Frankfurt-based multinational funding financial institution Deutsche Financial institution has seen its inventory worth decline over the previous 5 years with no indicators of revival. Common cryptocurrency fund supervisor Anthony Pompliano says that it might be attention-grabbing if individuals put their bitcoin collectively and acquired it out.

Deutsche Financial institution Shares in a Free Fall

Deutsche Financial institution (DB) is a big multinational funding financial institution that’s primarily based in Frankfurt, Germany. It at the moment has its shares valued at $14.12 billion.

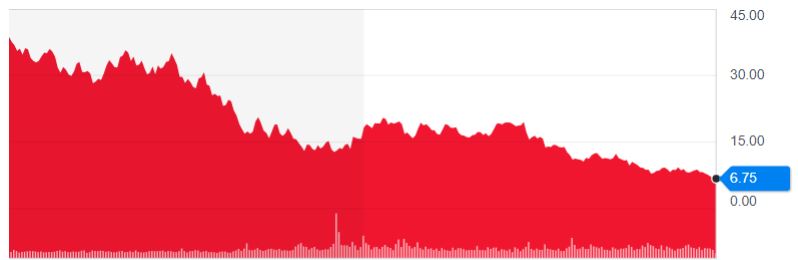

The inventory worth on the time of this writing is $6.76, which is a decline of round 5 p.c over the past 5 days. That is additionally an all-time document low.

“The pin that pops the current bubble will probably be Deutsche Bank declaring insolvency,” Max Keiser advised Bitcoinist final 12 months.

This would be the falling domino that begins one other Lehman-esque cascading down of markets.

If this doesn’t sound alarming so much, wanting on the greater image paints the whole story. And it’s alarming. Because the starting of 2019, DB’s inventory worth has declined by about 17.5 p.c.

Going again one 12 months provides us losses of round 39 p.c. Previously 5 years, DB has seen its inventory plunge from $38.74 to their present ranges, which is a devastating lack of about 82 p.c.

What’s much more alarming is that the general pattern within the financial institution’s inventory worth is greater than apparent – over the previous 5 years, it reveals completely no indicators of restoration.

What If… We Purchased It With Bitcoin?

The poor efficiency of Deutsche Financial institution’s inventory worth didn’t go unnoticed. Commenting on the matter was long-term Bitcoin proponent and co-founder at cryptocurrency hedge fund Morgan Creek Digital, Anthony ‘Pomp’ Pompliano.

At present Deutsche Financial institution is valued at simply over $14 billion and the inventory worth is in a free fall. If we might elevate the capital, it might be attention-grabbing to buy the failing financial institution and revive it by embracing Bitcoin. Crazier issues have occurred.

At present @DeutscheBank is valued at simply over $14 billion and the inventory worth is in a free fall.

If we might elevate the capital, it might be attention-grabbing to buy the failing financial institution and revive it by embracing Bitcoin.

Crazier issues have occurred

— Pomp

(@APompliano) Might 31, 2019

https://platform.twitter.com/widgets.js

The $14 billion price of BTC at the moment represents round 10 p.c of the cryptocurrency’s market cap. Absolutely, elevating that quantity can be difficult sufficient. Nevertheless, provided that DB’s inventory worth and BTC are at the moment going in numerous instructions, this may occasionally grow to be inexpensive with time.

However even when it’s doable, nonetheless, the query is whether or not it’s even wanted. Certain, it’s more likely to ship out an attention-grabbing message however aside from that, there doesn’t appear to be any level in that.

Apparently sufficient, one of many feedback below Pompliano’s tweet just about sums all of it up:

“When designing a space rocket you don’t need the Wright Brothers plane.” – Answered Gimme Crypto (@Retire_Young_1)

To supply a little bit of context, the Wright Flyer, designed and constructed by the Wright Brothers, was the very first heavier-than-air powered plane. It was in-built 1903 and it was the primary powered and heavier-than-air machine to realize a sustained flight with a pilot aboard.

Deutsche Financial institution Wouldn’t Like It

The German banking large isn’t a fan of Bitcoin, nonetheless. In 2017, DB chief strategist, Ulrich Stephan, referred to as the cryptocurrency a danger as a result of its volatility and lack of regulation.

Sarcastically, the headquarters of the identical financial institution was raided in 2018 as a result of suspicions that DB “may have helped clients in setting up offshore companies in tax havens.”

What do you consider shopping for out Deutsche Financial institution? Don’t hesitate to tell us within the feedback beneath!

Photos courtesy of Shutterstock, Yahoo Finance

The put up Purchase Failing Deutsche Financial institution With Bitcoin, Suggests Fund Supervisor appeared first on Bitcoinist.com.