Mikhail Mironov of SMC Capital says weekend buying and selling volumes for bitcoin and cryptocurrencies, generally, is indicative of rising retail buying and selling particularly from Asia.

Chinese language Retail Curiosity in Bitcoin on the Rise

In an unique chat with Bitcoinist, SMC Capital companion, Mik Mironov, explains why he believes weekend cryptocurrency buying and selling has exploded over the past month. First off, he factors to an increase in Chinese language retail curiosity in bitcoin as one of many main catalysts for the latest increase.

Mironov, a companion at a New York-based blockchain funding fund, says a brand new wave of crypto exchanges are coming on-line in mainland China. That is despite the blanket ban on crypto buying and selling and preliminary coin choices (ICOs) imposed by Beijing again in 2017.

Explaining additional, Mironov revealed:

Retail commerce from China is on the rise and deserves our shut consideration. Ever heard of Biki, Bliss, and MXC or Zg.com? These are all the brand new crypto exchanges in mainland China launched in latest months. They already run enterprise with tens of millions of customers acquired by deploying massive advertising campaigns, and that’s amid the notorious crypto buying and selling ban. So as to add, zg.com is a fiat to crypto platform accepting Chinese language RMB.

The SMC Capital companion additionally highlighted the entry of “new crypto traders” into the market. These contemporary members weren’t a part of the 2017 bull run and can probably have extra novel buying and selling patterns and habits which may set them aside from the final herd.

Mironov additionally supplied one other proof of elevated BTC curiosity in China based mostly on a parabolic rise in searches for bitcoin and crypto on WeChat – the nation’s largest social media platform with over 1 billion month-to-month customers.

Historical past: Repeating or Rhyming, Finish Outcome Stays the Similar

As for the 2017 bull market, the consensus is that FOMO-driven hype contributed to the bull market frenzy, the place each cryptocurrency recorded new all-time highs.

The hysteria round ICOs performed a component in driving the cryptomania, and Mironov believes preliminary trade choices (IEOs) could be having the same influence available on the market now.

Aside from China, Mironov additionally recognized India as one other FOMO set off for bitcoin. The VC’s stance attracts closely from the truth that the nation’s authorities seems to be headed down a path of a complete ban on cryptos.

With native exchanges shuttering since 2018, crypto merchants in India appear to be turning to foreign-based platforms. This development has led to rising person visitors and buying and selling quantity for a few of these exchanges.

As beforehand reported by Bitcoinist, BTC value reached a $500 premium in India final week. In response to Mironov:

Within the second quarter of this yr, KuCoin has seen a doubled month-to-month visitors because of the latest Bitcoin bull run. The worldwide trade’s each day buying and selling quantity reaches 200 million, nearly tripled in comparison with the quantity two months in the past. KuCoin now already has 5 million customers globally and it continues to develop quickly. In rising areas like SEA and South Asia as an illustration, KuCoin skilled drastic person progress within the final couple of weeks.

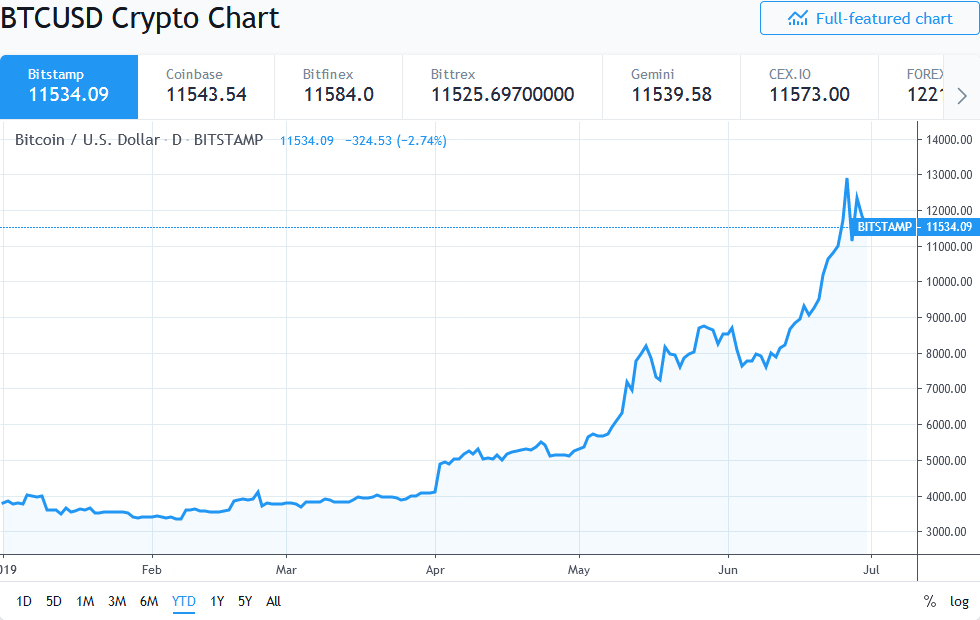

During the last 7-day interval, bitcoin topped $13,900 earlier than a value retrace noticed the top-ranked crypto fall nearly 25%. Bulls shall be hoping BTC is in an across the $12okay mark with the hourly chart displaying bitcoin in peril of slipping under $11,500.

Do you suppose the inflow of latest retail buying and selling cash from China will see bitcoin prime $20,000 in 2019? Tell us within the feedback under.

Pictures by way of Tradingview. Shutterstock

The publish SMC Capital Associate Explains Why Weekend Bitcoin Buying and selling is Booming appeared first on Bitcoinist.com.