In the world of digital assets, 2023 has seen a noticeable comeback for cryptocurrencies like Ethereum and Bitcoin. This rebound has not only signaled a turnaround but has also been crucial in drawing significant inflows into bitcoin funds all year long.

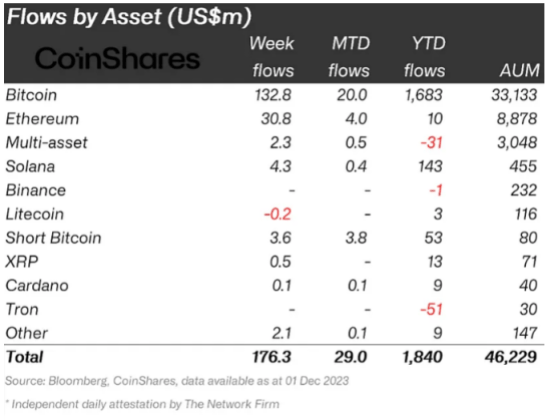

Asset managers such as ProShares, 21Shares, Grayscale, and others have reportedly received inflows totaling over $1 billion this year, including over $290 million in the last month, according to CoinShares.

A recent report from CoinShares shows that investments in cryptocurrency funds increased this week to a record $1.76 billion, the biggest value since the introduction of futures-based exchange-traded funds (ETFs) in the fall of 2021.

With $133 million in inflows, bitcoin is the largest cryptocurrency in the world. Ethereum came in second with $31 million. The majority of inflows went toward bitcoin. Compared to the previous week’s record influx of $312 million for bitcoin, this represents a rise.

Institutional Inflows Soar: 10 Weeks Of Consecutive Growth

According to CoinShares Head of Research James Butterfill, the latest inflow figure represents 4% of the $46.2 billion in assets now under management.

Based on CoinShares data, as of November statistics, year-to-date inflows have reached $1.14 billion, which is the third-highest amount ever. Simultaneously, the total assets under management increased by 9.6% last week and by 99% since the year 2023 began.

In terms of regional contributions to cryptocurrencies inflows, Canada and Germany continued to hold the top spots with $79 million and $56.9 million, respectively. US investors contributed an additional $53.5 million.

The Asian region is one among the few to have net outflows this year, despite having a very low total AUM and a very low number of ETPs.

Due to market excitement surrounding the imminent bitcoin halving and the potential approval of a spot bitcoin ETF by the US Securities and Exchange Commission, the prices of both bitcoin and ether have surged considerably in recent weeks, reaching 18-month highs.

As of today, the market cap of cryptocurrencies stood at $1.4 trillion. Chart: TradingView.com

The Appeal Of Cryptocurrencies: Investors Flock To Digital Assets

Crypto fund inflows, to put it simply, are the sums of money that investors are putting into funds created especially to hold different cryptocurrencies, such as Ethereum and Bitcoin.

Cryptocurrency funds, akin to conventional investment funds, aggregate cash from various investors to purchase and oversee a varied assortment of digital assets.

The rise in inflows into cryptocurrency funds in 2023 is indicative of a rising trend, as more people and organizations are choosing to invest in these funds due to the possibility of gains in cryptocurrency values.

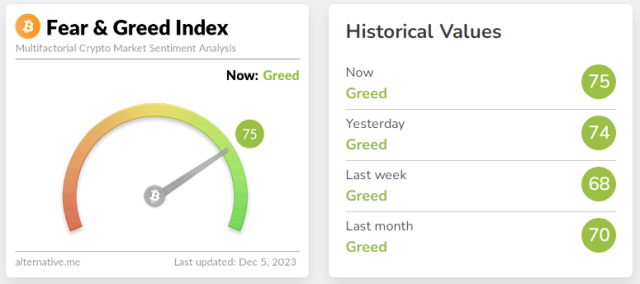

Crypto Fear & Greed Index. Source: Alternative

Investors looking to gain exposure to the potential growth and opportunities presented by cryptocurrencies are demonstrating a larger interest in and confidence in the digital currency sector.

Meanwhile, analysis by Alternative indicates that the Crypto Fear & Greed index is still rising into “Greed” area, with a current score of 74 out of 100, the highest since November 2021, when Bitcoin reached an all-time high of $68,790.

Featured image from iStock