Binance and different cryptocurrency exchanges are main international commerce quantity from their new base in Malta, recent analysis has discovered.

Malta Hits $35B Month-to-month Quantity

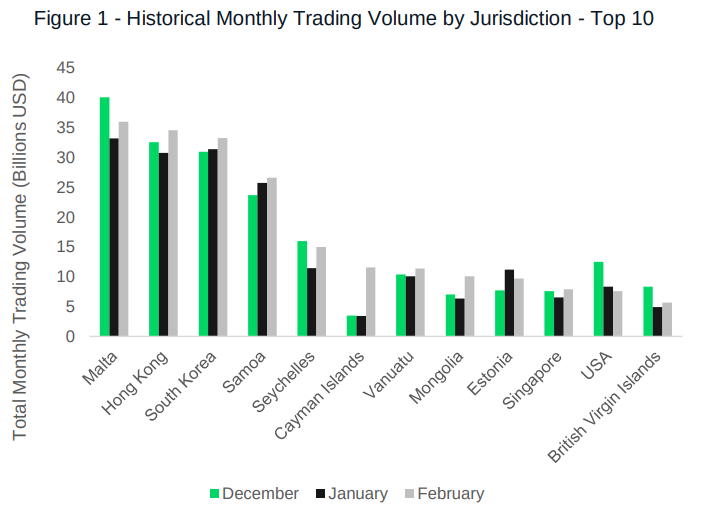

CryptoCompare gathered uncooked knowledge from the alternate sector masking the three months from December 2018 to February 2019, which it launched as a report this week.

Main the outcomes was a breakdown of alternate buying and selling quantity by jurisdiction, main Malta come beat nations similar to Singapore and the US.

“Maltese-registered exchanges represented the majority of trading volume in February (35.9 billion USD) as in previous months, followed closely by those legally registered in Hong Kong (34.5 billion USD) and South Korea (33.2 billion USD),” the report summarizes.

As Bitcoinist reported, Malta’s pleasant regulatory strategy has led a number of big-name exchanges to arrange on its shores, together with Chinese language names OKEx and Huobi along with Binance.

87 P.c Of Quantity ‘Suspicious’

The CryptoCompare figures come at a time when each commentators and market contributors are paying growing consideration to exchanges’ reported commerce volumes, following publication of additional analysis suggesting many such volumes are extremely inaccurate.

The product of officers from crypto buying and selling platform The Tie, a devoted report into the phenomenon appeared March 17.

In social media feedback on what they found, The Tie prompt big discrepancies in commerce quantity as reported by many exchanges in comparison with what could be anticipated.

“In total we estimated that 87% of exchanges reported trading volume was potentially suspicious and that 75% of exchanges had some form of suspicious activity occurring on them,” they warned.

…If every alternate averaged the quantity per go to of CoinbasePro, Gemini, Poloniex, Binance, and Kraken, we might anticipate the actual buying and selling quantity among the many largest 100 exchanges to equal ($2.1 billion) per day. At present that quantity is being reported as ($15.9 billion).

Binance CEO Warns Over CoinMarketCap

These revelations flip led to criticism from Binance CEO Changpeng Zhao, who prompt alternate rating sources wanted to be extra diligent in how they listed market contributors.

CoinMarketCap, maybe the best-known such useful resource, which has a widely-recognized presence all through the business, got here in for a particular point out.

Its recognition, Zhao argued, signifies that non-technical and novice buyers might view an alternate as reliable resulting from its reported volumes, however these within the know would take the other view and keep away from it.

“(CoinMarketCap) is [the] highest traffic website in our space, and [the] biggest referrer for all exchanges,” he wrote on Twitter in response to The Tie.

Ranked excessive on (CoinMarketCap) has advantages for getting new customers. BUT on the expense of DESTROYING CREDIBILITY with professional customers. Many overlook the later half.

Others commented that rankings ought to use totally different metrics altogether, similar to order guide depth.

Past exchanges in the meantime, Bitcoinist this week famous on how latest habits suggests China might be returning as a significant funding supply in cryptocurrency markets.

In line with knowledge monitoring capital influx, the yuan was the second-biggest supply of cash behind the US greenback this week, with 24-hour volumes hitting $165 million for Bitcoin and virtually $75 million for Ethereum.

What do you consider alternate quantity distribution and authenticity? Tell us within the feedback under!

Photographs courtesy of Shutterstock, CryptoCompare

The submit Malta Tops Crypto Buying and selling Quantity However 87% of Reported Knowledge is ‘Suspicious’ appeared first on Bitcoinist.com.