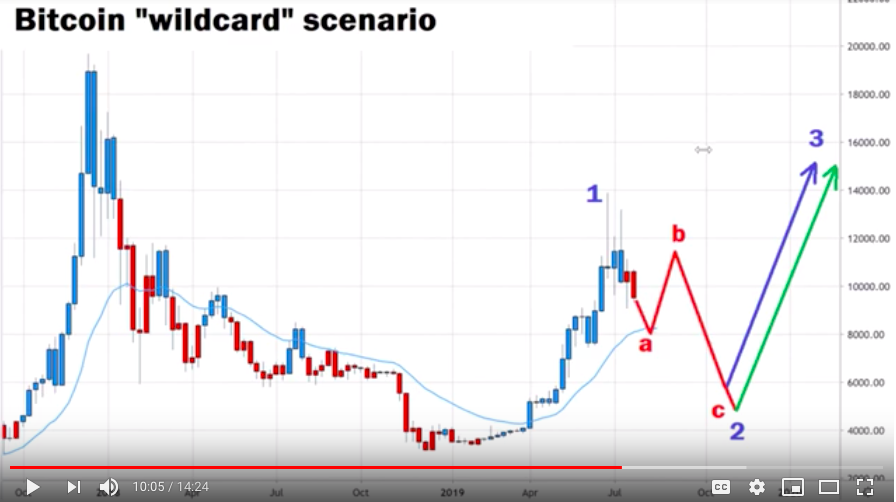

Since topping out at $13,800 Bitcoin has taken a chronic beating as shopping for strain evaporated and bears took management of the wheel. Bearish analysts have predicted that Bitcoin may drop as little as $4,000 earlier than reversing course.

In the meantime, Bitcoin bulls anticipate the digital asset to bounce off the 21-day exponential transferring common (EMA) at $8,000 to $8,500, then the uptrend may resume.

The golden cross has lengthy been seen as a long-term indicator of a bull market and the approaching cross of the 50-MA and 200-MA (transferring common) could be a primary since February 2016.

Again then, the golden cross occurred six months previous to Bitcoin halving occasion and analysts at the moment are questioning whether or not Bitcoin worth will comply with an identical trajectory to a brand new all-time excessive.

Down, however not out

In the intervening time, Bitcoin is down roughly 33 p.c from its 2019 excessive however hodlers and long-term traders will not be dismayed. It’s common information that long-term transferring averages and the MACD are indicators that lag behind BTC’s spot worth motion so the current crossover may merely be consultant of Bitcoin’s moon-like transfer from $3,200 to $13,800.

With that mentioned, this could not detract from the importance of the golden cross because the one from February 2016 noticed Bitcoin rally all the way in which to $20,000. On the time of writing, BTC trades for $9,650 and analysts appear to agree that the digital asset may make a run at $10,000 over the subsequent 24-hours. On the identical time, an in depth above $11,200 could be wanted to revive the bullish uptrend.

As of now, the short-term consensus on Bitcoin worth motion is comparatively bearish and most merchants await the much-discussed bounce of the 21-EMA. Lately, crypto-analyst Alessio Rastani suggested merchants to examine their affirmation bias and take into account quite a lot of bullish and bearish outcomes for Bitcoin.

In the meantime, Pantera Capital founder Dan Morehand predicted that BTC may attain $42,000 by the top of 2019. Morehead additionally believes Bitcoin may high $365,000 over the subsequent 2 years. Throughout an interview on the Unchained podcast, Morehead elaborated on every prediction by saying:

Graph the worth of Bitcoin logarithmically…its pattern goes to develop at 235% compound annual development price and…that put Bitcoin at $42,000 on the finish of 2019. And I do know this sounds loopy however we’re basically midway again there. I believe it’s a great shot that by the top of the yr we hit that. And in the event you simply extrapolate that line out for an additional yr it’s $122,000 per Bitcoin after which yet another yr, $356,000.

Do you assume the golden cross is an indication that Bitcoin worth is on the trail to a brand new all-time excessive? Share your ideas within the feedback under!

Picture through Shutterstock, Twitter: @JWilliamsFstmed, YouTube: AlessioRastani

The publish Impending Golden Cross May Begin The Subsequent Bitcoin Rally appeared first on Bitcoinist.com.