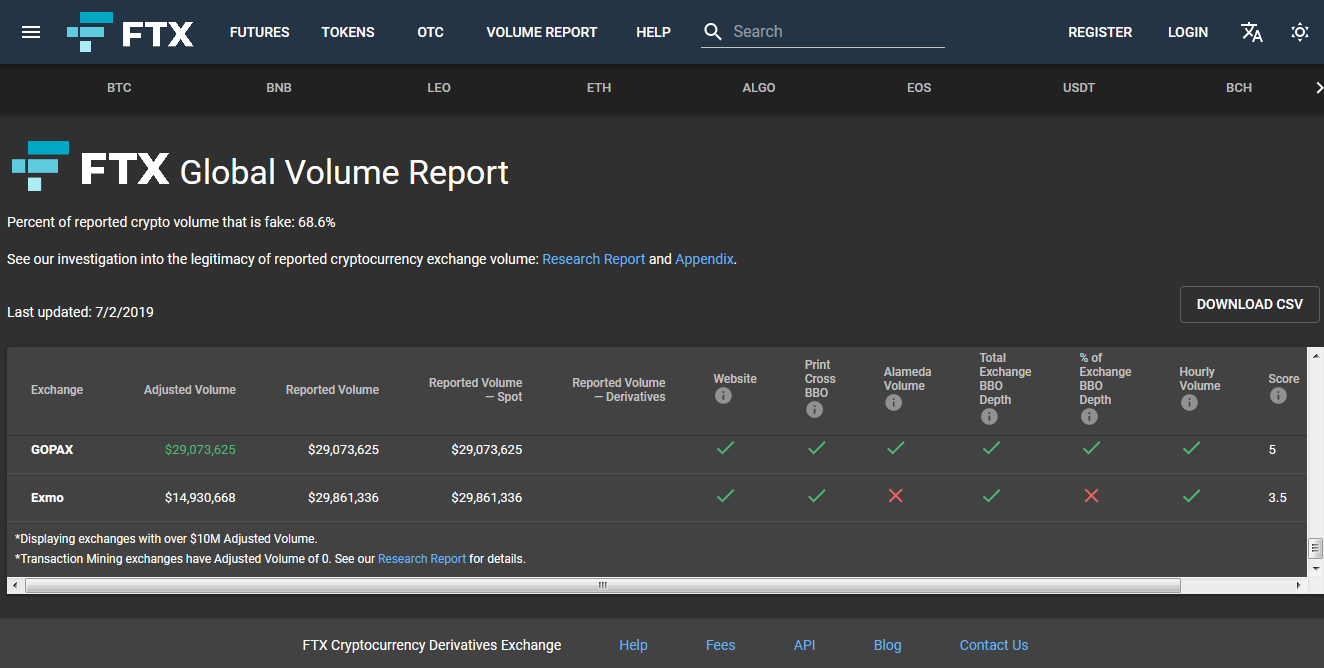

FTX World — a cryptocurrency buying and selling agency, say they’ve uncovered the soiled tips employed by sure crypto exchanges to inflate their buying and selling quantity.

68% of Cryptocurrency Buying and selling Quantity is Pretend

In a weblog submit printed on its official Medium account, FTX offered particulars about new analysis into crypto wash buying and selling carried out together with Alameda Analysis — a liquidity supplier.

In response to the corporate, 68.6% of crypto buying and selling quantity on indexes like CoinMarketCap (CMC) are faux. The figures offered by Alameda’s analysis are considerably decrease than the figures offered by Bitwise Asset Administration, earlier within the 12 months. The corporate defined the rationale for this discrepancy stating that the research carried out by Bitwise used parameters that over-filtered digital forex buying and selling quantity, erroneously characterizing ‘real volumes’ as ‘fake.’

An excerpt from the complete analysis report reads:

Whereas our strategies aren’t foolproof, we consider they paint probably the most correct image of the true nature of cryptocurrency buying and selling quantity that anybody has made publicly out there as of but.

Alameda’s methodology concerned testing the legitimacy of the buying and selling quantity information attributed to varied crypto exchanges in opposition to six parameters corresponding to handbook inspecting of buying and selling information, comparability between order e-book depth and quantity to say a couple of.

How Crypto Exchanges Inflate their Buying and selling Quantity

In response to Alameda, a handbook inspection of buying and selling quantity for a lot of exchanges confirmed clear proof of wash buying and selling. Elaborating additional, the researchers revealed:

Some had many prints going up mid-market, a lot bigger than any orders that they had on their order books. Others have been reporting different exchanges’ prints as their very own, on a small time delay. Others did considerably extra subtle issues, corresponding to slipping in giant faux prints solely once they have numerous smaller prints to cover them amongst.

And in different circumstances, they discovered

…many exchanges’ market pages show many trades which by no means appeared anyplace on their order books previous to the prints themselves occurring. Trades print considerably bigger than any orders that exist on the order books, at costs squarely in 2 the center of the order e-book each earlier than and after the trades

For a lot of of those commerce quantity ‘spoofers’, the principle aim is to achieve the next rank on CMC in order to draw hefty itemizing charges from altcoin cryptocurrency initiatives. It additionally serves to lure new clients on to the platform, who suppose these exchanges have greater ranges of liquidity than they really do. The extra clients on the platform, the extra transaction charges the trade earnings from.

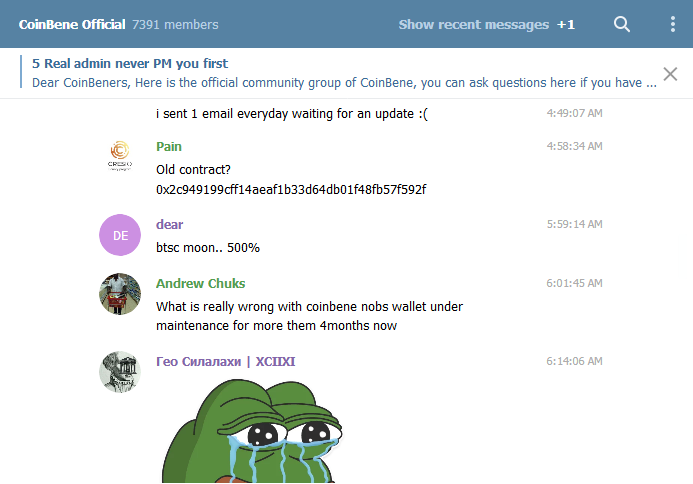

Take an trade like CoinBene, for instance. Alameda’s analysis identifies the platform as amongst these engaged in transaction mining to prop up its buying and selling quantity. Knowledge from CMC exhibits the cryptocurrency trade because the Sixth-largest crypto trade by buying and selling quantity — reporting $1.75 billion of buying and selling quantity over the past 24-hours. Yeah proper.

Three months on from struggling a $100 million hack, the platform is but to refund its clients. Complaints on the platform’s Telegram channel is met by the same old chorus of “wallet maintenance.”

The analysis paper went on to call and disgrace a number of extra ‘major’ exchanges that have been famend for faking buying and selling volumes,

…main exchanges that are identified to interact in transaction mining are FCoin, Bitforex, Coinex, Coinbene, and Coinsuper

As a part of the analysis, the Alameda group additionally offered a weighted rating for 50 completely different cryptocurrency trade platforms with a share move or fail rating hooked up to every primarily based on a comparability of their volumes with these of respected platforms.

Are you in any respect stunned by these newest findings? Tell us within the feedback under.

Pictures by way of FTX World Quantity Report, Shutterstock

The submit Report: The Secrets and techniques Behind Crypto Alternate Wash Buying and selling appeared first on Bitcoinist.com.