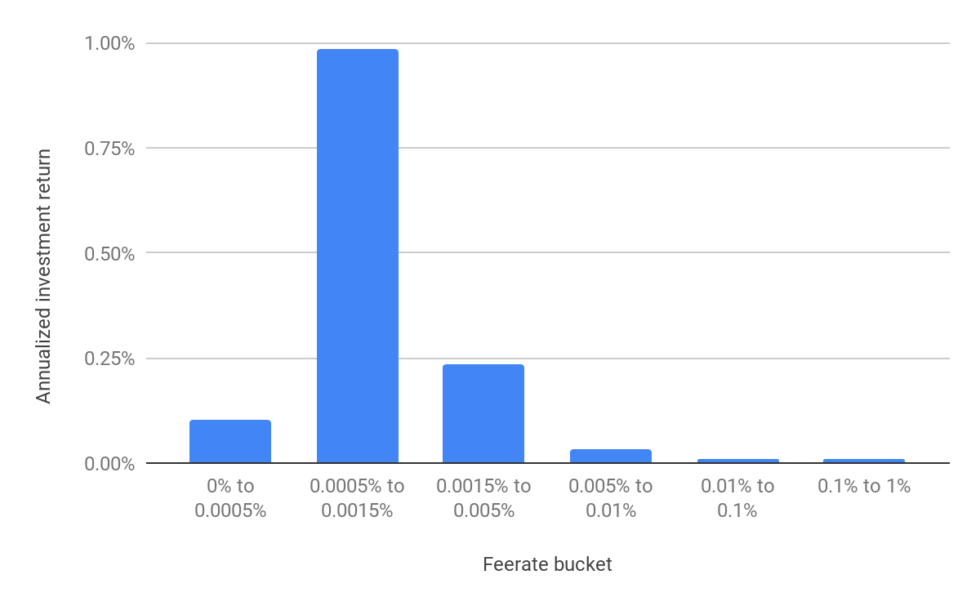

A brand new report by BitMEX Analysis reveals that probably the most worthwhile price bucket for operating a Bitcoin Lightning node has earned them an annualized funding return of virtually 1 p.c on their outbound channel steadiness. The analysis goes into particulars to find out the most important challenges the community must face if it begins scaling.

Bitcoin Lightning Node Operators Face Challenges

A analysis revealed by BitMEX Analysis on March 27th referred to as The Lightning Community (Half 2) – Routing Payment Economics examines the challenges that Lightning node operators would face if the community begins to scale.

The paper argues that it’s conventional monetary circumstances that may have a better affect on Lightning community charges, fairly than the technical elements of its routing issues.

In line with the research, the low limitations to entry into the Lightning community charges market may imply that the steadiness would favor customers and low charges as a substitute of funding returns for the liquidity suppliers.

This steadiness between guaranteeing the community has low charges for customers, whereas additionally guaranteeing charges are excessive sufficient to incentivize liquidity suppliers, is more likely to be a major challenge.

The Lightning Community has two varieties of charges. The primary one is the bottom price which prices a hard and fast quantity every time a fee is routed by means of the channel. There may be additionally the Liquidity Supplier Payment, which prices a proportion on the worth of the fee.

Therefore, based on BitMEX, Lightning node operators must face numerous challenges.

They must search for poorly linked Lightning nodes with excessive fee demand, monitor and rebalance channels to ensure there’s sufficient two-way liquidity, analyze the price market not just for the community, but additionally for high-demand and low-capacity routes, that are focused, and so forth.

The report outlines that there are presently no automated techniques able to dealing with the above and that this may require the setup of specialised companies to supply liquidity for LN.

‘Almost’ 1% Annualized Return

The research additionally outlines that BitMEX analysis have been in a position to make an annualized funding return of “almost” 1 p.c based mostly on probably the most worthwhile price bucket by operating a Lightning node.

But, issues stem out from investor sentiment within the cryptocurrency house:

A 1% funding yield could seem enticing within the present low yield setting, nonetheless the Lightning community might initially have problem attracting the fitting industrial liquidity suppliers. Traders on this house are usually in search of a excessive danger excessive return funding, which seems to be the alternative finish of the spectrum for the comparatively low danger low return funding on supply for Lightning liquidity suppliers.

The Bitcoin lightning node depend has grown quickly over the previous yr. It presently has 7657 modes, whereas the channels quantity 39,343, based on LN monitoring useful resource 1ML.com. The community has a capability of 1,048 BTC or about $4.2 million USD.

Would these findings encourage you to run a Bitcoin Lightning node? Tell us within the feedback under!

Photos by way of Shutterstock, Bitmex analysis

The put up Report: Working a Bitcoin Lightning Node Brings 1% Annualized Return appeared first on Bitcoinist.com.