The Texas State Securities Board announced on Wednesday that it had accomplished the second regulatory crackdown on cryptocurrency companies. The regulator’s Enforcement Division required two allegedly pretend crypto companies to stop their actions.

Bogus Crypto Corporations Mislead Traders

The Austin-based securities board accused PK Crypto Investment and Cyp Miner of presenting false and deceptive info to draw buyers who’re in search of high-risk returns.

Particularly, PK Crypto claimed that it was a US-registered asset-management funding agency. Nevertheless, the entity wasn’t registered both with the Texas regulator or the Securities and Alternate Fee (SEC). One other deceptive declare is that PK Crypto has its securities listed on an over-the-counter (OTC) market with the ticker GBTC. In actuality, this ticker is utilized by the Grayscale Bitcoin Belief.

Elsewhere, Cyp Miner claims it’s a licensed agency headquartered within the UK, however the regulator’s order exhibits that the UK corporations’ registrar doesn’t checklist it.

Apparently, neither of the 2 entities has a bodily location however exist completely on-line. For instance, PK Crypto lists workplaces in London, Vienna, Jakarta, and Shanghai. The corporate said that its primary headquarters is in Waco, Texas. Nevertheless, such a road tackle doesn’t exist in any respect.

Cyp Miner has been deceiving buyers by saying its funding merchandise are exempt from regulation. In actuality, the corporate was violating the Texas registration legal guidelines.

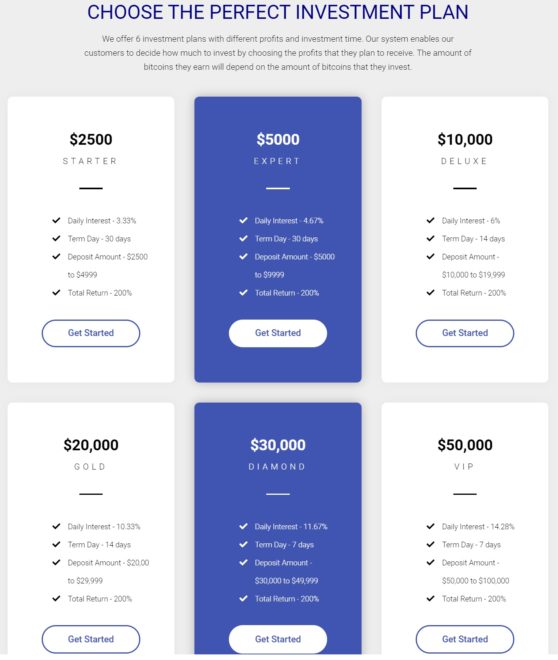

PK Crypto claims that an funding between $2,500 and $4,999 can generate a day by day curiosity of three.33% for a month. Because the preliminary funding quantity will increase, so does the potential return. For instance, by investing between $50,000 and $100,000, purchasers have been promised a day by day curiosity of 14.28% for every week.

Too look credible, PK Crypto instructed potential purchasers that it had collaborated with a authorized counsel and accounting firm that frequently audits its monetary statements. Nevertheless, the named accounting agency stated it had no affiliation with PK Crypto.

The First Sweep of Cryptocurrency Funding Choices Began in 2017

The Enforcement Division stated that this was the second spherical of crackdowns. The primary sweep started in December 2017, when Bitcoin hit its all-time excessive. Since then, Commissioner Travis J. Iles has despatched 26 orders in opposition to 79 people and entities.

The present sweep began in June of this 12 months as a response to the Bitcoin rally.

Joe Rotunda, director of the Enforcement Division, commented:

We shortly realized that unhealthy actors have been persevering with to capitalize on widespread curiosity in cryptocurrencies regardless of fluctuations of their costs and market worth.

PK Crypto and Cyp Miner, together with their executives, have a month to problem the regulator’s order.

Have you ever ever encountered false claims from bogus crypto companies? Share your experiences within the feedback part!

Photographs by way of Shutterstock, Pkcryptoinvest.com

The put up Texas State Securities Board Charges Two Suspicious Crypto Firms appeared first on Bitcoinist.com.