Russia and China shopping for up gold could also be setting the stage for a gold-backed cryptocurrency, suggests a former EU minister. Nevertheless, such a scheme would nonetheless be inferior to Bitcoin, in accordance with Russian economist Vladislav Ginko.

Russia Targets ‘Monetary Reset’

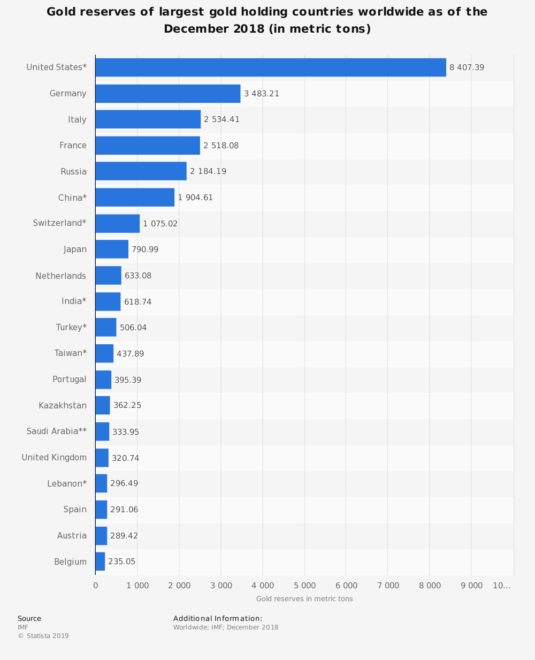

Russia was the most important purchaser of gold final yr and has quadrupled its gold reserves over the previous decade. The truth is, the nation has ramped up its shopping for spree lately, specifically, after US-led financial sanctions have been imposed in 2014.

Notably, Russia’s central financial institution added 651.5 metric tons in 2018 — 74 % increased than in 2017, in accordance to the World Gold Council. It’s estimated that the nation now holds roughly 34,000 tons of gold.

However Russia isn’t alone. China displaying related conduct shopping for 32.95 tons of gold in Q1 2019.

So why are the 2 neighboring superpowers so bent on boosting their gold reserves?

Bruno Maçães, former Europe minister of Portugal, says that whereas there’s no formal coordination, the 2 nations can count on mutual advantages in undermining the US greenback as a world reserve foreign money.

“The sheer dimension of the purchases would possibly reveal bolder motives, with Moscow making ready its first salvo within the coming battle for a financial reset,” he provides.

Russian ‘GoldCoin’?

However Maçães additionally means that this potential ‘reset’ may even have ulterior motives. He writes:

These strikes come at a second when gold has turn out to be engaging because the anchor for brand spanking new experiments in digital currencies. Gold and crypto are a wedding made in heaven, combining the steadiness of gold with the comfort and safety of the blockchain.

These digital tokens would flow into on a world on-line platform and and can be “entirely backed by gold reserves held in an international trust insulating them from state interference.”

Apparently, he notes that personal monetary establishments can be answerable for creating these ‘goldcoins’ and would subsequently finally management the provision. On the similar time, transactions can be peer-to-peer.

Cash transactions can be processed immediately between finish customers, with no intermediation from banks or governments.

There’s Only a Few Issues

Nevertheless, the previous EU minster shows solely superficial data of blockchain know-how. For one, calling it a ‘blockchain’ doesn’t mechanically make the community “handy,” not to mention “secure.”

Secondly, its node software program have to be distributed between friends everywhere in the globe. It can’t be restricted to a couple datacenters operated by a handful of personal insitutions. Such a scheme re-introduces central factors of failure making it a cryptocurrency in identify solely.

In different phrases, one can’t simply flip a change to activate a safe and trustless blockchain. It takes years if not a long time for the community impact to make it viable and worthwhile (assume: web).

Thirdly, no matter relative worth stability, gold’s bodily properties nonetheless entail prices of switch, storage, and belief.

The latter, specifically, can be a giant downside for Russia. To wit, gold isn’t a risk-free asset with regards to geopolitics. Venezuela, for instance, discovered this lesson the arduous approach earlier this yr.

Not your vault, not your gold. https://t.co/ThSkkuXGqO

— Jesse Powell (@jespow) January 25, 2019

https://platform.twitter.com/widgets.js

“[G]old is a US based asset and the experience of Venezuela has shown that in case of severe financial US sanctions Russia might also face the sell of gold would be impossible since such a deal would require USD nominated transactions,” Kremlin economist, Vladislav Ginko, advised Bitcoinist.

‘Gold is Highly Risky’ Not like Bitcoin

Bitcoin, however, has been battle-tested for over a decade. It’s blockchain is secured by a staggering quantity of accelerating computing energy, making it the de facto ‘metric system’ of cryptocurrencies at the moment.

Furthermore, regardless of worth volatility and being ‘unbacked’ — one bitcoin will all the time equal one bitcoin. However extra importantly, there’s no central authority that may change the foundations. This makes it the world’s most politically-nuetral type of cash ever and a great basis to construct not solely purposes however a brand new world financial system.

Ginko, who beforehand said that Russian have purchased over $6.eight billion in bitcoin for these causes, agrees.

“Bitcoin goes well so Russia doesn’t consider issuing gold backed stablecoin since gold is USD based asset. And its valuation and opportunities to sell this asset might be very limited in case of new US sanctions,” he mentioned.

Gold is extremely dangerous, unstable asset for Russia.

So then why is Russia shopping for a lot gold if the valuable steel remains to be largely managed by the US?

Ginko says the rationale has extra to do with its home gold mining trade. He defined:

The gold accrual by Russia’s central financial institution seems to be vital solely in bodily phrases. However in relative phrases this can be a minor fraction of complete reserves (much less 19%). The primary motive of Russian gold shopping for is to help the gold market. In 2018… Russia exported solely 5,4% (3,Four occasions lower than in 2017 yr) of its gold produced so the massive quantity of this home steel output was purchased out by the central financial institution.

Will Russia and China try to create a gold-backed stablecoin? Share your ideas under!

Pictures through Shutterstock, Statista

The submit Russia’s ‘Gold-Backed Crypto’ Would Lose to Bitcoin, Says Kremlin Economist appeared first on Bitcoinist.com.