Researchers at Adamant Capital say Bitcoin is coming into an accumulation part which is able to see the cryptocurrency commerce in a good vary on the way in which to a different large bull run.

Bitcoin Might be Vary Sure in Accumulation Part

In a report printed on Thursday (April 18, 2019), analysts at Adamant Capital characterised the current Bitcoin cycle as an accumulation part. On this part, the researchers anticipate range-bound buying and selling to characterize the BTC value motion.

An excerpt from the abstract introduction within the report reads:

Throughout this accumulation part, we anticipate for Bitcoin to commerce in a spread of $3,000 to $6,500 till the brand new bull market completely cements the denarian cryptocurrency as a multi-trillion-dollar asset class.

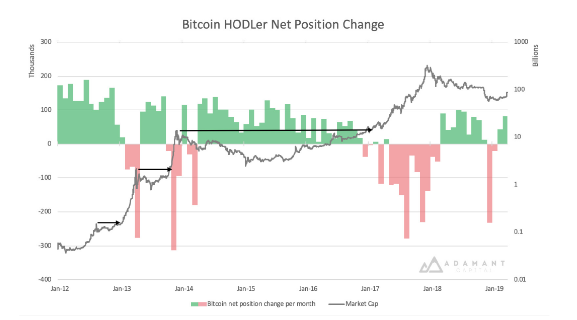

Based on the researchers, range-bound value motion which is a trademark of an accumulation part signifies weaker arms making an attempt to take earnings on the increased value vary and the stronger, extra dedicated merchants shopping for the underside vary in expectation of the approaching value increase.

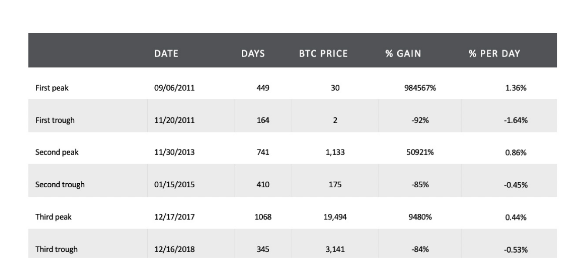

Going by earlier accumulation cycles, BTC will commerce sideways throughout this era. Nonetheless, there isn’t a consensus on the size of this current accumulation part.

Within the earlier boom-bust cycle for Bitcoin between 2013 and 2016, the buildup interval lasted from February 2015 to Could 2016. Throughout that interval, the BTC value 00 remained constrained between $200 and $400.

Shrinking Volatility – A Signal of Bitcoin Bottoming Out

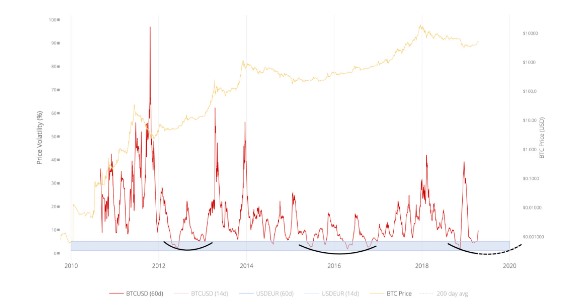

If Bitcoin is in or approaching an accumulation part, then the cryptocurrency should both have set or is near setting a long-term value backside. Based on the report, the shrinking BTC volatility factors to such a risk.

The 60-day volatility for BTC/USD is at present beneath 5 %. Aside from early November 2018 when it fell beneath two %, this present degree is the bottom in nearly three years.

Commenting on the implications of the shrinking BTC volatility, the report states that long-term buyers are starting to dominate the market, slightly than retail merchants with short-term value targets.

A number of analysts and commentators have additionally expressed related opinions just lately. Tom Lee of Fundstrat has mentioned that most of the “old whales” are again and are accumulating Bitcoin.

Bitcoin Market Might be Value Trillions of {Dollars}

Aside from signaling value bottoms, Tuur Demeester and Michiel Lescrauwaet of Adamant Capital consider the discount in BTC volatility factors in the direction of larger international adoption.

Based on the report, Bitcoin’s historic value motion seems to be transferring in the direction of “shallow cycles and lower volatility” instead of “steep cycles and high volatility.”

As for over 84 % decline in 2018, the researchers say it’s a direct consequence of the 2017 bull run constructed on hype and market mania.

The report additionally predicts that Bitcoin will finally change into a multi-trillion-dollar market like gold which has a market capitalization of about $eight trillion, saying:

As Bitcoin matures right into a globally traded commodity, it appears cheap to anticipate its cycles to proceed lengthening till finally, they’re on par with multi-decade cycles seen in commodities like copper or gold.

How lengthy do you suppose the buildup part will final? Tell us your ideas within the feedback beneath.

Photographs through Adamant Capital, Shutterstock

The submit New Report: Bitcoin in $3K-$6.5K Accumulation Vary Earlier than Subsequent Bull-Run appeared first on Bitcoinist.com.