Senior Quantitative Researcher, Hans Hauge, from Ikigai, has simply launched a sequence of recent metrics for gauging Bitcoin demand which suggests ‘the market bottom is behind us’. Let’s break down the findings.

The Market Gamers

In Hauge’s evaluation, he identifies two separate courses of merchants that take part within the Bitcoin market, who’ve a direct impact on the coin’s demand; The “Newbs” and the “Veterans”.

Newbs symbolize the latecomers to the Bitcoin market, who’ve solely lately began investing in BTC and usually commerce very emotionally – purchase on the prime, promote on the backside and so forth.

In accordance with the analysis, this explicit kind of dealer bases their choices on little info, holds BTC for brief durations of time and are thought of ‘weak hands’ throughout bearish shakeouts.

Veteran merchants are the antithesis of Beginner merchants. They’re those who’ve been concerned out there for a variety of years, have held BTC long-term and make few trades primarily based on in depth analysis. Such a dealer usually buys the dips and exits after hitting predetermined revenue targets.

Figuring out Demand Utilizing “Bitcoin Days Destroyed”

‘Bitcoin Days Destroyed’, or ‘BDD’, is a brand new metric devised by Hauge which determines Bitcoin demand by multiplying the amount of Bitcoins by the times because the cash had been moved.

Cash which were held for longer durations of time, by the Veterans, are weighted with a better worth than cash which have solely been held for a couple of days/ weeks. By doing so, this helps to segregate the info between short-term merchants and long-term HODL’ers, extra clearly.

The ‘Destroyed’ half now comes into impact, now that we’re accustomed to how Bitcoin days are decided. A Bitcoin Day is taken into account ‘destroyed’ when a amount of Bitcoin has been moved. Within the paper, Hauge makes use of the instance;

“…if I purchased 1 Bitcoin and held it for 7 days, when I move that Bitcoin from my wallet the Bitcoin days are considered destroyed. One BTC held for 7 days would destroy 7 Bitcoin Days when it was moved (7 BDD).”

To additional enhance the accuracy of the info, in addition to account for the rising quantity of Bitcoins which can be getting into the market day by day via crypto mining, Hauge employs an Adjusted BDD calculation which takes the BDD worth of every day and divides it by the every day circulating provide.

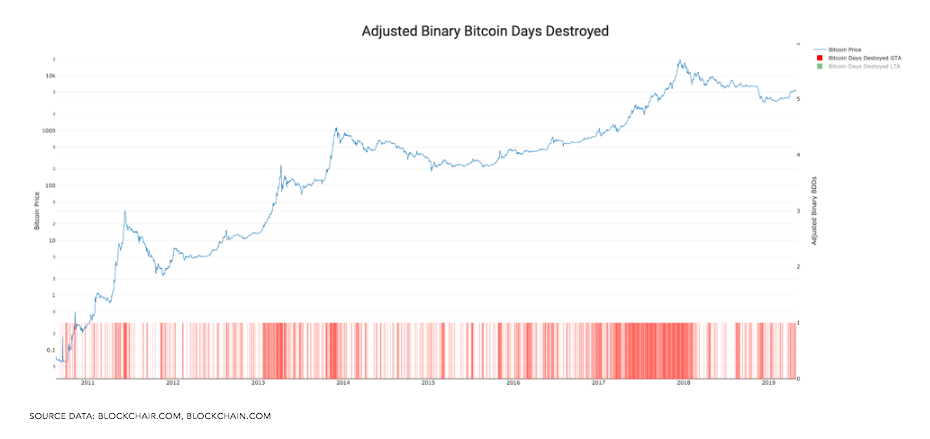

The chart beneath exhibits on which days extra Adjusted BDD’s had been destroyed than on a mean day. Apparently, it exhibits that Veterans tended to exit out of the market very near the height value factors on a variety of events over the past eight years.

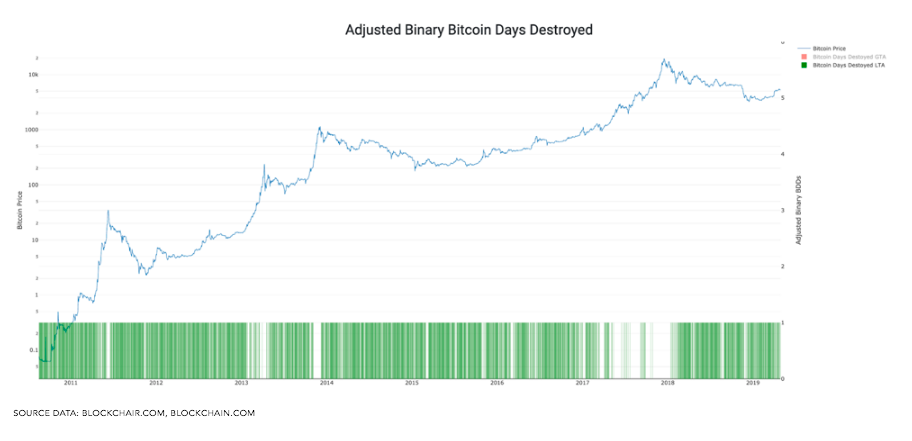

What’s much more attention-grabbing, is that once we have a look at the chart that exhibits the place there have been considerably much less BDD’s than common (beneath), the Bitcoin market tended to enter right into a bull market shortly after. This highlights areas of accumulation, as extra merchants start to HODL forward of a value breakout.

The analysis additionally elements in a ‘Value of Coin Days Destroyed’ (VOCD) calculation, which is used to focus on when extra Bitcoin Days are destroyed than created on any given day.

In accordance with Hauge, the VOCD is ‘a time-USD quantity metric’ versus a time-Bitcoin amount metric. Which in different phrases, measures the US greenback worth held and/or moved on a given day in comparison with a mean day.

A median common line might be utilized to this mannequin, which primarily acts as a ‘signal line’ akin to what we see on many different indicators such because the MACD. A development above the road indicators a promote, a development beneath indicators an excellent shopping for alternative.

Lastly, a metric which determines the US greenback equal that made long-term merchants HODL their Bitcoin versus promoting it, has been used which Hauge calls ‘HODL Bank’.

By summing the mixture US Greenback quantity over time, you arrive on the cumulative alternative value that made the choice to carry reasonably than promote over the lifetime of the Bitcoin community (scaled all the way down to a single Bitcoin worth phrases). That’s the HODL Financial institution.

By dividing the ‘HODL bank’ worth on a specific day by the worth of Bitcoin at the moment, one other signalling line known as ‘The Reserve Risk’ is created.

Right here we are able to see that over the past eight years, every time the Reserve Threat line (backside line) has dipped beneath the index vary (pink channel), it has constantly marked the underside of the Bitcoin market.

Proper now, we are able to see that the Reserve Threat line has hit a brand new low outdoors the channel for the primary time since 2015. From this, we are able to infer that the underside of the market is now out of sight, and a brand new bull market lies forward for Bitcoin.

What do you concentrate on this Bitcoin days destroyed metric? Share your ideas beneath!

Pictures by way of Shutterstock

The submit This New Bitcoin ‘Days Destroyed’ Metric Paints a Vivid Image for Worth appeared first on Bitcoinist.com.