There have been plenty of instances not too long ago the place folks have flocked to bitcoin as their very own economies face uncertainty. China, Britain and Venezuela are the distinguished examples however now Argentina could also be added to that record as their forex and inventory markets crumble.

Inventory Market and Forex Crushed

Argentina is waking to fears of a full blown monetary disaster at this time because the nationwide forex and inventory markets stoop. In a shock end result to main elections over the weekend, President Mauricio Macri’s demolition has rattled buyers and induced an exodus to start.

In accordance with Bloomberg, the S&P Merval Index plunged 48% in greenback phrases which is the second largest someday rout on any of the 94 inventory exchanges the outlet has tracked for the reason that 1950s. The concern stems from the chance of a protectionist authorities taking energy later this 12 months and unravelling belief that has been constructed up with worldwide markets.

Argentina has billions in overseas forex money owed and fears of defaulting at the moment are starting to develop. The report added that credit-default swaps now present that merchants are pricing in a 75% likelihood that the nation will droop debt funds within the subsequent 5 years.

Along with the inventory market collapse, the Peso plunged over 25% on Monday to a file low of 60 to the greenback. Argentina is not any stranger to financial turmoil and worries of a return to instances the place forex controls, information manipulation, and protectionist insurance policies on commerce to guard nationwide industries had been commonplace, are rising.

Folks Turning to Bitcoin?

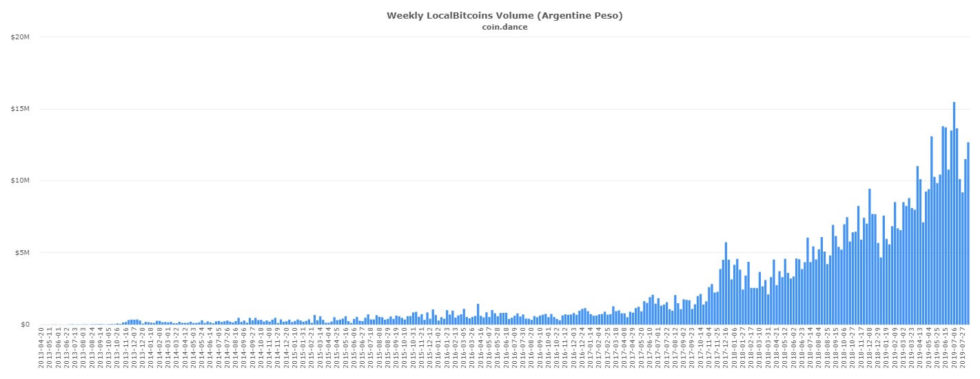

In Venezuela the inhabitants turned to bitcoin because the forex was crushed however is identical taking place now in Argentina? Quantity on Localbitcoins has been steadily rising since 2017 however this development has occurred elsewhere.

LBC quantity ARS – Coin.dance

Analyst and dealer Alex Krüger identified that bitcoin consciousness may be very low within the South American nation which is closely hedged to the greenback. Consequently the BTC market may be very small there, simply $220,000 USD final week in response to Coin Dance. Krüger added that quantity is barely rising because of the depreciation of the Peso.

One may level at LocalBitcoins’ ever rising volumes. Nevertheless, quantity is barely rising in ARS phrases because of the depreciation of the peso. Quantity has been dropping steadily and registered solely 23 bitcoin in complete final week.

One may level at LocalBitcoins’ ever rising volumes. Nevertheless, quantity is barely rising in ARS phrases because of the depreciation of the peso. Quantity has been dropping steadily and registered solely 23 bitcoin in complete final week. (would count on although a pointy improve this week) pic.twitter.com/OhRT2hHxWs

— Alex Krüger (@krugermacro) August 13, 2019

https://platform.twitter.com/widgets.js

He added that a big spike was anticipated this week as bitcoin turns into a greater hedge than the USD which can also be being manipulated by the Trump administration in its protectionist efforts to battle with China over commerce.

Is bitcoin changing into a greater hedge in financial uncertainty? Add your ideas under.

Pictures by way of Shutterstock, Twitter @Krugermacro, Localbitcoins

The submit Is Bitcoin an Possibility In Argentina as Inventory Market Collapses appeared first on Bitcoinist.com.