Liquidity decline attributable to BitMEX’s trade coverage is the primary purpose behind the newest bitcoin (BTC) value crash, newest evaluation suggests.

The bitcoin market massacre has continued right this moment, with BTC testing the $7750 assist a couple of hours again. All of it started yesterday, with the unfold widening on BitMEX and futures contracts getting constantly liquidated.

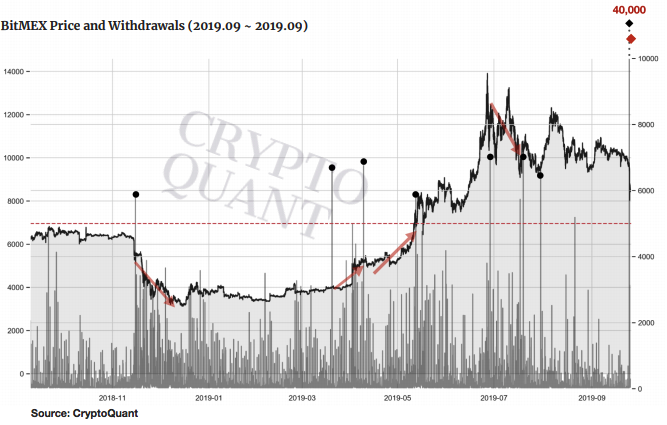

Connecting BitMEX Outflows and BTC Value

Yesterday’s downside BTC price move was nicely anticipated, however the velocity with which it occurred was surprising. In response to experiences furnished by CryptoQuant, an on-chain information options supplier this may be largely attributed to ~$700 million price of contracts liquidated throughout this decline.

Bitcoin outflows from BitMEX act as main indicators for these mass liquidations, and the mass volatility that outcomes. Being the largest bitcoin futures exchange on the market, BitMEX is infamous for influencing BTC value motion. How precisely the platform’s margin calls exercise dealt a loss-laced blow to the highest cryptocurrency wants a deeper perception.

Again and again circulate fashions have been used as one of many key metrics for understanding bitcoin value conduct, and the evaluation relating to the identical is well-established. However commonplace fashions of influx/outflow don’t actually match nicely with BitMEX.

Bitmex BTC outflows have a reasonably pronounced impact on bitcoin’s volatility, which in flip could cause the value to understand in addition to depreciate, courtesy, the trade’s particular withdrawal coverage. Whereas deposits can be found around the clock, withdrawals occur solely as soon as throughout the day, at UTC 13:00.

On this constricted timeframe, outflows are likely to exceed inflows by giant multiples. Following which, a liquidity scarcity, and a rise within the unfold takes place. These attributes result in BitMEX margin positions getting uncovered to a liquidity scarcity and cascading liquidations.

When the bitcoin outflow on BitMEX exceeds a sure level, the potential for these giant strikes will increase considerably. Based mostly on on-chain information, it seems that when greater than 5,000 BTC is withdrawn in sooner or later, the publicity to this volatility multiplies manifold.

Now shifting on to what occurred precisely.

From BTC Outflow to Bitcoin Value Volatility

Taking a fast look at CryptoQuant’s on-chain information relating to bitcoin inflows and outflows from BitMEX on November 14, 2018, April 19 and September 25 i.e yesterday, it may be seen that there’s a clear correlation between value volatility and outflows.

On every of those dates, the value volatility occurred inside a brief interval following the BitMEX day by day withdrawal at 13:00 UTC.

As soon as liquidity dried up, bitcoin value rapidly responded. On September 24, on-chain it was recorded that 49141 BTC was withdrawn from the BitMEX pockets. Volatility adopted inside 5 hours, with the value falling over 8%. As a result of precision of the on-chain information, we will see the precise block by which the BitMEX outflows spiked.

What do you consider BitMEX’s function in inflicting the bitcoin market to crash? Share your ideas beneath.

Pictures through Shutterstock, CryptoQuant

The submit Yes, BitMEX Liquidations Caused Bitcoin Price to Crash; Here’s How appeared first on Bitcoinist.com.