Morgan Creek Digital co-founder Anthony Pompliano acquired a verbal beating for disclosing that 50% of his portfolio is in Bitcoin. Query is…is his lack of diversification a foul factor?

Is Pomp Loopy?

Earlier this week, Anthony Pompliano participated in a CNBC Squawk Field panel which mentioned macro-economics and its impression on Bitcoin worth motion. One panelist requested Pompliano what share of his web value was invested in Bitcoin and Pompliano resolutely stated 50%.

Panelist Kevin Oleary, a well known Canadian businessman, swiftly pounced on Pomp and administered a verbal beating, together with a fast lesson within the economics of investing.

O’Leary stated:

That’s loopy, I forbid that, that’s insane, that breaches every part about diversification investing!”

O’Leary then rattled off an inventory of top-10 altcoins, stating their important losses since 2017, then requested Pompliano, “If this is really such a great idea, when is there only one Vegas game working?”

Pompliano did his greatest to clarify why institutional and retail traders ought to make an allocation for Bitcoin as it’s a scarce asset that’s non-correlated to conventional markets, and can be a hedge towards macroeconomic instability.

Neglect Altcoins, Go Bitcoin

Whereas conventional economists, monetary advisors, and market analysts are prone to agree with O’Leary’s scolding of Pompliano, a cryptocurrency analyst from Twitter swiftly got here to Pompliano’s protection.

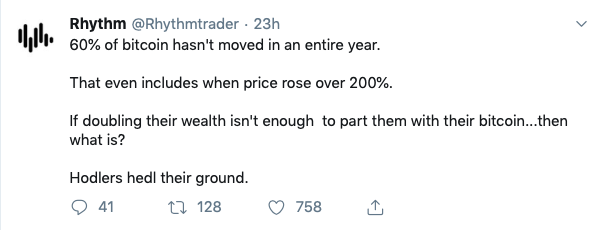

@RhythmTrader identified that regardless of a 200%+ achieve from Bitcoin, 60% of Bitcoin hasn’t moved for greater than a 12 months.

This assertion aligns with latest information launched from CoinMetrics which additionally confirmed that Bitcoin’s ‘untouched provide’ had risen to a brand new excessive of 21.6%.

The report additionally noticed an uptick within the origination of recent Bitcoin addresses. RhythmTrader then requested, “if doubling their wealth isn’t enough to part them with their Bitcoin…then what is?”

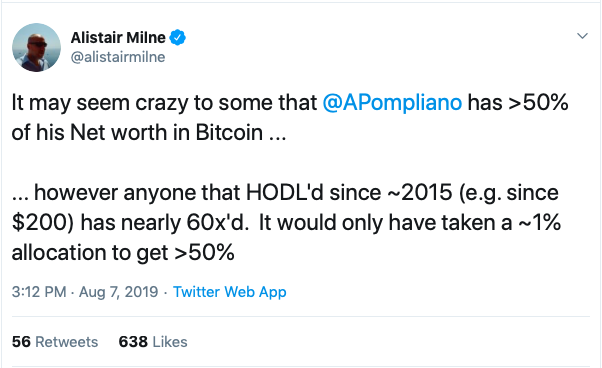

Alistair Milne additionally chimed in and tweeted that whereas it might appear completely loopy to take a position 50% of 1’s web value into Bitcoin “anyone who “HODL’d since 2015” has seen 60x returns. Based on Milne, “it would have only taken a 1% allocation” to financial institution at the least a 50% return.

Good Issues Come to These Who Wait, for Bitcoin

After all, traders ought to perform due diligence previous to investing in any asset, particularly ones which might be identified for his or her volatility. Additionally, whereas traders are inspired to diversify their portfolios, it ought to be famous that Bitcoin just isn’t a inventory.

It has no must generate income, it doesn’t reply to a board of ‘shareholders’, it isn’t managed by any centralized entity. Placing all one’s eggs in a single basket is dangerous however RhythmTrader left his followers with this:

Do you suppose it’s clever for Anthony Pompliano to maintain 50% of his web value in Bitcoin? Share your ideas within the feedback beneath!

Do you suppose it’s clever for Anthony Pompliano to maintain 50% of his web value in Bitcoin? Share your ideas within the feedback beneath!

Photos from Shutterstock, Twitter: @Rhythmtrader, @alistairmilne

The publish Pompliano Labelled ‘Crazy’ For His 50% Market Publicity to Bitcoin appeared first on Bitcoinist.com.