- Bitcoin was able to post an incredibly strong monthly candle close yesterday

- This marked the first time that the crypto had closed its monthly candle above $10,700 since mid-December of 2017

- Shortly after the close took place, bulls stepped up and allowed BTC to set fresh 2020 highs of $11,800

- It did face some heavy selling pressure at these highs that caused its price to see a sharp decline, but it has since stabilized

- Analysts are now widely noting that the benchmark crypto is poised to see further upside, but there are some grim signs

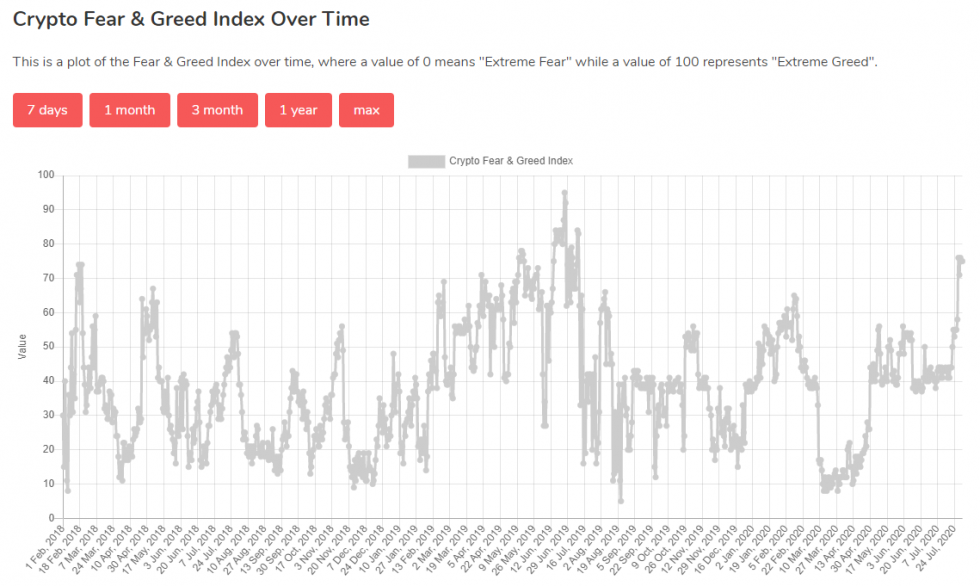

- One such sign would be investor greed – which has been rocketing higher in recent days

Bitcoin and the aggregated cryptocurrency market is flashing some overt signs of strength as BTC hovers within the mid-$11,000 region.

Overnight, it was able to surmount the previous resistance it faced around $11,400, with the break above this level propelling it to fresh yearly highs of $11,800.

At this point, it lost some of its momentum, subsequently declining down to lows of $11,500.

Despite not breaking into the $12,000 region, it still appears to be incredibly strong and well-positioned to see further upside.

This overt strength has caused investor greed level to rocket – which is a sentiment indicator that analysts often use to determine when the market may be due for a pullback.

Bitcoin Rallies to Fresh 2020 Highs Following Bullish Monthly Candle Close

At the time of writing, Bitcoin is trading up just under 2% at its current price of $11,545.

This marks a notable surge from daily lows that were set within the lower-$11,000 region and came about close on the heels of the asset’s bullish monthly close.

While speaking about the strength that this monthly candle provided the cryptocurrency, one analyst explained that it is hard for him to imagine anyone being bearish at this time.

“BTC HTF Update: Imagine being bearish, strongest monthly in 3 years,” he said.

Image Courtesy of Cactus. Chart via TradingView.

Investor Greed is Flashing a Grave Sign for BTC’s Uptrend

One factor that could signal Bitcoin is overdue for a pullback is the sharp rise in investor greed seen throughout the past couple of days.

On this topic, one analyst explained that even during firm bull markets, sharp pullbacks do happen.

“Greed almost at 80. I’m absolutely not telling you to short, but it is finally time to take some profits. Even in a massive bull run, pullbacks happen,” he explained.

Image Courtesy of Byzantine General.

The reason why greed could be a counter-indicator is that it suggests traders may be overleveraging their Bitcoin exposure – resulting in high leverage margin positions and other factors.

This could provide bears with fuel to spark a short-term decline.

Featured image from Unsplash. Charts and pricing data via TradingView.