Analysis from The Block exhibits that whereas some IEO’s have been wildly profitable, the bulk are usually not worthwhile for traders.

IEOs are Common however Not At all times Worthwhile

On Wednesday blockchain and cryptocurrency researcher, Larry Cermak posted an intriguing Twitter thread concerning the efficiency of IEOs in 2019.

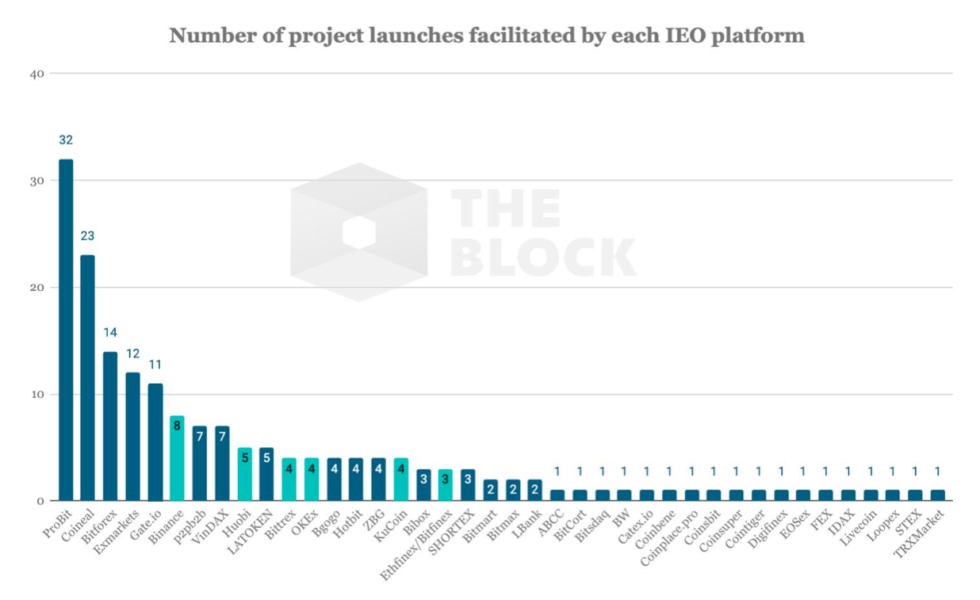

In line with The Block head of analysis, about 180 blockchain initiatives secured funding by an inside change providing (IEO) and presently 40 exchanges have hosted a minimum of one IEO.

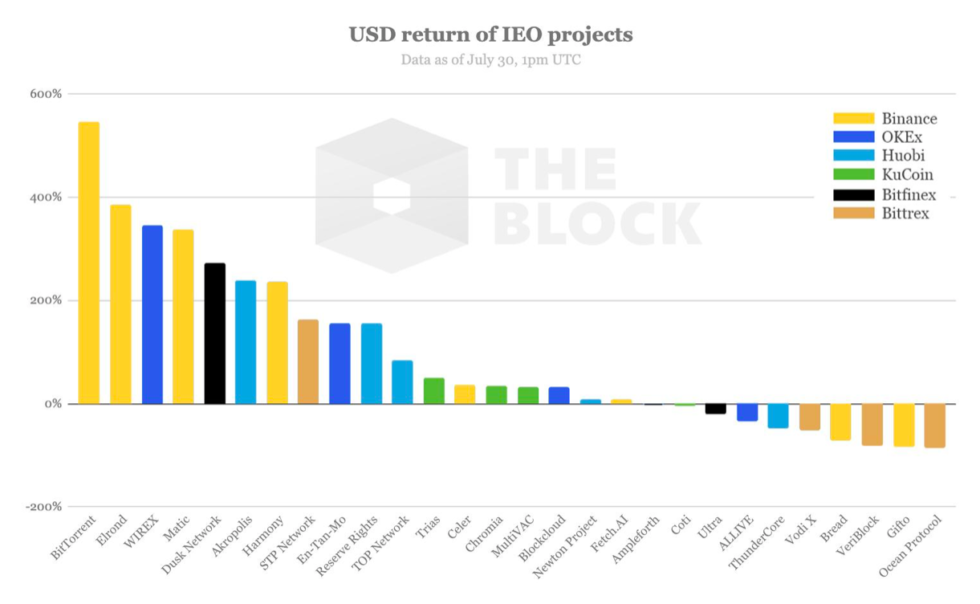

Cermak correctly selected to focus solely on reputable exchanges as a substitute of these recognized for pump and dumps, and manipulated buying and selling quantity. Professional exchanges hosted a complete of 28 IEOs, of which 18 (64%) had been internet optimistic in USD phrases. Additionally it is notable that lower than half of those initiatives outperformed Bitcoin.

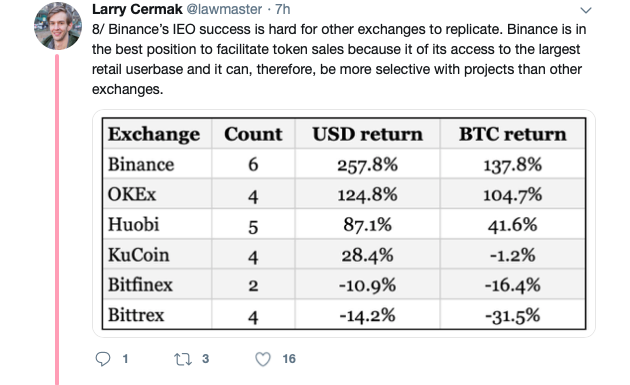

Binance Leads in Worthwhile IEOs

Binance presently leads the sector in internet hosting profitable IEOs which comes as no shock given the change’s worldwide attain and capability to checklist an unlimited array of cash. Other than Binance, 4 comparatively unknown exchanges (Coineal, Exmarkets, Bitforex, and ProBit) hosted 45% of all IEOs.

In line with information offered by The Block, the attract of IEOs is overwhelmingly speculative and in 2019, 12 initiatives produced a 500% return for traders. Cermak defined that:

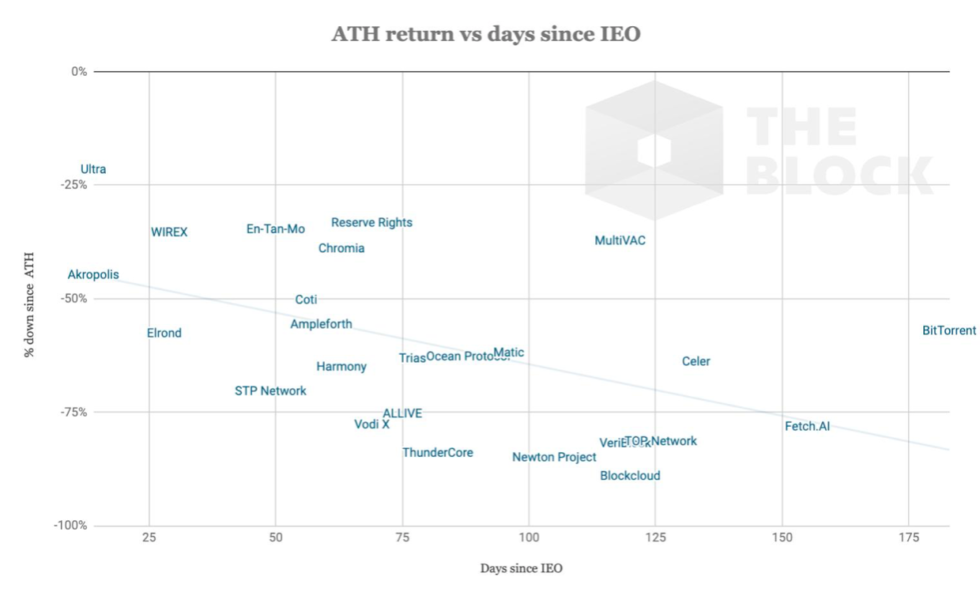

However as a result of a lot of the traders purchase the tokens simply to promote them for the next value a number of months later, the worth is rarely sustained. About 75% of initiatives have misplaced 50% of worth since their all-time excessive and 39% of initiatives misplaced greater than 75% of worth since reaching their all-time excessive.

Knowledge exhibits that there’s a sturdy relationship between a token’s value fluctuation from it’s all-time excessive and the variety of days that handed for the reason that token sale itemizing.

Given the speculative nature of those token listings, Cermak means that traders ought to take care in selecting which initiatives to put money into and advises that they need to not sit in any explicit IEO token for too lengthy.

Cermak concludes that roughly 75% of initiatives dropped 50% of their worth since reaching an all-time excessive and he noticed that:

The info exhibits that IEO tokens can’t maintain worth over the long run. Probably the most rational technique to maximise earnings would, subsequently, be to put money into IEOs facilitated by probably the most profitable exchanges and to not maintain over the long run. Long run, put money into one thing else.

Do you suppose IEOs are the brand new ICO or only a approach for exchanges to extend quantity and value for his or her native change tokens? Share your ideas within the feedback under!

Picture by way of Shutterstock, Twitter: @lawmaster

The submit Simply 64% of Professional IEO’s Had been Worthwhile, New Knowledge Exhibits appeared first on Bitcoinist.com.